The day of reckoning for student debt has arrived and the bubble begins to deflate: JP Morgan exits the student debt market. Similar trends occurred with the subprime market in 2007.

- 2 Comment

The student debt bubble begins its inevitable decline from unparalleled heights. This week too big to fail bank JP Morgan issued a memorandum that it is exiting the student loan business. What is interesting in this move is that it is eerily similar to banking moves made back in 2007 as some banks started to back away from the subprime mortgage market. At that point, it was too late and the most toxic of the toxic loans were already collapsing ushering an era of over 5,000,000 foreclosures with another 2,000,000 likely to happen in the next few years. Student debt has surpassed the $1 trillion mark and delinquencies in student debt are now the highest of any debt class. With the announcement by JP Morgan, we are now getting a taste of what is to come. The day of reckoning for student debt has arrived.

How a $1 trillion market pops

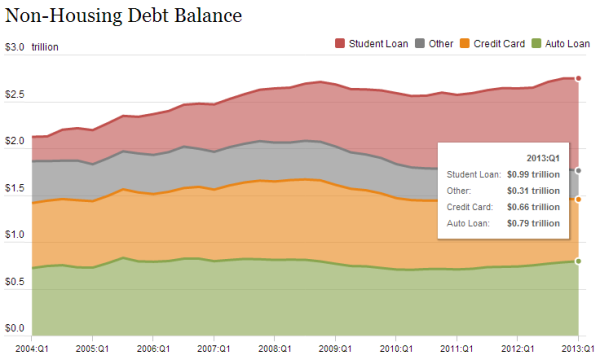

Student debt is now the biggest non-housing debt class in the United States:

Back in 2004, total outstanding student debt was at $260 billion. Today it is well over $1 trillion which is an incredible rate of increase in less than one decade. This is clearly an unsustainable path and the market is now facing some serious challenges.

The news by JP Morgan Chase is a very familiar song:

“(CNBC) “We just don’t see this as a market that we can significantly grow,” Thasunda Duckett tells Reuters. Duckett is the chief executive for auto and student loans at Chase, which means she’s basically delivering the news that a large part of her business is getting closed down.â€

The move is eerily reminiscent of the subprime shutdown that happened in 2007. Each time a bank shuttered its subprime unit, the news was presented in much the same way that JPMorgan is spinning the end of its student lending.â€

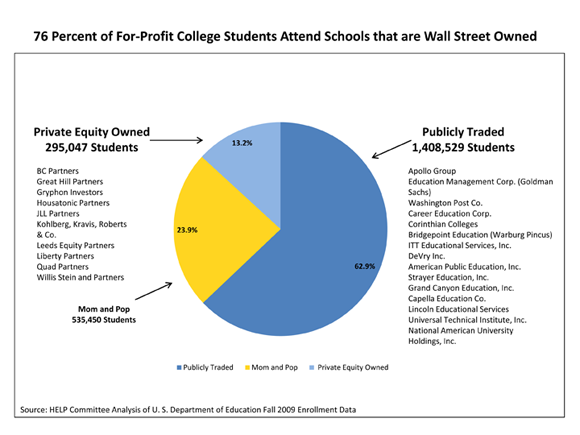

This is an interesting development. Wall Street has been gorging at the trough for years here. In fact, many of the for-profits which amount to the subprime of the colleges are owned by Wall Street:

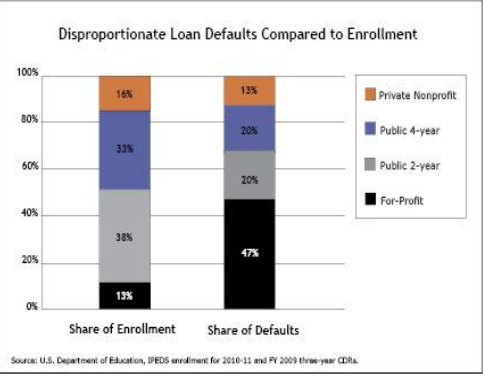

The exploits of the for-profits has been well documented for years and has now reached epic proportions. While for-profits enroll about 13 percent of students they make up nearly 50 percent of all student loan defaults. These schools fully rely on easy government student loans:

This portion of the market is bursting in spectacular fashion. The student loan sharks go after these students with the vigor of a middle ages land owner chasing struggling peasants off their land. The government (that is, the American public) essentially guarantees this debt so it has been a safe bet for Wall Street for many years. The way student debt compounds with fees and debts can turn a $20,000 debt into something like $40,000 or more over a lifetime since this debt cannot be discharged like a tax debt for example.

