Are you looking to earn low wages? A college degree might be your ticket. College earning power dwindles over the last 15 years.

- 1 Comment

We constantly hear the loud drumbeat that a college degree is your ticket to untold fortunes. Of course we never get the detailed report showing students that are drowning in debt and also many that went to for-profit schools or pursued unmarketable majors and guess what? These people would largely have done better by not going to college (you avoid that mega debt). The amount of debt people are taking on to obtain a college degree is at an all-time record high. You would assume that simply having a college degree is sufficient to boost your earnings potential. That is not the case at all. We now have the largest percentage of adults with a college education in history. A good thing right? But we also have the largest number of Americans with unmarketable degrees and many from schools that are one step above a paper-mill. Many would have been better learning a trade (and their earnings would be much higher). One recent report that reflects this big change is the percentage of low wage workers with college degrees (think of the person with the master’s degree serving as a Starbucks barista).

Low wages and college degrees

Here is what a recent report shows on college education and low wage work:

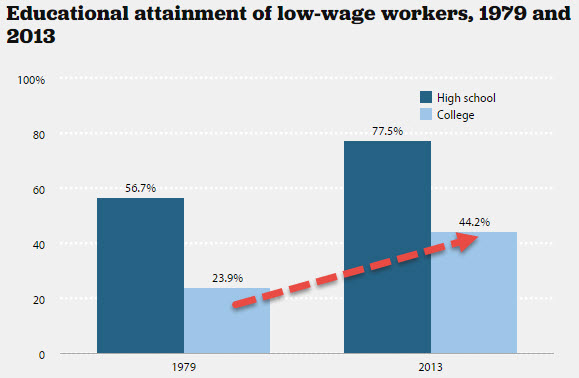

“(EPI) In 1979, only 56.7 percent of low-wage workers had a high school degree, compared with 77.5 percent in 2013.

Correspondingly, many more low-wage workers have attended at least some college or have a college degree, which the graph identifies as “college.†While only 23.9 percent of low-wage workers in 1979 had some college experience or a college degree, that group had grown to 44.2 percent by 2013.

Yet low-wage workers’ hourly wages have not improved much over this time.â€

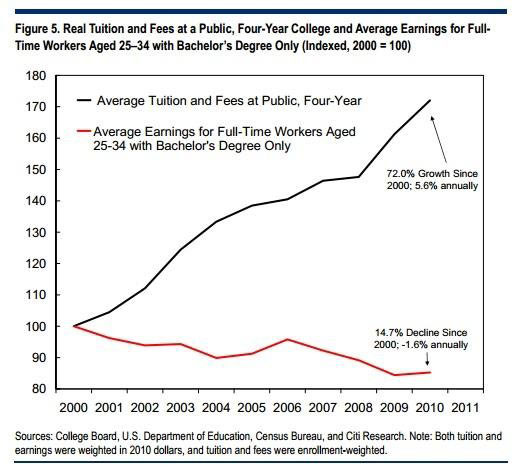

In other words, while the cost of a college education is soaring the income of college graduates is falling:

In 1979 of low-wage workers, 23.9 percent had a college education. Today, it is up to 44.2 percent. Even at the bottom spectrum of earnings in the US a college education is becoming more common. It also helps to shed light on why so many college graduates are having a tough time paying their student loans since their income is simply not enough.

Starbucks made headlines about paying college tuition for their workers but this isn’t so clear cut:

“(Komonews) Initially, Starbucks said that workers would be able to offset the costs through an upfront scholarship it was providing with Arizona State, but declined to say exactly how much of the cost it was shouldering. The chain estimated that the scholarship would average about $6,500 over two years to cover tuition of about $20,000.

Following the announcement, however, Arizona State University president Michael Crow told The Chronicle of Higher Education that Starbucks is not contributing any money toward the scholarship. Instead, Arizona State will essentially charge workers less than the sticker price for online tuition. Much of the remainder would likely be covered by federal aid since most Starbucks workers don’t earn a lot of money.

Workers would pay whatever costs remained out of pocket for the first two years, and Starbucks would bear no costs.â€

This is a big trend across the board. For-profits are masters at doing the “find the Americans with the lowest wages†and suck them into the federal aid vortex. Quality of education is the last priority on the list. The lower your income, the more you can expect in federal aid.

Yet a college degree simply isn’t giving that across the board boost in income as you would expect:

This chart tells it all. College tuition is soaring beyond any other component of inflation yet wages are actually moving in the opposite way. Also, not all college degrees are created equal. Pursue a degree in engineering, computer science, biological sciences, chemistry, nursing, or accounting and you should be in good shape (assuming you do well of course). It also matters the quality of the institution you are going to. But with over 4,000+ colleges in the US, how do you go about choosing a good one and a high potential major? Then you have the battle between following your passion and pragmatism. You can see why many 18 year olds are simply not making the best decisions.

But one trend is clear: a college degree might simply lead you into a low wage career. It might even be required in the upcoming years. Otherwise you might be part of the 93.2 million “not in the labor force†Americans that simply are ignored by the popular media.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Edward J. said:

I would point out that ” attended at least some college” it a huge hedge on the data. Someone signing up for a class or one semester of college is NOT GOING TO COLLEGE. It’s playing around while figuring out what your going to do. We need to blast from the roof tops the data for GRADUATES in STEM fields. People with SKILLS are paid well, unskilled even with a piece of paper are not. That’s a good thing, it should give incentives for people to upgrade their SKILLS.

Lets stop confusing SKILLS with a piece of paper!May 27th, 2015 at 3:26 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â