The uneasiness of Quantitative Easing: How QE is ineffective with helping the broader economy in favor of boosting support for too big to fail banks.

- 0 Comments

Quantitative Easing outside of economic and financial circles is a mystery to most of the public. In fact, start talking about the Federal Reserve and eyes will glaze over as if you were speaking in tongues. The financial sector counts on the public being ignorant of such things. That is why the failure of QE is such an important topic to discuss. The consequences brought on by QE have resulted in massive distortions in the market. First, we have incredibly high speculation once again from the financial sector (it never really went away and was the fodder for our last financial implosion). QE simply provided an easy mechanism for cheaper funds via interest rate distortions. The second key point is that banks have increased their leverage via easy debt and are crowding out smaller players in the market. A perfect example is the flood of big money investors crowding into residential real estate. QE has ultimately turned out to be a very selective bailout of the too big to fail banking sector.

How QE failed

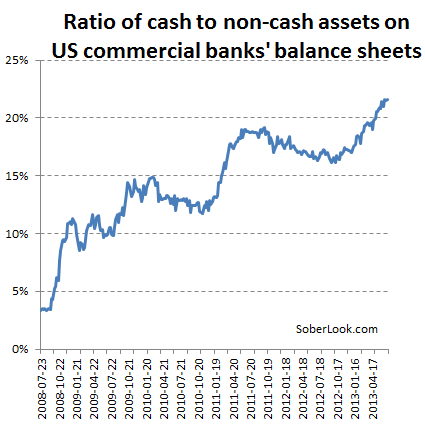

The main reason for QE was for banks to push out newly added funds to the public (that was the premise at least). Instead, banks are hoarding this easy money and speculating:

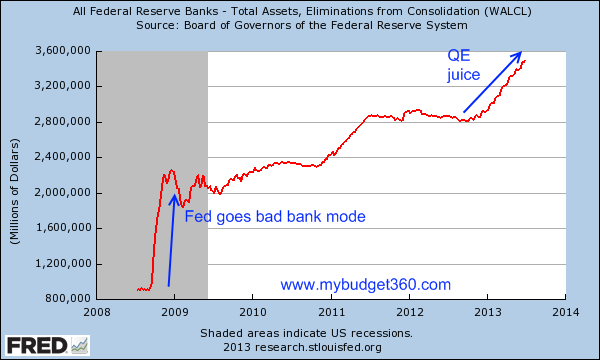

This cash to non-cash asset ratio is reaching record levels. And this did not come cheaply:

The Fed has taken their balance sheet into deep and uncharted territory. All the taper talk was simply the Fed bluffing. Look at the chart above. Do you see any tapering in that? When the crisis was unfolding it was very clear that too big to fail was a central reason why our economy was melting down. These large banks took on irresponsible bets and lost. Yet they ultimately needed the public for a bailout. It is incredible and a testament to modern psychology how much chicanery the financial system was able to get away with. You would think that at least the too big to fail banks would have been forced to face some checks and balances given the funds they were receiving. Instead, they grew even larger:

JP Morgan – Total Assets

December 2009:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.031 (trillion dollars)

December 2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.117

December 2011:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.265

December 2012:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.359Â Â +16% from 2009

The Fed’s balance sheet growth was largely a result of the bailout of the shadow banking system. Banks transferred questionable assets to the Fed as a temporary holding spot while tapping into multiple streams of new income from the Fed. No need to mark-to-market or follow accounting rules that most people have to follow.

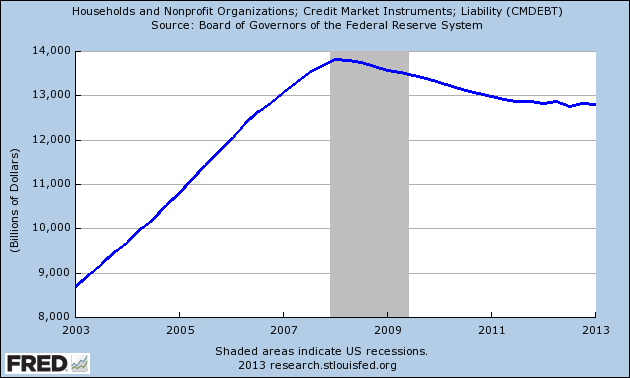

QE’s main goal was to get money into the hands of Americans. How has that worked out?

Households continue to deleverage even though the Fed has allowed massive leverage to infiltrate the banking system. Where is this leverage going? Well for one, deep into the stock market. Another area is the residential real estate market that is benefitting from QE and the artificially low interest rate that is brought on from QE. It is a simple path to understand:

-1. QE function purchases MBS at artificially low rates

-2. Banks push product to public (and collect nice fees servicing and originating these loans)

-3. Banking profits are solid but rates are low (time to chase profits)

-4. 5 million foreclosures and bargain basement prices in many real estate markets (push out the local crowd with all cash buying)

-5. Chase yield while handing out 0 percent on savings to regular customers

How is this even viewed as a success? So we are trading a normal market rate mortgage on say a $150,000 home for an artificially low rate mortgage and a $250,000 home? Yet American households have seen their income retreat to levels last seen in the 1990s. Is this the goal of QE? All you need to do is look at banking profits and compare this to household income and wealth and you’ll see what the true intention of QE was. It is time the public pays attention to QE.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!