Why are so many young Americans living at home? Record number of Americans living at home while student debt reaches another record.

- 0 Comments

While the unemployment rate continues to fall in large part because people are dropping out of the workforce, we reach another record which highlights a difficult economy for young people. A record number of young Americans now live at home. It would be one thing if this was being driven by a desire to stay at home but this is not the case. Economically younger Americans are simply having a tougher time starting their own households. Combine this with the record amount of student debt largely shouldered by young Americans and it is easy to understand why this trend is occurring. This living at home trend also helps to explain one of the reasons why homeownership has fallen overall. This is not a positive trend no matter how people try to spin it.

Record number of young people with mom and dad

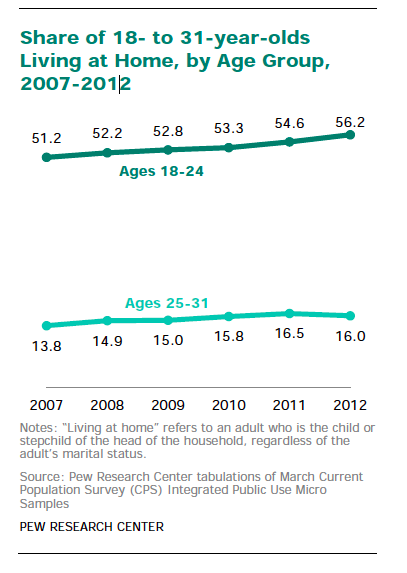

A recent study from the Pew Research Center shows that a record number of those 18 to 31 are now living at home:

The trend is unmistakable and has not reversed since the recession ended in 2009. Some try to explain that there is a rise in students living in dormitories but this only explains one tiny piece of the puzzle. And the evidence highlights that a large jump has come from boomerang college graduates coming back home after they receive their degree (you can’t live in dorms forever).

“(WP) After graduation, many of my Columbia University students plan to move back home. And they’re happy about this. My generation — Oberlin, Class of 1973 — would have regarded returning home as the ultimate symbol of failure and a huge sacrifice of personal liberty. But my students consider their parents friends. Their homes will be their base camps from which they will pursue the internships and educational experiences they want. For one of my students, this involved volunteer service at the Arab American Family Support Center and internships at Freedom House and Seeds of Peace. She also had the opportunity to curate a museum exhibit before leaving to study Arabic in Qatar. That’s a circuitous path, and one that required enormous help from her family well beyond graduation.

But it turns out that this type of path is the best preparation for success in an economy that rewards ambition, risk-taking, entrepreneurship and adaptability.

With very few exceptions, the students whom I and other faculty members around the country work with are not a generation that has gone soft from being coddled. They are a generation facing a historic transformation in the route to a successful job and family life.â€

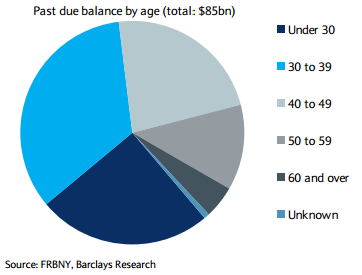

There are a variety of reasons for moving back home and largely, most are driven by economics. In fact, there are now a record number of student loan defaults and most are carried by younger Americans:

Over 60 percent of past due loans are carried by those 39 and younger (a large portion by those under 30). Since many do not begin paying student debt until they graduate this is saying that these people have degrees yet are unable to service their loans. The idea that young Americans are moving back home in droves is startling because it has a large implication on many other sectors of our economy. For one, Social Security and Medicare are going to feel some incredible strain with a record number of baby boomers retiring and a less affluent young generation is largely going to pay into the system with less than what was expected.

A degree is not boosting wages like it once did

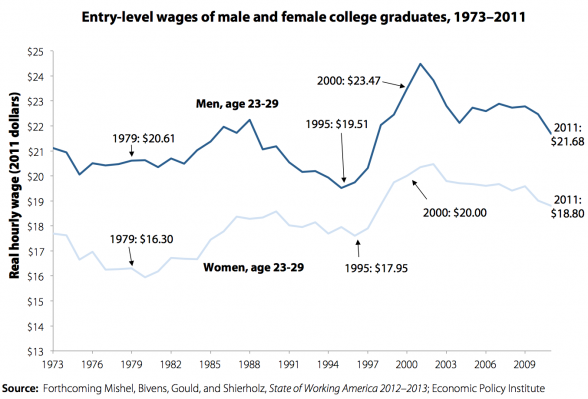

There was a time when getting a college degree was a no brainer in terms of employability and wages. Today, for most career track positions a college degree is a necessity yet many even with college degrees are unemployed. In fact, wages for college graduates has fallen recently:

The picture is more dramatic when we look at those only with a high school diploma. So it is understandable that many younger Americans are living at home. The reasons are many but they break down as follows:

-1. Less affluent than previous generation

-2. Weak employment market

-3. Starting families later

-4. More going to college and coming out with high levels of debt

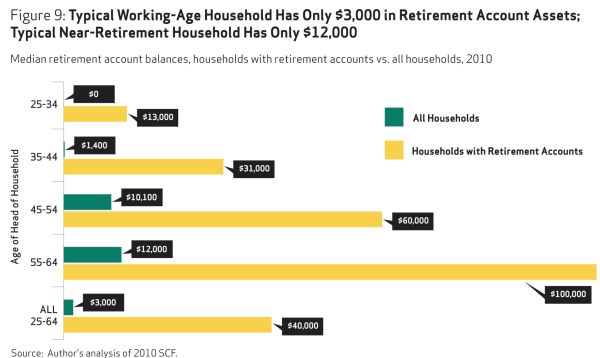

However none of the above shows that the economy is booming for young people in this country. You also have those 25 to 34 having no money in retirement accounts:

It is hard to see how this trend will reverse anytime soon so we can expect that more and more young people will be living at home. This is what is presented to us as an economic recovery.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!