Wealth distribution in US rivals a modern day Gilded Age: In 2013 wealth inequality at record levels. 72 percent of wealth in US held by 5 percent of the population.

- 3 Comment

Americans continue to live through a modern day Gilded Age. Wealth inequality is at its highest levels since the Great Depression, when names like Mellon and Morgan plastered the headlines. Yet this time around, the availability of debt provides the illusion that the playing field is even. Americans are massively in debt and when we look at actual wealth, we find that many have very little to their name. In fact, millions of young Americans are in a negative net worth situation thanks to their student debt. Wealth inequality has reached record levels because the system is now operating under a dysfunctional corporate and banking welfare structure. The public is forced to deal with compressed wages, weak benefits, and basically what we know as economic austerity. While this is happening, big banks use the Fed to their advantage and even when they lose, they win. This is how 72 percent of all the wealth in the US is held in the hands of 5 percent of the population (with 42 percent of this in the hands of 1 percent).

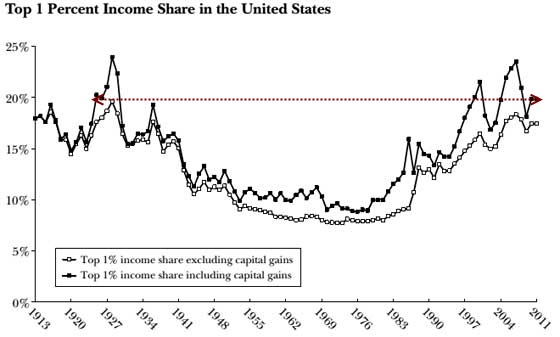

Top 1 percent share of income

You would think that the Great Recession would impact this distribution but it has only accelerated it:

In regards to income, the top 1 percent are now earning 20 percent of all US income. This is the same level that was experienced in 1920. Compare this to about 10 to 13 percent between 1948 through the 1980s when the US had the biggest booming middle class. It should come as no surprise that the middle class has suffered mightily during this “recovery†even as the stock market hovers near record levels.

A variety of measures beyond income share are also showing this growing in economic disparity.

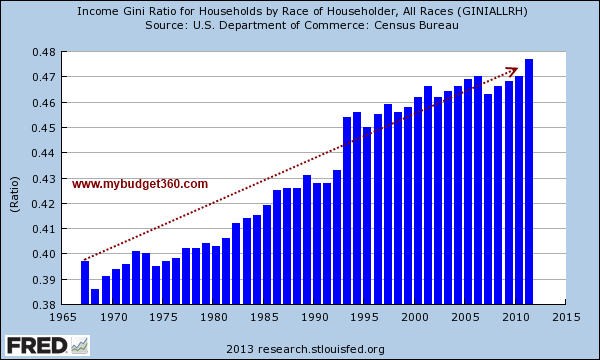

Gini Ratio

The Gini Ratio highlights income disparity in a country. The US is seeing generational highs when it comes to looking at this measure:

As you will notice, the recession did push this ratio lower (more income equality) but that has now washed away. Income inequality in the US is now at record levels. Again, we would have to go back to the Gilded Age and the days prior to the Great Depression to find this kind of income and wealth disparity. People realize that there will always be income disparity in a free market but not to these unbalanced levels.

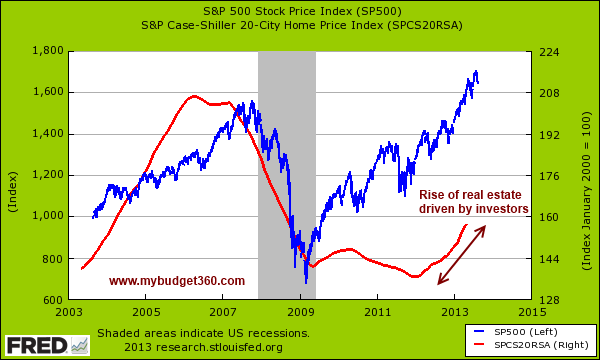

Even one of the places where most Americans keep their wealth, housing is now being sucked away from big banks leveraging easy money from the Fed.

