One third of 18-34 year olds living at home with parents and student debt rages out of control to $1.6 trillion. Total US credit market debt at $74.5 trillion.

- 3 Comment

Young Americans are having a tough time in this economy when it comes to pursuing their own version of the American Dream. New data highlights that many young adults are still living with their parents deep into adulthood and this is largely being driven by economic reasons. This is all happening during a time when the stock market is at a record high, housing values are up, and the employment rate appears to be healthy. So what gives? What gives is that many young Americans while having work, are not making enough to save for a home and are stuck having to pay off a mountain of student loan debt. Student loan debt now sits at $1.53 trillion officially but this data is old and we are racing to $1.6 trillion. Young Americans are having a failure to launch moment because many are already carrying mini-mortgages before jumping out of the nest.

The struggles of young Americans

You would expect that with the booming economy more young Americans would be out living on their own away from their parent’s discretion. Yet we are still seeing record levels of young adults living at home with their parents.

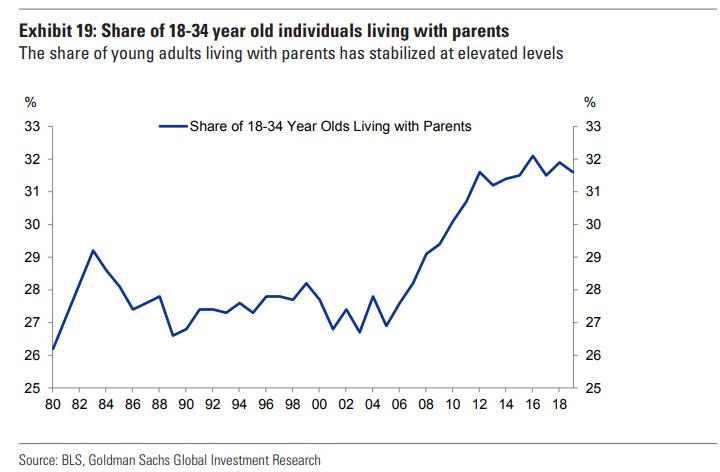

Finally some updated information is out regarding young household formation and we are seeing that for young Americans many are still living at home at record rates:

Nearly one out of three 18-34 year olds are living with parents. You can see from the chart above that the Great Recession did cause some sort of generational shift. This is not typical for this generation. Something is going on that is beyond the headlines of the economic recovery.

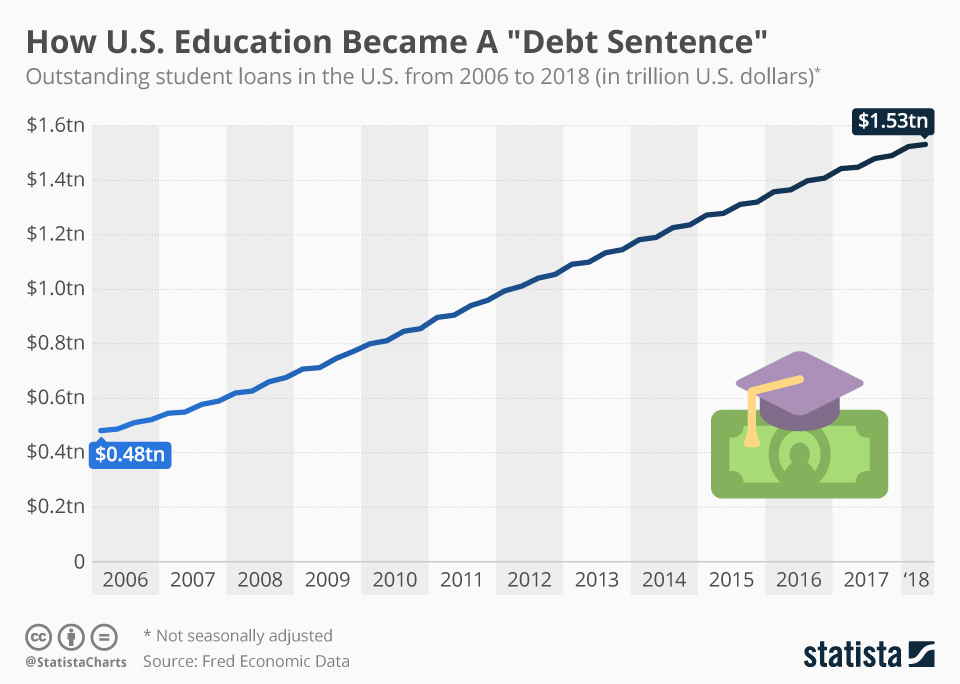

What is going on is multi-faceted but one major albatross that young adults are carrying is student loan debt. Student loan debt is now the second largest class of debt in America only behind mortgage debt. Just take a look at how quickly student debt has spiraled out of control:

In ten years we’ve added more than $1 trillion in student debt and it doesn’t seem to be slowing down. We now know that one big campaign topic for this year is going to be student debt and how we are going to address it. Something has to give and household formation is being stunted because millions of Americans are left paying mini-mortgages on student loans.

