Modern day financial repression and disinformation: Financialization of America creates incentives for massive income inequality.

- 2 Comment

America in the last couple of decades has undergone a massive reformation when it comes to the financial system. The ability to convert everything and anything into a tradable security has been the biggest goal of Wall Street and has captured our entire economy like a starving grizzly bear chowing down on Alaskan salmon. Even once stale real estate, once thought of as the cornerstone of wealth for most Americans is now a volatile and speculative commodity where large hedge funds dive in and out like bombers for quick profits. The end result is that more Americans are finding it harder to keep up while most of the wealth aggregates in fewer and fewer hands. Since the recession ended, most of the new jobs are being added in low wage segments of the economy. An easy way to boost profits is to slash benefits and cut wages. Good for the stock market but not necessarily for working Americans. Sadly, that is the rub of this modern day system. The stock market is benefitting companies that may not have the best interest of the overall economy at heart. If that is the case, is this system truly functioning well?

Low wage job growth

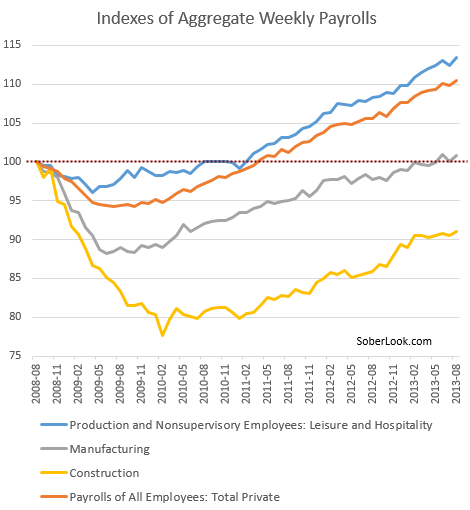

It is abundantly clear that most of the job growth since the recession hit has come in the form of lower paying sectors:

Leisure and hospitality, typically the lowest paid of the service sector fields is the top employment growth segment. It should be no surprise then that household incomes adjusting for inflation are back to levels last seen in the mid-1990s. At the same time while wages hover in purgatory, inflation in important items like housing is increasing yet again. The increase in housing over the last few years has largely been because Wall Street investors have decided to chase after residential properties as a way to diversify their portfolios. It is also easier to pilfer properties from struggling Americans losing their homes at the hands of financial products created by said Wall Street firms. Easy to leverage the easy money the Fed is handing out to the large banks but the end result does not benefit most Americans.

Growing income inequality however is benefitting the stock market. So in a way, it also makes sense that lower paying jobs are growing because people are having less access to disposable income and credit to the majority of Americans has tightened up dramatically since the recession hit (not so much for large banks hence the flood into the real estate market).

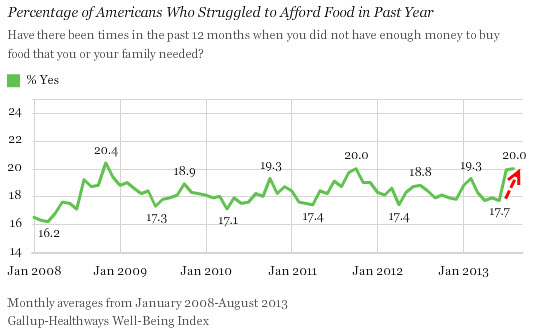

This large financialization is also being seen as many more Americans struggle for even basic necessities.

Struggling for food

One recent poll found that 20 percent of Americans have struggled to afford food in the last year:

Source:Â Gallup

This is incredibly high and nearly matches the figure we saw in the depths of the recession. It also helps to explain why we now have a record number of families on food stamps. Record in the stock market and record usage of food stamps. These are probably two stats you do not expect to occur for the same country but that is the current situation we live in.

Ultimately the system is not benefitting most Americans in what you would expect from a booming stock market and real estate market. The tools necessary to play in this game are being heavily restricted (i.e., easy credit, etc) and most Americans are left to contend with the pangs of an ongoing austerity.