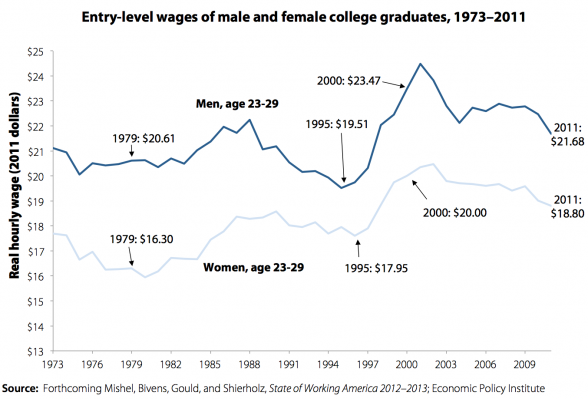

The problem with the high cost of college is that wages for college graduates simply have not kept up with tuition inflation:

So students are paying more to essentially earn less in this low wage system for the young. You have this odd case where people need skills for the jobs that are out there yet wages are stagnant and the cost to acquire those skills continues to go up. This is why young Americans are having such a tough time getting ahead. A recent study found that those 25 to 34 have a median of zero dollars saved for retirement. In other words, most have nothing to their name when it comes to their future economic well being. This is the same group shouldering a large burden of the $1 trillion in student debt.

So the fact that a big name is exiting the private student debt market is no surprise. It is incredibly similar to the trend of banks exiting the subprime trade in 2007 but then again, we are destined to repeat another bubble burst as Wall Street has turned everything into a pump and dump scheme.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

DADDY WARBUCKS said:

The subversion of ‘students’ for the continuity of university professor’s and administrator’s obscene salaries, opulent 6 figure pensions and benefits.

At what point will the students get it? Education for a better life (not yours).

“… the Department of Education’s SWAT team bungled a raid on a woman who was initially reported to be under investigation for not paying her student loans, though the agency later said she was suspected of defrauding the federal student loan program.

The details of the case aside, the story generated headlines because of the revelation that the Department of Education had such a unit.”

NSA will report anyone complaining to the IRS, DHS and your local democratic headquarters SWAT Team, who will then red flag your residence for immediate inspections from the EPA, FDA, DOE, ATF, DEA who will then send you to a FEMA camp work program and confiscate your property and bank account. (How else can we fund all these expanding federal agency complexes, vehicles, salaries and pensions?)

NSA, DOE, FDA, EPA, IRS, DEA, CIA, FBI, DEP, NPS, DHS, CIA, DOJ, DNR, USDA, DOT, NFS, ATF, USPP, etc., (and growing) federal agencies becoming predatory towards it’s citizens, that produce nothing and generate no revenue but require massive funding from a dwindling, overtaxed private citizen work force.

Outright confiscation of private citizen’s property and wealth is all but carved in stone to feed this monster.

Since 2011 US consumer credit outstanding has risen by $312 billion and of this growth, 85 percent has come from student debt. This is completely unsupportable and student loans now have the highest delinquency rates of any debt class in the US.

Student loans are now the worst performing debt class and now the new sub-prime debt bubble that’s about to burst, overtaking credit card debt – professors call to immediately​y cease and desist the program?

Have you heard the outcry and massive protest marches by university professors and administrators to immediately stop and abolish the student loan program in the USA that is DESTROYING hundreds of thousands of their students financially and continues unabated?

Clueless 18 year olds are given huge loans, permanently nailed to them for life with no recourse to default, that would never be given to them under ANY other circumstances.

What? ….there is no outcry from university professors and administrators? …..not even…..anything? to save the financial future of hundreds of thousands of kids? ? No demands from universities to immediately cease and desist the program?

Oh, they’re keeping quiet and sacrificing their students futures for their own salaries, pension security and fancy offices, bonuses and parties (oops, I mean ‘conferences’ so they can give each other awards for excellence)?September 8th, 2013 at 9:53 am -

David Martin said:

Daddy ‘bucks, you nailed it.

If anything the Profs and Admin types try to further indebt the average student.September 26th, 2013 at 10:54 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!