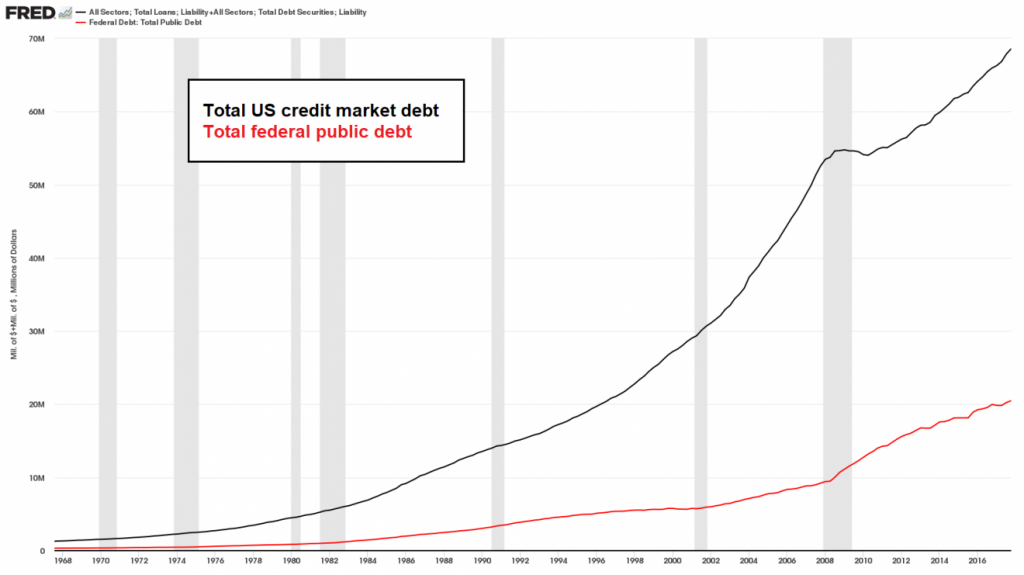

America needs to wrestle with the idea of halting a generation of young adults because we are now living in an era of rampant debt usage. This excessive usage of debt is happening in all forms:

-Mortgages

-Auto loans

-Credit cards

-Personal loans

-Government debt

-Corporate debt

In total there is more than $74.5 trillion in debt in America:

At this rate it is shocking we don’t all live at home with parents. Ultimately this path is unsustainable and something is going to have to give. All is fine so long as debt is accessible but there is always a day of reckoning with these type of situations. If you remember, the Great Recession was largely a liquidity crisis driven by the inability to service debt similar to someone being unable to pay their bills and having to go bankrupt. Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

David Gerwin said:

Circumstances existed in the past also. I lived with my parents to support them for about 10 years until they were eligible for social security as my fathers self employed business was not doing well. During that 10 years I also was in school part time for training for my job. which I paid as I learned. Shortly after my girl friend and I got married. She had also had been living with her parents and we between us had saved enough to put 50% on a fixer upper house. This took place from the early 1960s to mid 1970s. At that time houses priced like many are today did not sell. Which along with education cost would come down if people would just say no prices would come down. In fact in 1986 we were looking for a different house and actually had one built on property that I had inherited from my father for less than an equivalent existing house. Today the idea that the buyers can have some control of the situation seems to be lost.

January 19th, 2020 at 5:58 pm -

Arizona said:

AMERICANS don’t pay taxes to educate their children any more,THEY PAY taxes to support the military so they can bomb the world,HAVEN’t you guys heard, AMERICA ARE THE POLICE OF THE EARTH,we tell other countries what they can and can’t do…our kids can jump in the lake,children are of ZERO value to americans…their Future is over…

January 19th, 2020 at 7:13 pm -

Ela said:

This is all HOGWASH!!!!

When I was in college the last few years, paying as I went without loans, I saw these so called poor baby students living on the hog with these credit cards handed to them by the banksters that gave them credit. Every morning they stood in line to get breakfast and $10 lattes, then again at lunch, then again for late lunch. The colleges are just as guilty for allowing these lunch areas that didn’t blink an eye at how much it was costing, for all these coffee and food breaks, and the cost of books that is out of this world. And now the demogogs want the taxpayers to bail them out? To hell with that.January 21st, 2020 at 3:21 pm