The new American retirement plan equates to working forever: Nonexistent nest eggs and most Americans are bad at planning as to how long they will live.

- 4 Comment

The idea of retirement is a modern one especially when it comes to saving and having a nest egg. In the past, retirement was only a luxury afforded to a small number of wealthy families. The rest of the population was destined to work until they died. That may seem harsh but that is historical fact. After World War II the idea of mass retirement started to take hold. Even Social Security was merely a safety net to keep you from starving or being homeless. Social Security was never designed as the main source of income for retirees but that is what it has become. Many older Americans simply did not prepare adequately. The taking away of pension plans was supposed to usher in the era of the self-directed 401k. One generation later the results are in and Americans are looking into the new retirement plan. The new retirement plan is working forever (in other words, until people can no longer physically hold down a job). This certainly doesn’t coincide with the brochures we see of older Americans galloping across the beach with cocktails in their hands.

The retirement savings crisis

Saving for retirement is flat out unsexy. Advertising is designed to separate Americans from their money even if it involves them going into massive levels of debt. Is it better to squirrel $500 a month away for 30 years in a boring index fund or is it better to lease a brand new shiny car? Most opt for the car. Also, with the median household income of $50,000 and the cost of living soaring, many Americans just don’t have money to set aside after all the bills are paid.

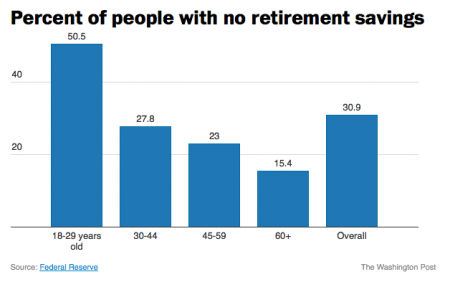

One scary fact is 30 percent of Americans flat out have zero dollars in retirement savings:

And according to Census data the typical American household (bias by older families) has something like $17,000 to their name when we remove housing equity. In other words, most Americans are not prepared for a long retirement. And old age for many will be many years. This is why you see many older Americans working deep into old age. They simply need the money. Food costs are high. Housing costs are high. And for this age group, healthcare costs are soaring. Because of these changes people are pushing retirement age deeper into the future.

Average age of when people will retire and life prediction

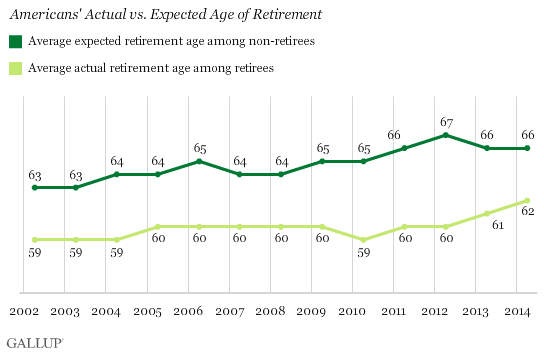

Even as the economy recovered, the average age of expected and actual retirement has jumped up:

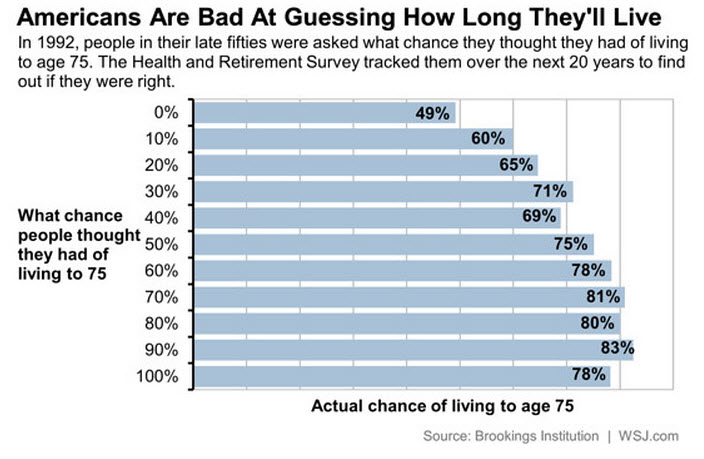

Americans are working more years than they once would have expected. Having a nest egg is crucial to being able to retire. And many Americans simply do not have adequate savings. Planning for the future is difficult. Many Americans are bad at planning how long they will live:

What does the chart above show? That people over estimate how long they will live. But this is also telling regarding psychology. If people are so confident they will live late into life (75+) why are they planning so poorly when it comes to retirement? The answer is the cost of living is soaring, inflation really does exist, and people still want to pretend like they are millionaires even though they are broke without debt.

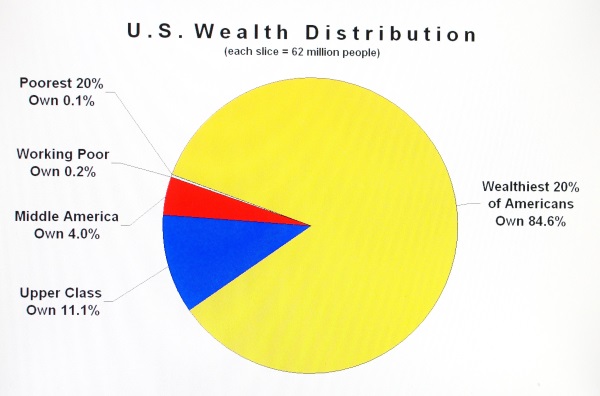

Retirement money held in the hands of the few

Half of Americans don’t own one stock. And the bulk of wealth is in the hands of a few. 84 percent of the nation’s wealth is held in the hands of the top 20 percent:

The rest whether they admit it or not, are going to rely on Social Security. Most retired Americans rely on Social Security as their primary source of income. Half of people on Social Security would be out on the streets if it were not for their monthly payment. As far as retirement planning goes, there very little retirement or planning going on. And we have 10,000 Americans hitting retirement age per day for the next decade.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

laura m. said:

Working people need to put max . in their 401k or if self employed set up an IRA at a credit union. Best not to raise kids, they are super expensive with no guarantees, and only wealthy can afford to. Women need to stay in the workforce, not raise kids. Many buy large houses they don’t really need, can can live more frugal lives if they chose to. We retired at 62 from a blue collar skilled job. Many I know are still working in their late 60’s on into 70’s. I view them as greedy or selfish, because they won’t quit the work force and make room for the young who need jobs. They had all these years to plan but most people are stuck in stupid anyway.

April 13th, 2015 at 8:29 am -

sharonsj said:

Just keep in mind that any Congresscritter who spends 6 years in Congress is paid a FULL pension, but us peons have to work for 46 years and if we retire before age 66, we are penalized 25% (while they are not). In addition, they refuse to raise the cap which means only people who earn less than $110,000 actually pay into Social Security, so this is yet another social program where the effing rich screw us over.

April 13th, 2015 at 12:52 pm -

williamrw said:

laura m.

You are 100% correct about so many Baby Boomers obsession to work into their late 60’s on into their 70’s. But if these people are greedy or selfish “The Joke is on Them” Because let’s not forget about “The Health Factor” Most of these people have early stage cancer, heart disease and diabetes, to name a few age related maladies. “Their Retirement” will be that drive in a hearse from the job site to the grave site!

April 15th, 2015 at 5:12 am -

No Nonsense Landlord said:

Most lower income people will be protected by SS and do not need as much. Higher spending people need to save the most.

Rental property can be a great way to achieve retirement income, but it is a bit risky if you do not understand the concepts.

April 15th, 2015 at 7:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â