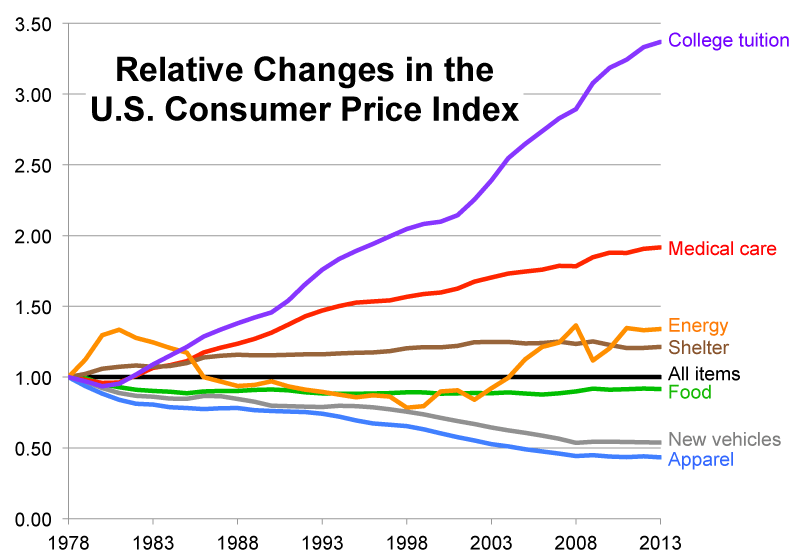

Is going to college worth it? College tuition has increased at a faster rate than housing, energy, food, and medical care costs over the last decade.

- 2 Comment

For an entire generation it was an easy question to answer. Is college worth it? Absolutely. There was little debate regarding the “worth†of a college education. Of course this question was usually asked during more affordable times and not when $1.2 trillion in student debt was out sloshing about in the economy.  I think most people agree that moving your knowledge forward is a good thing. Learning about a broad range of categories is useful in creating well rounded citizens. Yet is this worth $25,000 per year? $50,000 per year? When costs soar to these levels, you need to examine the question of worth. Families are struggling to get by since the per capita wage is $28,000 in the United States. With families being unable to pay the college bill, students are taking the next logical step. They are taking on massive levels of student debt. With easy access to debt, the cost of a college education has outpaced practically every other sector of our economy.

The massive college inflation Â

When housing values got out of control thanks to easy lending policies, we were left with the housing bubble which subsequently led to the Great Recession. The bubble burst and left a myriad of problems in the economy. Today, we have another debt area growing courtesy of easy access to debt. Student debt is a big problem.

Take a look at the cost of tuition versus other sectors over the years:

You see that blue line? There is no category after adjusting for inflation that has gone up so dramatically over the last generation like that of college expenses. Families with no savings are left with sending their kids to college and having their education funded by debt. Depending on the quality of the school and major, the expenses incurred are worth it. But for many, we are seeing that the cost of attendance is simply not worth it.

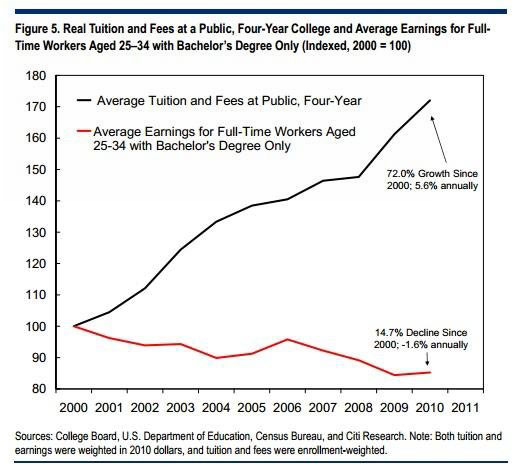

If we measure a college degree versus earnings potential, we see that something is amiss:

While the cost of tuition has significantly increased, the earnings potential of many college graduates has not. There was a report highlighting that nearly half of college graduates are working in jobs that don’t require the degree in which they studied. Now many will argue that a college degree is not a vocational degree and is designed to turnout well rounded citizens. I can see that argument and feel that a country with an educated population is beneficial but what is the degree worth? The only reason college costs are soaring so far out of control is because of easy access to government backed debt.

Many of the new jobs being created in the low wage economy really don’t require a college degree. Many of the fields that pay a good wage require a technical background including:

-Engineering

-Computer Science and Programming

-Healthcare

-Accounting and Finance

These fields all require specialized degrees and some, require additional certification beyond the four year degree. Of course this is merely a subset and there are other high growth sectors but many degrees are simply not preparing students for the jobs in the current economy. The epidemic of high student debt is leaving many mired in problems.

Is college worth it? Like most things in life, it really does depend what price you pay. Many students simply do not understand the price since they are stalling out the payment until they are fully out in the marketplace. Some schools are charging for one year of education, the median income of an American family. Take some time and digest on that tidbit.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Don Levit said:

“The only reason college costs are soaring so far out of control is because of easy access to government backed debt.”

Couldn’t the same analogy be applied to subsidies for health insurance policies in the individual exchanges?

The higher the subsidies, the higher the gross premiums rise.

Don Levit

Managing Partner

National Prosperity Life and HealthOctober 30th, 2014 at 3:24 pm -

Scottar said:

It’s largely due to the Feds subsidizing loans. Want enrollment?, got government loan?, good to go.

November 3rd, 2014 at 10:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â