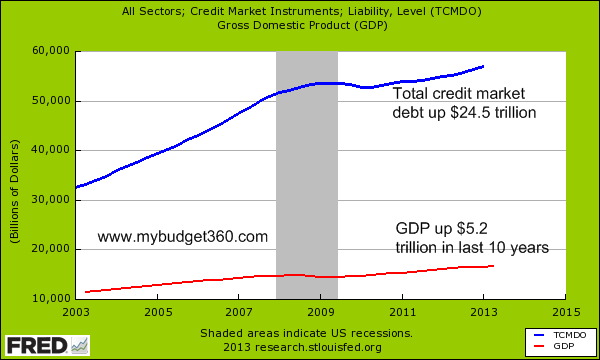

Long live the reemergence of the FIRE economy: Over the last decade GDP is up $5.2 trillion while the total credit market debt owed is up $24.5 trillion.

- 1 Comment

The current economy is juiced on the rivers of easy debt. An addiction that is only getting worse. Want to go to college? You’ll very likely go into deep student debt given the rise in college tuition. Want a home? Prices are soaring because of speculation but you’ll need a bigger mortgage to buy. Want a modest car? A basic new car that has four wheels will likely cost $20,000 after taxes after fees are included. Need gas for that car? The price of a gallon has quadrupled since 2000. Combine this with the reality that half of Americans are living paycheck to paycheck and you can understand why the debt markets continue to grow at an unrelenting pace. Here is some food for thought; in the last 10 years, GDP has gone up $5.2 trillion however, the total credit market has gone up by $24.5 trillion. An increasingly large part of our economic growth is coming from massive leverage. This is why the market sits fixated on the Fed’s next move regarding interest rates even though in context, rates are already tantalizingly low. The FIRE economy is driving a large portion of corporate profits yet most Americans are left in the cold winds of austerity.

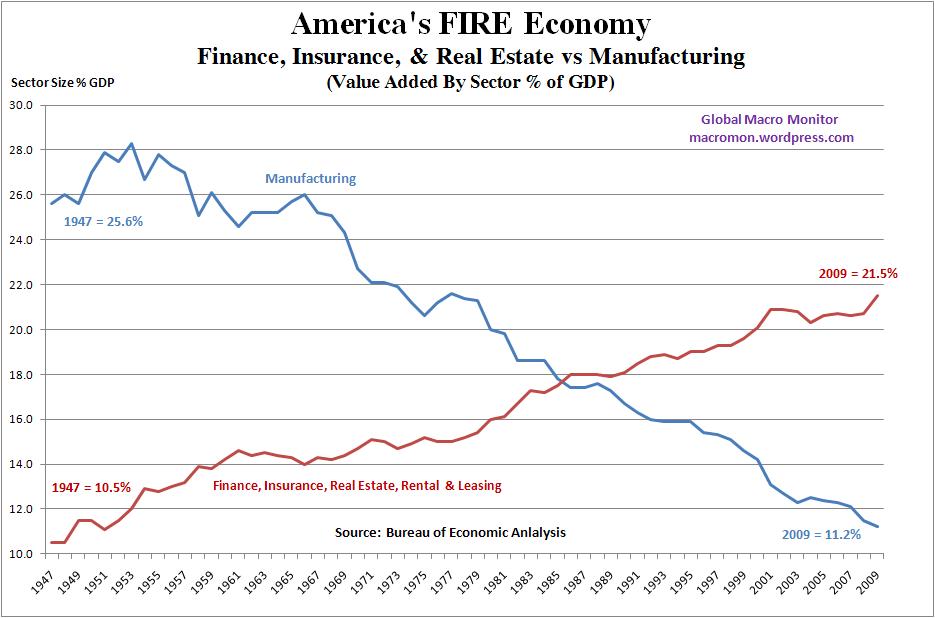

GDP being driven by FIRE

More and more of our growth is coming from a massive expansion of debt:

