Comparing the cost of living from 2000 to 2020: Inflation is a lot higher than you think and your purchasing power is declining.

- 1 Comment

The cost of living in the US is getting more expensive and the way our banking system is setup, we are primed for continued inflation. Our major purchases are financed with debt and low interest rates so the true cost of many things in our lives are understated by the “monthly payment†mentality that many people live under. Yet there is a major catch since we are addicted to low interest rates and we really can’t go much lower so that silver bullet has now been maxed out. This impacts college tuition, housing prices, automobile costs, and practically all items that we utilize and purchase in our lives. Inflation catches up on you in a slow and sneaky way. Little by little you start to realize that your money isn’t going as far as it once did. We typically see reports showing that inflation is moving along nicely through the Consumer Price Index (CPI) but in reality, things are very much different. Let us compare the cost of living between 2000 and 2020.

The impact of inflation

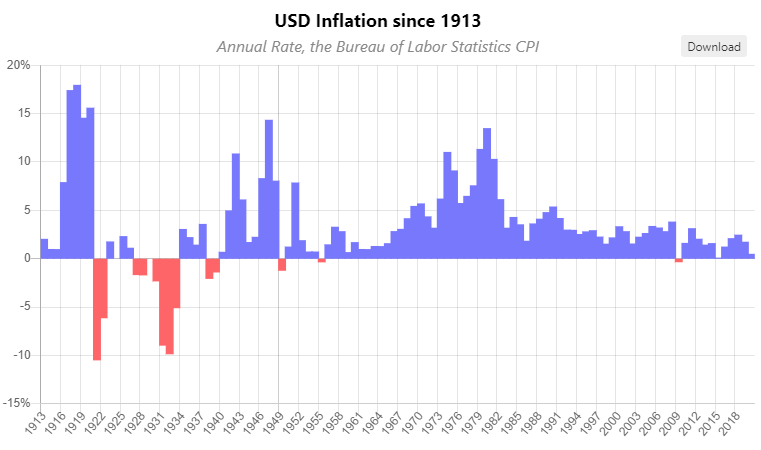

Take a look at the following chart:

The only time we have faced broad drops in prices were during the Great Depression and the Great Recession. The system is designed to keep prices rising to avoid the hoarding effect. Why would you buy a car today if you knew it would be cheaper tomorrow? Overall the system is designed this way to keep people spending – but this has hit a wall and utilizing debt is now a cornerstone to our economy.

The above chart shows inflation over time. From the early 1990s to today you would think that things are moving along nicely and controlled versus the wild days of the 1970s and 1980s. But the reality is different when you start to look at the items individually.

We should start off by looking at US median household income as a baseline:

2000: $42,148

2020: $63,179

So over 20 years household income went up by 49%. But as you know, you have to look at what your money can buy and this is where inflation eats away at purchasing power. Let us start at looking at some key expenses.

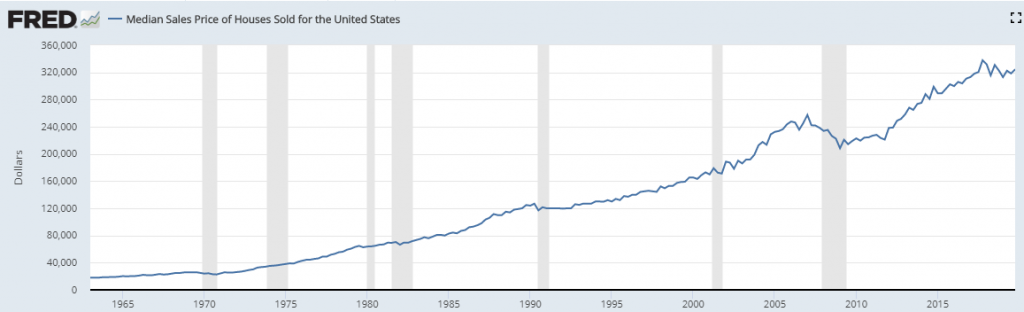

Housing

The median sale price of a new US home in Q1 of 2000 was $165,300. As of Q4 2019 it was $324,500. That is a 96% increase over this period. So the cost of buying a new house went up at nearly twice the rate relative to income.

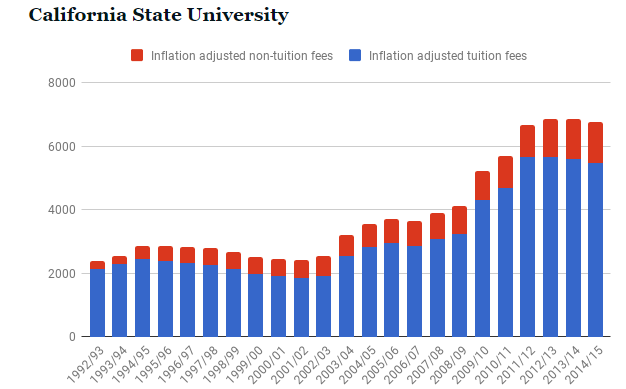

College

Let us now look at college tuition. According to NCES data the typical tuition at a public college was $7,586 in 2000-01. The latest data on the report is $17,237. This is a 127% increase and the latest data in the report is from 2015-16. It is actually higher. Just look at one example here:

The California State University system is massive with 23 campuses across the state enrolling nearly 500,000 students. In 2000, tuition alone was $1,428. Tuition alone today is $5,742. This is a 302% increase!

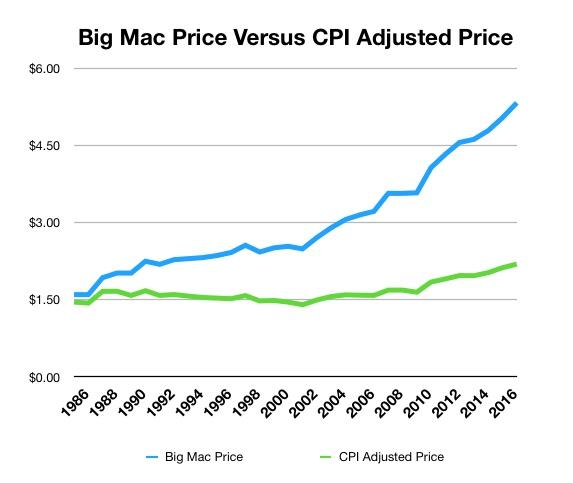

These are big ticket items but what about with something as simple as a Big Mac?

Cost of a Big Mac in 2000 was $2.50. Today it is close to $5.67. That is a 126% increase. So even with something as simple as a Big Mac, you see that wages are simply not keeping up.

This is why inflation is so important to examine at a closer level. So how are people keeping up with buying all these things if wages are not? Simple. By going into massive student loan debt, taking on bigger mortgages, and financing cars with debt that many can’t even manage. Once you start looking at items one by one, you start realizing that purchasing power has fallen dramatically and low interest rates followed by going into debt have made the situation less apparent to Americans – that is until they have to pay it all back. Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Don Morrison said:

The other thing is that products that don’t go up in price use the trick of smaller sizes. I just re-bought toothpaste and the new tube is 4 oz. The old tube I bought less than a year ago was 5.5 oz. No price increase at all. BUT, that’s a 30% price hike- without them raising the price.

February 10th, 2020 at 1:12 pm