Student and auto debt fuel credit bubble 2.0: Student loans carry the highest delinquency rate of all debt classes. Student and auto debt up $1.15 trillion in last decade.

- 1 Comment

A large portion of our recent recovery has come from debt fueled consumption. The bailouts have been favorable to financial institutions but access to debt for American families has been in segments that are counterproductive to wealth accumulation. There is no benefit in having access to cheap loans for purchasing a car, an “asset†that loses value immediately after you pull it off the lot. This is what is going on and we have seen a surge in subprime auto loans which is a double-whammy in slamming your financial future. The biggest non-housing debt class in the United States is now with student debt. Student loans are now viewed as the pathway for accessing college. Over $1.2 trillion in student loans are now outstanding in the US and this debt class has the highest delinquency rate of all debt classes. What this tells you is that many with student debt are unable to pay their bills. That is problematic. But this debt fuels the economy in odd ways. Let us take a look at the two fastest growing debt fields.

Student debt and auto debt

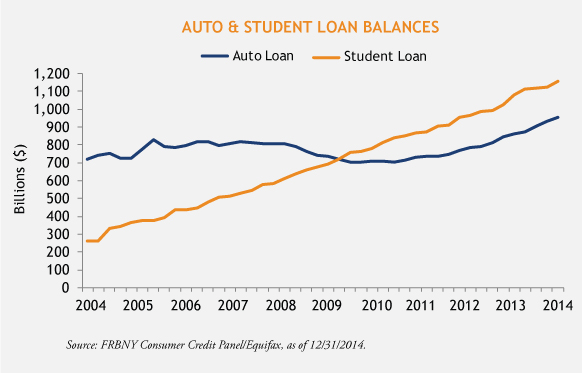

Back in 2004 there was roughly $250 billion in student debt outstanding and $700 billion in auto loans outstanding. Today we now have $1.2 trillion in student debt outstanding and $900 billion in auto loans.

That is an increase of $1.15 trillion in student debt and auto debt over this 10 year period. Plus, most of the growth has come in the form of more student debt. This is problematic in many ways because many recent college graduates are starting their working lives with the equivalent of a car payment or in some cases, what amounts to a small mortgage:

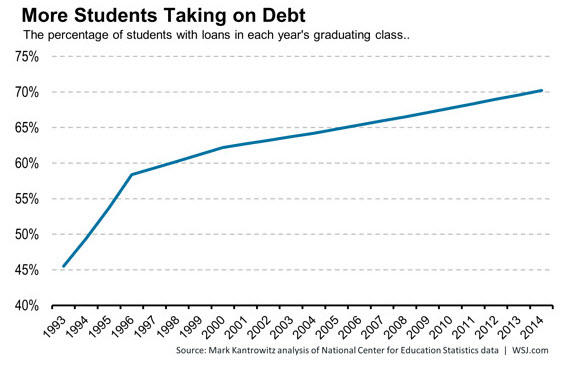

Debt has a place in any economy. But we have now become fully reliant on debt to finance virtually all purchases in our economy. Good luck going to college or buying a car without a loan. The data backs this up:

In 1993 45% of the graduating class took on student debt. Today, it is above 70%. And it should also be noted that the amount of debt in 1993 was nothing compared to what it is today relative to what recent college graduates are earning. Many struggle to find work and end up working in the low wage sector of the economy.

The most delinquent debt sector of them all

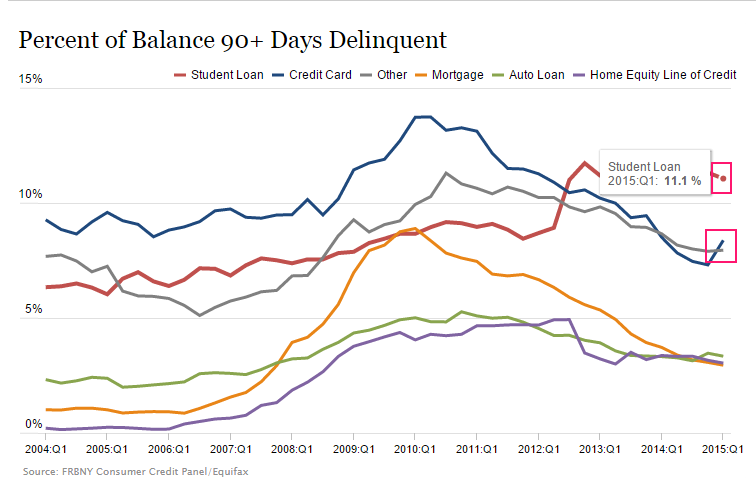

Another problem that is happening is that college graduates are unable to service their debt. Keep in mind there are a multitude of student debt repayment plans including graduated payments, income based repayments, and also the ability to defer if you go back to school. However, even with all these outlets people are having a hard time paying their debt back:

That is not what you want to be seeing and this adds an additional layer of financial strain to the young in our country. We already know that many are struggling to purchase homes in this economy because of lower wages, higher student debt, and Wall Street crowding out regular families in the single family home market. In the end, buying a home with a mortgage can serve you well since it is a forced savings account. Yet many are unable to do this and are forced to pay their student debt and go into debt when buying a car. These do not help in starting to save money for retirement which Americans are horrible at doing despite the massive stock market rally.

Student debt is a big problem especially with so many working in the low wage segment of the economy:

We need to focus on the issue carefully. Low cost options like community colleges have weak outreach arms and massively impacted classes. The for-profits have stepped in with sophisticated marketing operations but poor teaching quality and career placement results that leave much to be desired. Public education is also getting more expensive and more selective. So there needs to be a serious dialogue on what we envision for the future of higher education. There are many online options from reputable schools that have the ability to scale on a massive level (for example with Massive Open Online Courses known as MOOCs).

One thing is certain and that is we are on an unsustainable path when it comes to student debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Dave said:

But, but, but, the Republican pull-yourself-up-by-your-boots-and-get-an-education-to-further-yourself-mantra-is…wrong?

May 15th, 2015 at 3:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â