The total credit market is now roughly 4 times the size of our annual GDP (inching closer to $60 trillion in the US). While some think that this growth is natural and easy, in reality most of it is coming from growth in the financial services side of the economy. The banking system is currently operating in a way that really does not benefit the typical Americans family. Take a look at two employment sectors over the last few years:

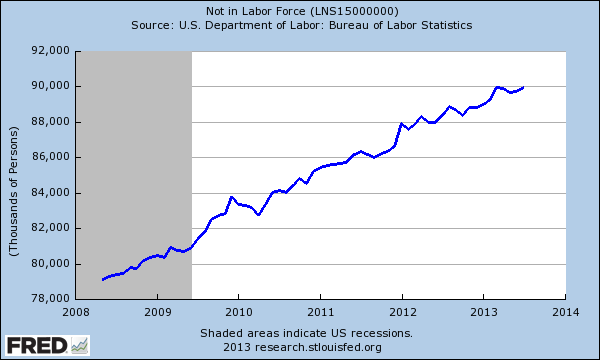

In 1947, the FIRE side of the economy made up roughly 10 percent of GDP. Today it is 21 percent. On the other hand manufacturing in 1947 made up 25 percent of GDP while today it is closer to 11 percent. It comes as no surprise especially as we now see big banks and hedge funds crowding out the real estate trade. Prices in real estate continue to rise at levels last seen during the bubble yet the homeownership rate continues to fall. We keep adding more and more Americans as “non-workers†and then wonder why we have 47 million on food stamps:

The number of Americans not in the labor force is booming because of demographics but also because people are dropping out of the workforce. This certainly doesn’t coincide with some of the data being produced from other channels.

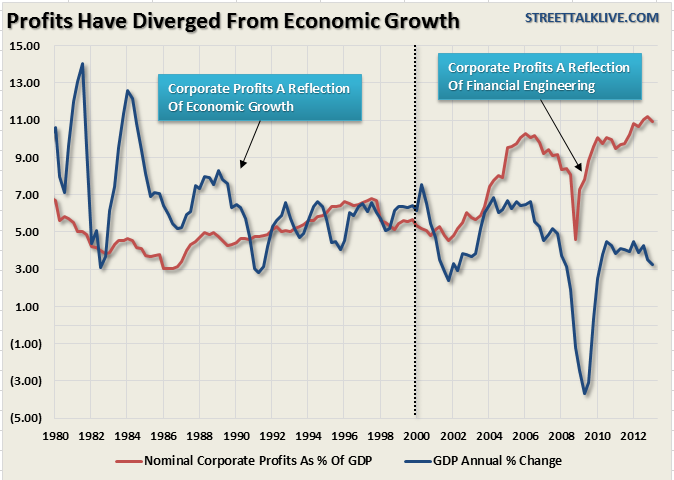

The reason why most Americans are not feeling the recovery trickle down to them is that the FIRE side of the economy is capturing a large share of the profits (more fuel for the growing income inequality trend). Just take a look at how much of the recent growth has come courtesy of financial engineering:

Corporate profits as a percent of GDP are at generation high levels. Yet GDP growth is weak (especially if you consider how much growth is coming from FIRE activity). This is reflected in stagnant household income growth and the reality that wealth continues to shift into the hands of a very few Americans.

Redoing the last bubble

The problem with all of this is that we are simply redoing the last bubble. This is a similar variation of our last bubble (i.e., financial sector deep into speculation, quickly rising real estate, no income growth, leveraging on debt, etc). The finance and real estate side of the economy is driving profits and speculation, yet we see that for most Americans, the gains are simply not there. This is just part of the financialization of our current system. It is odd that big banks and firms are so interested in rental real estate yet they can extract money from Americans via this measure because the Fed is basically offering zero percent rates to member banks. In other words, it is a riskless trade so why not grab all the real assets you can while the Fed continues to devalue the purchasing power of Americans?

The FIRE economy is back in a big way. Of course you shouldn’t be surprised that this isn’t helping most Americans prosper.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Dick Mazess said:

What is date of the FIRE article, and if 2013 has it been updated?

Who are the principals of MyBudget360 (the principles are great)May 2nd, 2016 at 11:06 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!