1 out of 4 college adjunct faculty collecting government assistance: Students in debt and professors barely getting by all the while tuition soars.

- 0 Comments

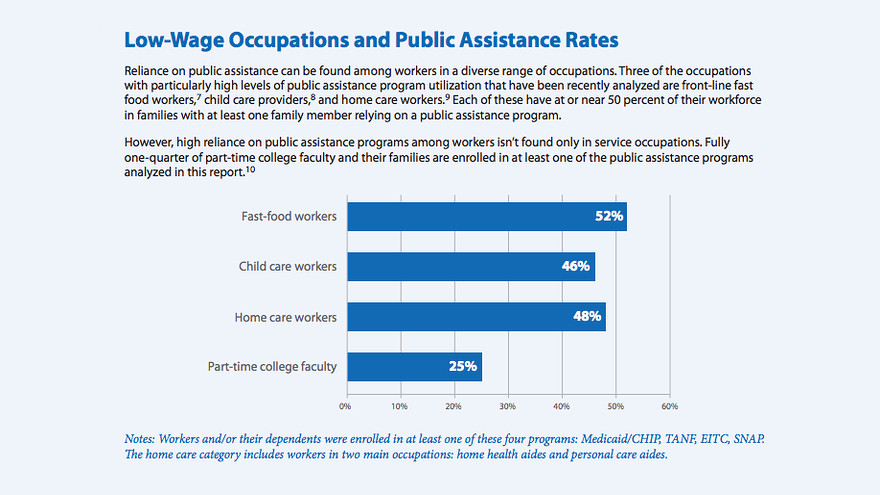

The student debt crisis continues to move across the nation’s landscape like an unrelenting storm. The stories of economic pain are growing involving students but what about adjunct professors? For those of you that are unfamiliar, adjunct professors are like contract teachers at many colleges. Many carry a heavy teaching load but receive very little job security. At many for-profits, more money is spent on marketing than actual instruction which begs the question as to where the money is flowing. It certainly isn’t on career services to help students given the abysmal results. Adjunct faculty as it turns out, are now part of the new low wage America. A recent study found that a whopping 25% of college adjunct faculty are receiving some form of government assistance. This isn’t someone working a part-time job making pizza. No, these are people teaching your young college kids economics and science.

Professors on government assistance

The number of Americans receiving government assistance is no surprise. Even though the paper economy is booming (i.e., the stock market, equity in housing, etc) many Americans are still unable to meet their monthly expenses without outside help. What is a surprise is the large number of adjunct faculty receiving government help:

“(MarketWatch) Nearly 100,000 of these part-time faculty, generally known as adjuncts, benefit from the earned income tax credit and, to a lesser extent, Medicaid and the CHIP health-care program for children, the Supplemental Nutrition Assistance Program, previously known as food stamps, and Temporary Assistance for Needy Families, or TANF, according to the study.

“It’s shocking, but it’s the reality,†said Carol Zabin, research director at the Center for Labor Research and Education. “Universities are depending much more on part-time and adjunct faculty.â€

The data isn’t pretty:

What is happening is that many colleges are not paying their fair share and allowing for these government subsidies (aka, taxpayer dollars) to make up for the gap that is being taken home by these adjunct instructors. Many are kept at lower hours to avoid paying for retirement plans or healthcare benefits. Someone ends up paying the bill.

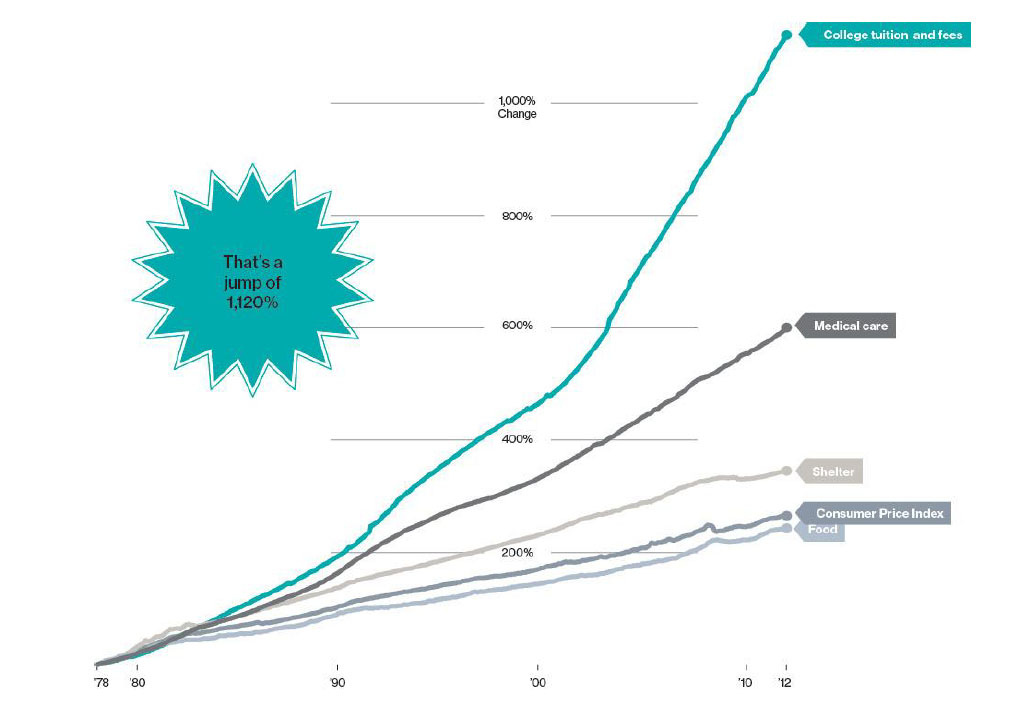

You wouldn’t think of someone teaching at a college as being on government help. You certainly wouldn’t expect it given the rise in tuition:

Adjuncts make up a large part of the teaching pool:

“Indeed, the American Association of University Professors reported this week that well over half of the college academic labor force is part time. That includes both graduate teaching assistants, which account for 12.2%, and other part-timers, or adjuncts, which are 46.7% of the total.â€

Now you can feel comforted that you as a college student are eating Top Ramen but so is your professor. I’m sure that will make paying the tens of thousands of dollars in student debt more satisfying. If you don’t think that we have some serious challenges in the current college structure and student debt markets, you are in for a big surprise.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â