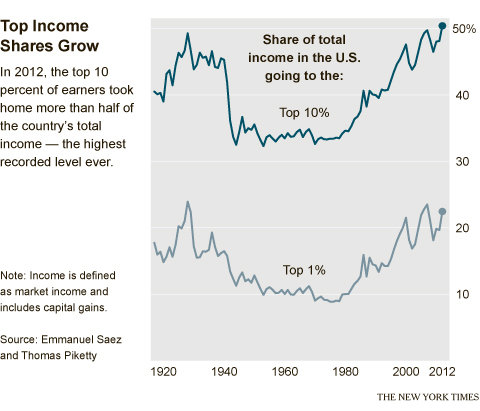

Income inequality in a modern Gilded Age

Historians look back at previous depressions and point out massive income inequality and stock market euphoria as indicators of underlying problems. In the 1920s, income inequality was incredibly rampant as many in big cities like New York benefitting from financial mania partied on while most parts of America were struggling. Today, income inequality is even higher than it was back then:

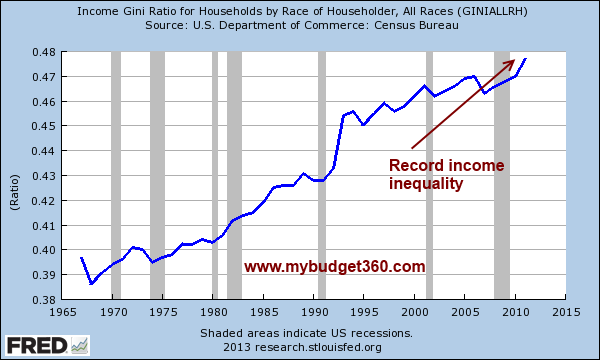

Over half of all income generated in 2012 was at the hands of the top 10 percent of income earners. What this means of course is that the other 90 percent are battling out for the remaining 50 percent of income. This also explains why we now have a generationally high Gini ratio:

It is important to have an economy that builds up the bulk of our households, not just a tiny portion. The stock market is simply reflecting a system that is designed for a small minority. We should be concerned about a dramatically shrinking middle class and the fact that many cities are literally going into failed state status but this is simply ignored in the press. If you think that it is good to follow this policy, just look at economies where they have a massive underemployed youth population or where income inequality is this high. This kind of financializaton is destined to bring booms and busts and after each cycle, the middle class continues to diminish.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

It is I only said:

“Latest Gallup poll: 20 percent of Americans are struggling to pay for their food. Greatest nation on earth?”

USA! USA! USA! USA! USA! USA!September 12th, 2013 at 5:37 pm -

theyenguy said:

In 2009, Fed Chairman Bernanke introduced QE1, traded out money good Treasuries, TLT, for the most toxic debt of all types held by the banks, which found their way back to the Fed as excess reserves. This interventionist policy secured investment trust, and reinflated credit worldwide, stimulated global growth and trade, and provided spectacular investment rewards, in such things as Small Cap Value Stocks, RZV, and Global Producers, FXR, through the Leverage Speculative Investment Community, consisting of Asset Managers, such as BLK, Stock Brokers, such as AMTD, Investment Bankers, such as JPM, Banks such as LYG, and Creditors, such as IX.

Through the US Federal Reserve’s “crisis aidâ€, losses were socialized to the unsuspecting public, and gains privatized to wiley investors. Along this line of thought Joseph Kishore of WSWS writes US income inequality soars to highest levels on record. The top 1 percent of income earners in the US took in 95 percent of all income gains between 2009 and 2012. And Jerry White of WSWS writes The social chasm in America. Recently released figures document the growth of social inequality in America to levels not seen in nearly a century.

There is no sustainable economic boom as Jesus Christ operating at the helm of the Economy of God, Ephesians 1:10, enabled the bond vigilantes to rapidly call the Interest Rate on the US Ten Year Note, ^TNX, higher to 2.01% on May 21, 2013, which constituted a “termination event†in Emerging Market Investment, EEM, in Utility Stock Investment, XLU, and in Real Estate Investment, IYR, such as REM, REZ, ROOF, and FNIO. And the further fast rise of the interest rate on August 13 2013, to 2.71%, constituted an “apocalyptic event†which terminated fiat money, in particular Major World Currencies, DBV, and Emerging Market Currencies, CEW, both of which bounced higher in value, in response to the averting of war in Syria.

The crack up boom part of the Business Cycle is now complete as World Stocks, VT, relative to World Treasury Debt, BWX, that is VT:BWX, and Eurozone Stocks, EZU, relative to EU Debt, EU, EZU:EU, have peaked at their all time highs, on margin credit.

Jesus Christ acting in Dispensation, presented in Ephesians 1:10, that is in oversight of all things economic and political for the fulfillment of every age, era, epoch and time period, has completed the paradigm of liberalism and is the paradigm of authoritarianism. Liberal policies of investment choice and schemes of credit are being replaced by authoritarian policies of diktat and schemes of debt servitude, where banks will be integrated with the government, and be known as the government banks, or gov banks for short, and nannycrats will rule in statist public partnerships over the factors of production for regional security, stability, and sustainability, establishing austerity over all of mankind.

September 13th, 2013 at 5:00 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!