Stocks and real estate

Most Americans own their home. When we say own, we mean with a mortgage but this is where most Americans gain their wealth. However, the recent rise in real estate values is being driven by investor demand. This is how you can have a big drop in homeownership while investors buy up nearly half of all real estate in 2013. Is this positive? What appears to be happening is more and more asset classes are being funneled into the hands of a very few. This helps to explain why incomes are down for most and how we now seem to have a permanently large group of Americans on food stamps (something like 1 out of 6).

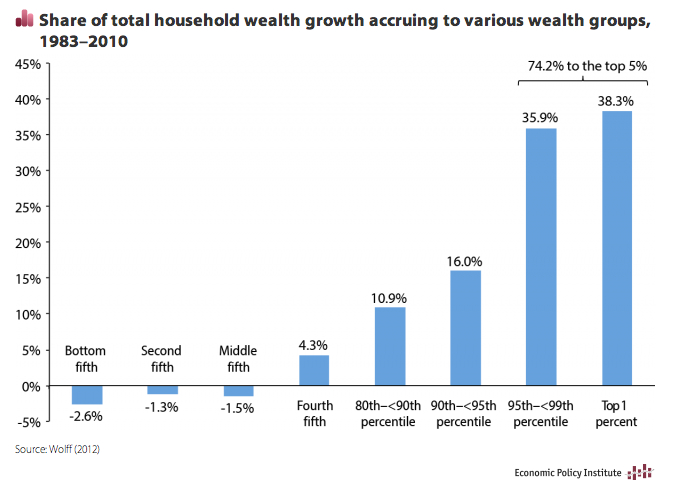

A massive amount of this wealth aggregation to the top has happened over the last few decades.

Where is wealth growing?

The bottom 80 percent have been punished in the last generation (even the bottom 90 percent have not done so well in context):

The top 5 percent has captured over 74 percent of all wealth growth. This tied in with all the other data demonstrates how uneven this wealth distribution has become. And don’t think many of these top winners are doing things that are good for the economy. Many are hedge fund leaders that have actually placed bets on the failure of Americans and made money on complicated derivatives that helped destabilize the system. Instead of being “job creators†these people are job destroyers yet are rewarded by the system. Austerity for the masses and corporate welfare up to the top. Many are starting to realize they are living in a new Gilded Age controlled by student debt, massive healthcare bills, and hidden inflation that eats away at their paychecks.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Brian Sharpe said:

As a guy who joined the ARMY for the GI Bill money to go to college and improve my families earnings from the second fifth I struggle to see the issue.

With hard work I have moved from the bottom fifth in my 20’s to the top fifth by my late 30’s. This country is full of opportunity for those who work there ass off for it.

August 26th, 2013 at 5:03 am -

David Lee said:

Immigration of cheap labor was cut off around 1930, which is when the wealth disparity began to fall. The rise in wealth disparity began shortly after 1965 when immigration of cheap labor began to be encouraged again. Just a coincidence?

November 26th, 2013 at 5:41 am -

Ann Moore said:

I was born in 1935 and worked since I was 16 at jobs paying under $5.00 an hour. In 1950 admission to a movie theater was 25 cents. If I I had wanted to buy clothes I had to work for them. My Dad worked for AT&T and New England Tel so we had food on the table. Lived through the recession with tokens to buy food. My parents bought their home in 1926 for $5,000. In 1982 I sold it for $52,000. After I sold the house I was placed on Disability (government) having under $300. a month. Ihad losses after an accident, my job, family, home,income my dog, that was enough to do anyone in. I have been living in a nursing home receiving $72.00 a month after payment of my SS is made to the home. I know about wealth distribution. and much more. What I have left are some ideas (still have them) about having an income again.In 1971 I applied for aSBA loan developed a small business, travel l related and ran it for 4 years. I learned about incorporation, sold stock to investors and had contracts with people. Interesting experience.So, here I am, wanting very much to live somewhere else. Wealth management, Good Luck. Ann Moore

July 8th, 2016 at 5:23 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!