Will quantitative easing 2 bailout the commercial real estate market further? The shadow bailout world not being covered by the mainstream media. Fed deliberately trying to crush U.S. dollar to bailout banking system.

- 0 Comments

As the Federal Reserve gears up for quantitative easing part two, a slow hidden bailout is occurring in the commercial real estate market. Commercial real estate is a giant industry making up over $3 trillion in outstanding loans in the U.S.  Yet not much is being said about this in the press. Why? Because in a way, commercial real estate (CRE) is being funneled through various channels to bailout horrible banking loans but the process is convoluted on purpose. We already have examples of the Federal Reserve owning a shopping mall out in Oklahoma for example. The Fed has purchased incredible amounts of debt including CRE debt. Much of the focus has been on the Fed monetizing residential real estate debt and this is true. After all, they did buy over $1.25 trillion in residential mortgage backed securities.

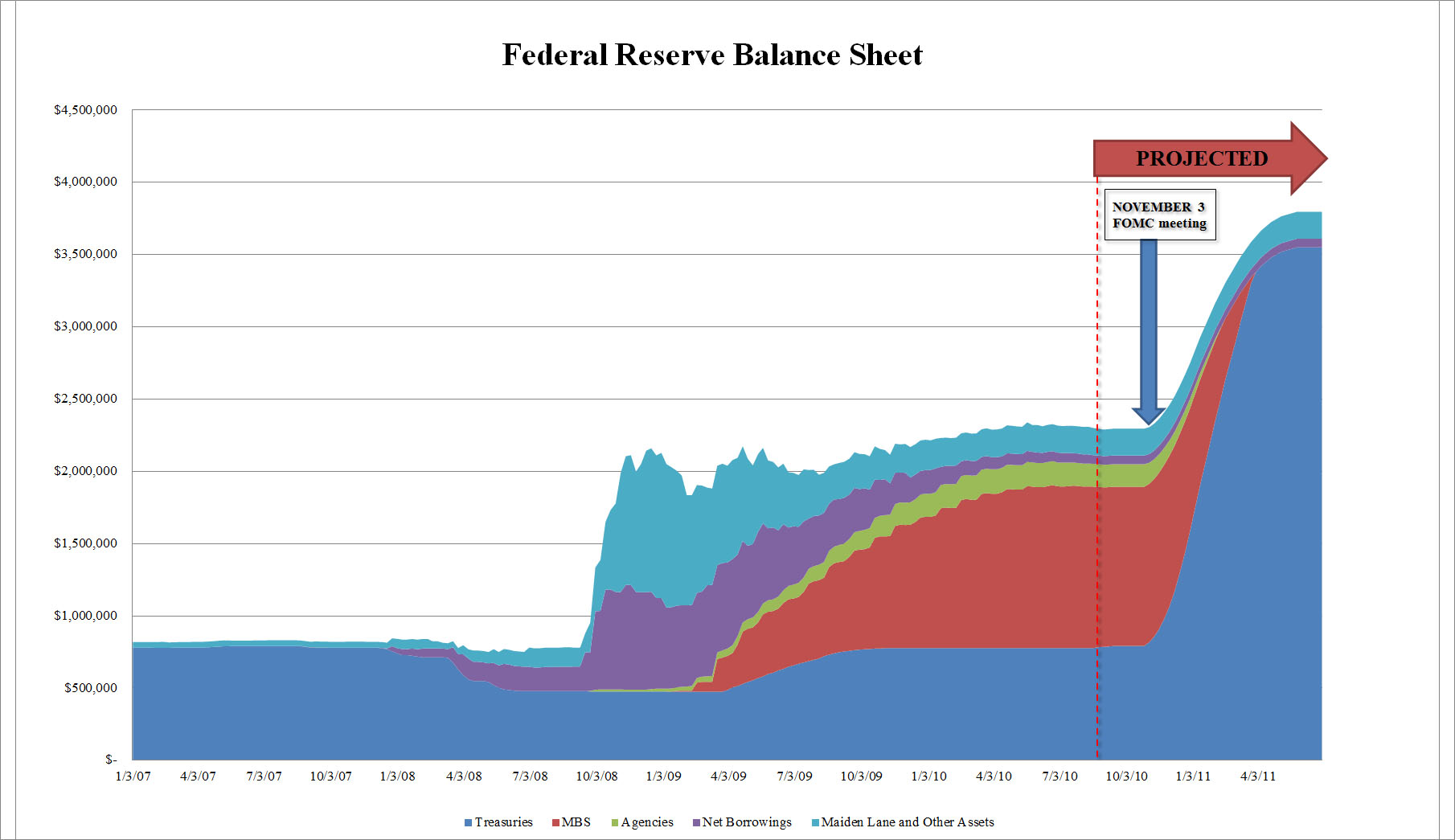

The Fed balance sheet which used to be made up of safe U.S. Treasuries is now composed of mortgage waste:

