Failure to launch into household formation: Record 36 percent of young Americans (18 to 31) living at home with parents. Where is household formation coming from?

- 3 Comment

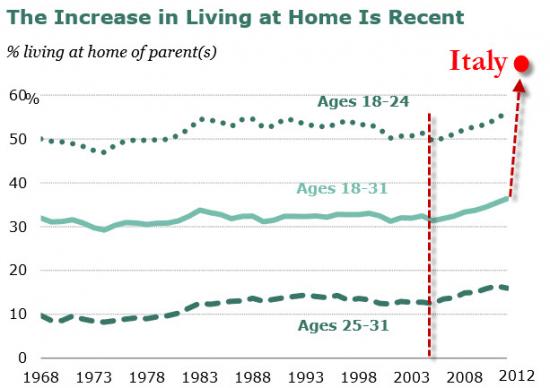

The notion that the housing market is surging because of young Americans buying up homes to form households is simply incorrect. The housing market is rising like an artificial phoenix built on Wall Street’s insatiable appetite to leverage easy money from the Fed and investors. If we look at data regarding young household formation we actually find that a record number and percentage of young Americans are living at home into their 30s. Many look at places like Italy with cultural norms that favor children living at home into older ages and think that somehow, Americans are very different. Well apparently this isn’t the case when we look at the numbers. The economy has been very tough on young Americans and the lack of household formation in this group simply reflects constrained finances for this group.

Record number of young living at home

A recent Pew study had some troubling figures regarding the number of young Americans living at home:

Source:Â Pew, via ZH

Going back to 1968 this is a record number of Americans living at home between the ages of 18 and 31 (this translates to 21 million Americans). Keep in mind this applies for both renting and buying. This data flies in the face of the meme that housing is recovering because of an across the board jump in household formation. A large part of the housing market’s surge has come because of investor money and a market where supply has been stifled by banking charades brought on by suspending accounting rules.

Yet the above chart highlights that young Americans are having a tough time launching their own economic lives. We have been conditioned that each subsequent generation would have it better than the previous one. It is become more apparent on the financial front that this generation will have it tougher.

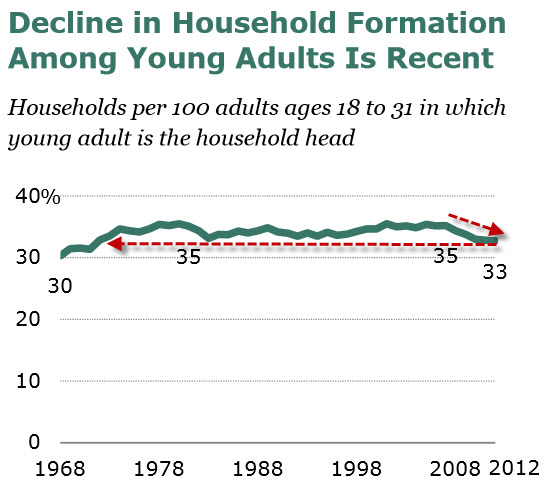

This decline in household formation is a new one:

We are going back a generation here. A lack of financial security but also massive amounts of student debt are stifling the financial lives of many young Americans. Why would someone take on a mortgage when they are already carrying on student debt that rivals that of a home loan? Financial necessity seems to be the bigger reason many younger Americans are living at home versus a desire to stay with mom and dad into your early 30s. American culture is fiercely independent so it is unlikely that we’ve suddenly decided that we want larger families under one roof. Economic necessity is driving this. Maybe with time this perception will evolve but that is not the case in the current environment.

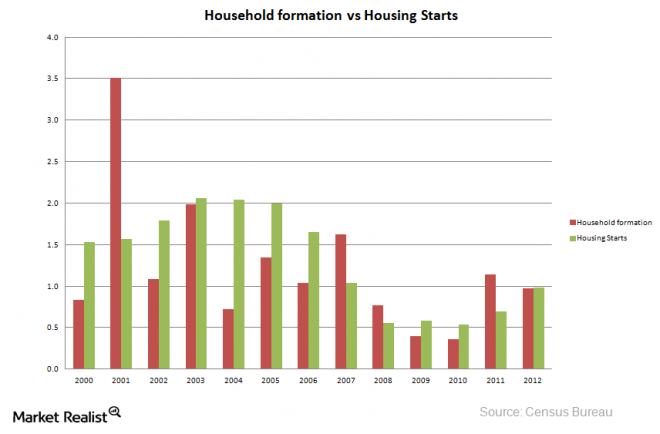

Household formation and housing starts

Household formation has picked up from the depths of the recession but where is this growth really coming from?

You’ll notice that since 2008 we’ve been at a very slow pace for household formation. Given that household formation is not coming from those 18 to 31 you have to wonder what other groups are contributing here. Since many investors are buying up properties to rent out you actually have many people transitioning into rentals. This constitutes a household being formed but not someone actually buying a home for their family as the media likes to perceive this housing recovery.

Of course the above requires looking at multiple data sources and trying to figure out a bigger trend. Household formation for young Americans has been falling yet household formation has picked up overall since the lows of the recession. From where? What is the impact of large investors dominating the real estate market with easy Fed money? It is rather obvious that this recession has caused a failure to launch for many younger people in the US.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Norma said:

Do you think this is an aberration?

Only in the U.S. , which btw, throws away it’s old people, in “Old fol’s homes” because they’re can’t be bothered with.

In other Cultures, worldwide, even in Europe, the young people either build an addition to the original home, or stay in the same town….where the family stays close, and helps / support each other, monetarily and many other ways.

August 5th, 2013 at 9:49 am -

Russ Smith, Caliornia said:

Hi!, Patrons Et Al:

The American Institute For Economic Research in Great Barrington, Mass. believes that we are forming an economic recovery based upon New Housing Starts which are climbing but they do minimize their outlook also due to the pressures of Student Loans etc.

Please readers contact them @ (888)528-1216; to ask them about purchasing their Chart Book of which their 1st Chart is: The Purchasing Power Of The US $ plus others. U will be amazed @ what has taken place; in regards to the $’s overall loss of buying power semse Presidend Nixon closed the US Gold Window August 15, 1971 from around 140 pennies per US $ down to around 2 pennies on the right hand side of their US $ Purchasing Power Chart. What’s to be done about this annomoly; contrasted against Article 1; Section 10 of the US Constitution which telll US that we are to have only gold and silver coins as OUR money? What would be the value of housing and student loans for example denominated in silver $’s alone? We have lots to ponder and overcome in my perspective.RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.comAugust 6th, 2013 at 9:18 pm -

Bruce said:

Did you ever think that a lot of this is due to the baby boomers needing someone to care for them? My mother hasn’t reached that stage yet but it is coming. Should I say at my residence or stay at my parents home? Do you account for these situations. There are over 2 million retirements of baby boomers a year. The demographic is HUGE.

August 7th, 2013 at 5:33 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!