Student debt now makes up nearly half of federally owned financial assets. The student debt bubble edges on with many more unable to pay their debt.

- 0 Comments

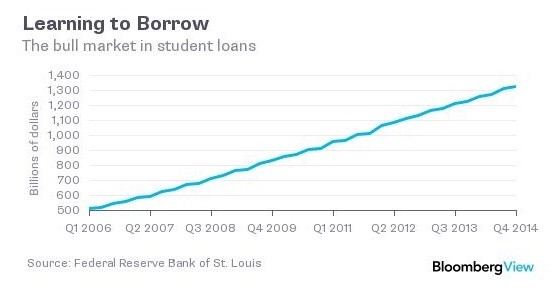

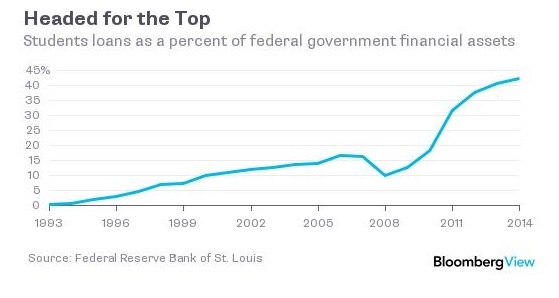

The student debt epidemic is spiraling out of control and the public is becoming more aware of the situation. $1.3 trillion in student debt is now outstanding. This is already a problem with nearly one out of three loans in repayment already in some form of delinquency. Clearly if you are not paying back an obligation there is some sort of underlying problem. But like most of the epic debt bubbles, people are slowly coming to the realization that most of this debt will never be paid back. Consider it a forever loan. The problem with this mentality is that student loans are now becoming a giant part of federal assets. In fact student debt now makes up nearly half of federally owned financial assets. Again, I remind you that nearly one out of three loans in repayment is in some form of delinquency.

The student debt bubble grows

One area in which we are seeing heavy inflation is with tuition costs to attend college. While wages go stagnant, the cost to attend college has soared. In order to avoid being part of the low wage economy, many find it a necessity to go to college. But the menu of options and prices has confused many younger Americans and many have made poor choices that have saddled them with insurmountable levels of debt.

Student debt has now crossed the $1.3 trillion mark:

If this were not bad enough, of federally owned financial assets student debt now makes up 45% of the portfolio:

“(Bloomberg) Student debt now comprises 45 percent of federally owned financial assets. Of course, that doesn’t include assets owned by the Federal Reserve, and it doesn’t include real assets like land. Still, it’s a startling figure.

This trend worries me. Why? Because when the government owns student loans, it has every incentive not to fix the country’s student-debt problem.â€

This is a troubling trend. Since student debt has no discharge option via bankruptcy, many students unable to pay their loans find that the original principal balloons to outrageous amounts. In the end, fees and interest eat up a large portion of what could have gone to chopping the initial amount down. There is little reason to have such high interest rates on student debt while the Fed makes it easy for large banking firms to borrow near zero percent to speculate. It simply shows the priorities of our financial system.

Is the student debt problem truly an issue? Absolutely. Student debt now makes up the largest non-housing related debt sector. And delinquencies are highest amongst this debt category. Not being able to pay back your debt should indicate a sign of instability.

The fact that the government now owns such a large portion of student debt at a time where it is performing so badly should give us pause for caution. We are all on the hook after all.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â