Pension disaster looms over the horizon: In 1980 60 percent of Americas participated in a pension program. Today it is less than 10 percent and the amount saved for retirement is startling.

- 1 Comment

Americans are on the verge of a retirement disaster. As pension plans slowly go extinct Americans are not saving enough for retirement. The figures point to a looming pension and retirement disaster. Retirement for most Americans is largely a mirage. As organizations switched from pensions to 401ks it was expected that most Americans would save money. This trend started in 1980 and over 30 years have now passed. We now have enough data to see if this transition has been beneficial to most Americans. Unfortunately the answer highlights an American population that has not saved enough for retirement. Most Americans will make Social Security their default retirement plan. Pension issues also loom as many state governments contend with deep underfunding for retirement benefits. In the end, there is a disaster looming.

The disappearing pension

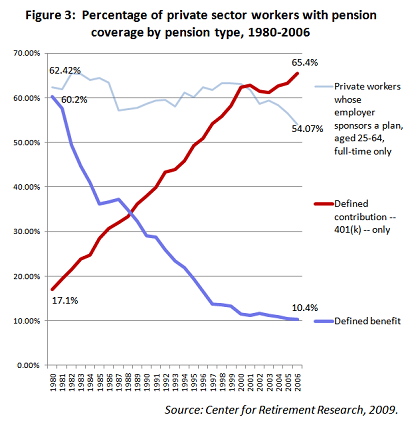

Very few Americans now have access to a pension. This wasn’t always the case:

Today, less than 10 percent of Americans have access to a pension. Most however have access to 401k plans and other retirement options. Unfortunately as the middle class shrinks more Americans are finding it more difficult to save any money.

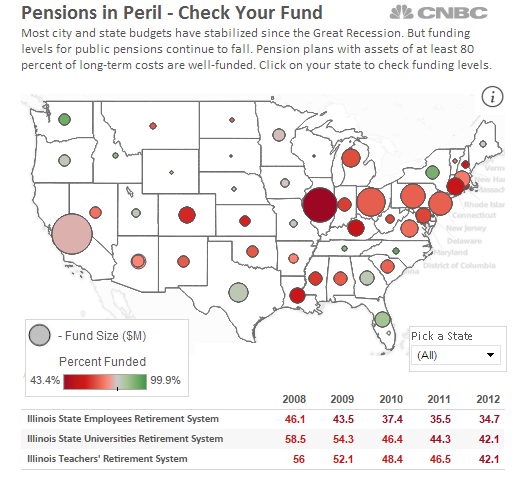

Social Security unfortunately is going to become the default retirement plan for many. Many current pension plans are setup with unrealistic returns. Many states are underfunded in spite of the dramatic returns in the stock market:

Keep in mind there is simply no way the stock market can continue producing returns as it has. It is simply impossible and already ratios are getting inflated showing a slight exuberance. As the chart above highlights, many state pensions are underfunded and if the market even has a slight correction, this will exacerbate the problem.

Beyond the above data that only impacts a small number of Americans, most simply do not have enough (or anything) saved for retirement.

The lack of savings in retirement accounts

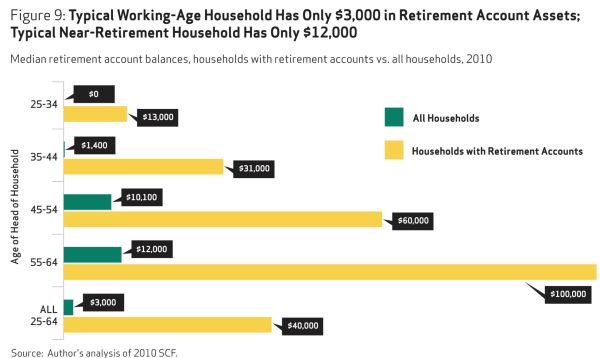

Without pensions many Americans are left to fend for themselves via retirement accounts. How has this worked out?

These are disturbing figures. The median amount saved by all Americans is $3,000 for retirement! Even those nearing retirement in the 55 to 64 age group have roughly $12,000 to get by in their later years. In other words, many are going to be working deep into old age.

A lot of this can be attributed to the lack of income being made by most Americans. As we have seen income inequality is at record levels, even higher than it was prior to the Great Depression. It is simply hard to get by when the per capita wage is $26,000 and the cost of living continues to increase without any wage increases. Getting by is priority number one, not a far off retirement.

Retirement dreams pushed out

As you would imagine the retirement age is being pushed out:

It is becoming tougher for Americans to retire and there is less of a safety net. Since the retirement amount saved is so low, many are going to depend on Social Security as their main income stream in their later years. Much of this money is going to be paid by a younger and less affluent generation. You can already see this disaster lining up. As young people struggle, how will they feel when they see pensions going out while they struggle to find work? If you think you have heard the last of this think again.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Bert said:

Overseas, where they’re drinking our national economic lifeblood and laughing all the way to the bank on account of our nonstop oil import habit, are many tears being shed over this circumstance? Probably not. The People’s Republic of Taxhavistan just doesn’t care.

September 15th, 2013 at 2:51 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!