Nearly 1.5 Million Foreclosure Filings in 2008. California Represents 110,000 of Those Foreclosures.

- 1 Comment

Everyone by now realizes that not all states are facing the same problems with the current housing market. Foreclosures are now accelerating in states that had the highest appreciation in prices and consequently, are causing the most financial damage that is rippling throughout the economy. Foreclosures are the worst sign in any housing market. They destroy money. Lenders lose money since in rare circumstance are they able to recoup the full face value of the mortgage. Borrower are harmed since they lose their home and any semblance of good credit. Much of the rhetoric in Washington is shrouded around these stories and most people realize that there is very little good that can come from a foreclosure.

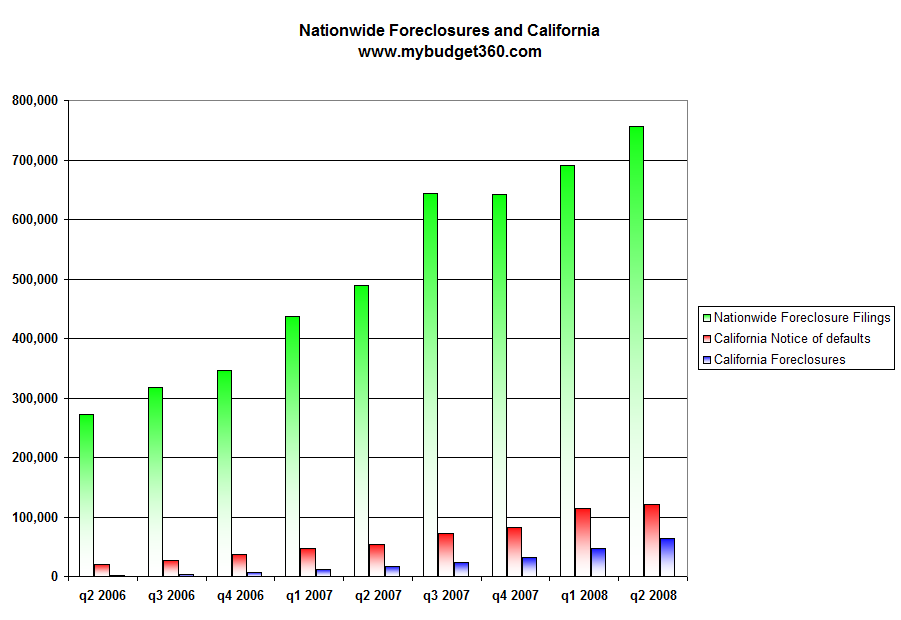

We keep hearing that things are bad but until we graphically show the growth of foreclosures it is hard to comprehend. I developed a chart that uses data from RealtyTrac for nationwide foreclosure filings and data from DataQuick to highlight the problems in the California housing market. Take a look at this chart:

What you’ll notice in the chart above is that nationwide foreclosures stayed relatively stable in 2006. They were growing but nowhere near the current pace. The more startling fact is the lack of foreclosures in California during this time. You can hardly see it on the graph since California was still booming in 2006.

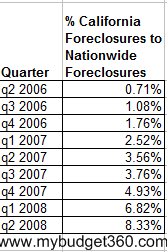

As things progressed, you started to first see an increase in the notice of defaults in California. These are early signs of problems. Little by little until the second half of 2007 when prices stalled did the entire housing market come crashing down. Now, foreclosures and notice of defaults are spiking at an alarming pace. California foreclosures now make up 8.3% of all foreclosures in the country. Take a look at how quickly this has changed:

This is where you can see how one state with the size of California can quickly drag an entire nation into the doldrums. In the second quarter of 2006 California made up only 0.71% of all foreclosures nationwide. In the second quarter of 2007 it made up 3.56%. Now, California foreclosures make up a stunning 8.33% of all foreclosures nationwide.

Even with the Fannie Mae and Freddie Mac legislation, there is going to be very little relief to states like California that are now becoming a larger piece of the nationwide foreclosure pie. First, many of the loans that are defaulting in California are subprime. In the next few months, the vast majority will be Pay Option ARM mortgages that have in many cases negative amortization. Meaning, many borrowers will now have a larger balance to pay off on a home that is worth much less.

Lenders are still hiding what is really going on in their bottom line. The deferred interest on these negative amortization loans is actually counted as income and the borrower is having an artificially low payment. Once these payments recast, both lender and borrower are going to quickly realize how phony the sense of calm they both shared is.

In addition, the current legislation would require lenders to shave off 15% off the current appraised value of the home. That is assuming the buyer is even up for this since the legislation also requires the buyer to agree to give up their upside on the home to pay off the government in the future. You can already see how this will not help people in California. Let us do a crude example:

You buy a home at: $600,000 at the peak in early 2007

Current appraised value: $400,000 (this is a fair assessment given the state median price is off 35% in one year)

Note went up to: $625,000 (you went zero down and paid the minimum which made the loan a negative amortization product)

You are underwater by: $225,000

Let us now go through the current government program:

Current appraised value: $400,000 x %15 = $60,000 to be shaved off

Refinance loan into government backed loan of $340,000

Do you really think the lender is going to eat a $285,000 loss? Many will elect to foreclose and take their chances with the market. Many borrowers will still find the reduced price too high and walk away anyways either because the conventional mortgage payment is too high or they simply do not have the funds to continue. They also have little incentive if they know any future appreciation will go to the government.

This may help other states but anyone in California thinking this will help is looking at the wrong numbers. It is still up to buyers whether they even want to continue with the program. Lenders may not even want these major losses. Talk about a giant waste of taxpayer money.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

nuckels said:

great article, hope to link to your information with my new blog, countrylied.com

July 28th, 2008 at 7:07 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!