Source:Â Zero Hedge

Since the public has no ability to do a full audit on the Fed, we really have no idea what is sitting on the balance sheet. If that doesn’t make you feel uncomfortable, just wait until QE2 hits and more debt is monetized into the system. The bailout is happening and taxpayers are on the hook for this mess. Keep in mind that this current path is destroying the U.S. dollar and it obvious to see. If the Fed which is the bank of all banks is basically eating up the junk, what do you think happens when they dish out those green Federal Reserve notes? The value goes down and down:

It is apparent what will be happening moving forward. The attempt is to monetize as much of the toxic debt and inflate out of this current crisis. But can you monetize your way out of $3 trillion in CRE debt plus another $10 trillion in residential mortgages? Now of course, not all of this debt is bad. Most are paying their mortgage on time (at least with residential RE). Yet the big problem is the way banks leverage their assets. With so many little to nothing down mortgages out there, $1 trillion in bad assets was enough to sink the system. We have that much in the CRE markets:

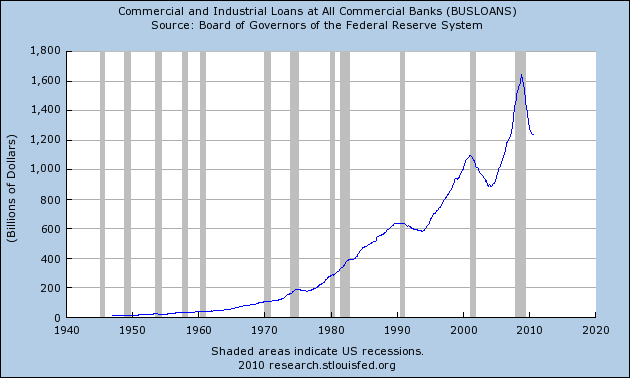

Commercial loans from big banks (only one subset) have fallen by $500 billion from their peak. This is enough to sink most of the current banks out there. Yet what has happened is the Fed has allowed this shadow monetization of the debt and banks let borrowers roll over CRE debt without even making payments in many cases! Think of an empty shopping mall. There is no buyer for this in the current market. So why would a bank want to foreclose on the borrower? Instead, they pretend the asset is worth $10 million while the borrower makes no payment and the Fed keeps funneling money into the banking system. In the end, the value of the dollar gets crushed and you end up bailing out the banking system.

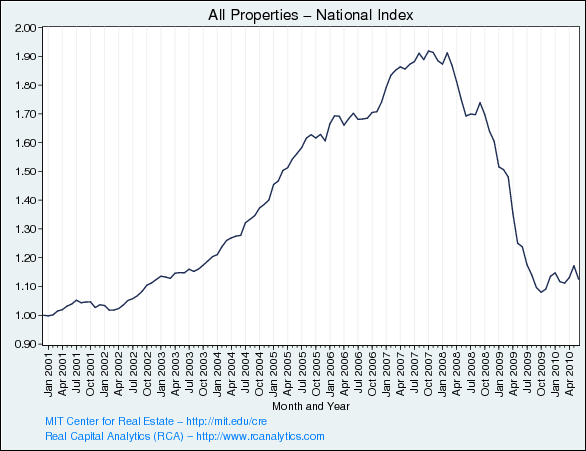

It is disconcerting that no serious talk about inflation or deflation has occurred in the mainstream media. They focus on the smaller stimulus bailout but this is nothing compared to what is happening through the Federal Reserve. Even the CRE market problems will cost more than the entire stimulus that is constantly talked about. At one point all U.S. CRE was valued at $6.5 trillion secured by $3.5 trillion in loans. Today it is closer to $3 trillion in value with the equal amount of loans:

Source:Â MIT

Commercial real estate has collapsed even harder than residential real estate. This market is enormous in terms of actual debt. There is no official bailout on the books but it is occurring through a slow and deliberate process. Banks know that they are essentially insolvent and they are dumping this junk onto the taxpayer. While people are distracted with the financial pangs of the recession they are destroying the U.S. dollar and trying with all their might to inflate out of this mess.

The CRE bailout has been going on for well over a year through various Fed vehicles. Just don’t be surprised when QE2 comes out and you start seeing the value of your dollar declining slowly because of supporting the current banking system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!