The secret to the current recovery is that American households are up to their eyeballs in debt once again! Consumer credit hits a record $3.7 trillion.

- 4 Comment

Do you notice more credit card offers hitting your mailbox? Are you noticing more “easy financing†for purchasing a new car? Welcome to the new recovery where spending is being fueled by consumer credit.  Once again people are spending beyond their means. In an economy driven by consumption you need to keep people spending and splurging to keep the machine moving. Yet this recovery is being driven by massive consumer debt. We now have record credit card debt, record student debt, and record auto debt. None of these sources of debt really builds wealth in the long run. And banks are once again going into the subprime trenches just to find consumers to lend to. The Great Recession was really the Great Credit Crisis and here we are going deep into debt again.

Consumer debt hits a record level

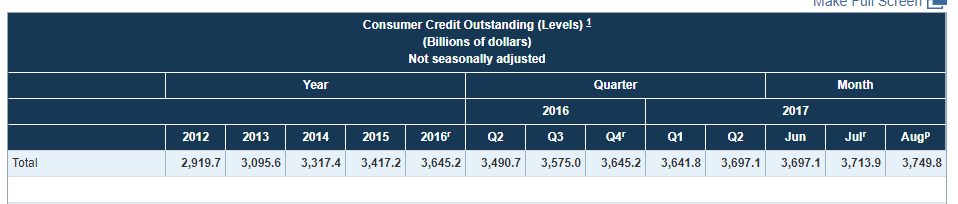

Consumer credit has now hit a record level at $3.7 trillion. This segment of credit is not really beneficial in building long-term wealth especially if you look at credit card debt or auto loans. This is simply spending future earnings today.

Take a look at consumer credit:

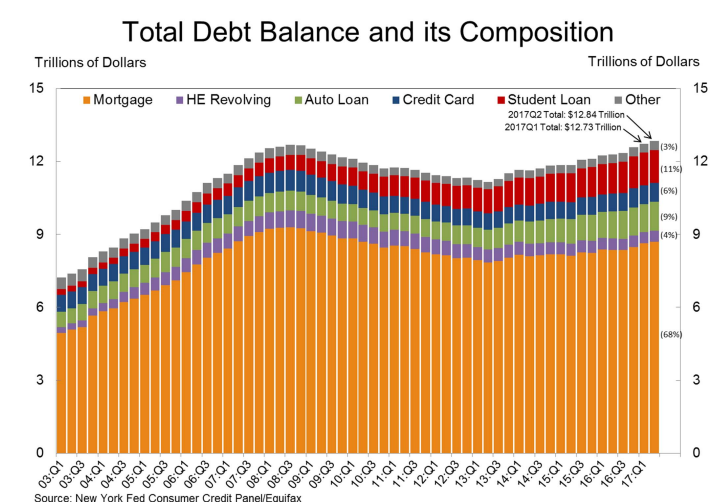

Total consumer credit is now at $3.7 trillion. That is an $800 billion increase in merely five years. People are yanking out those credit cards, personal loans, and signing away years of work for new cars. This is a big problem especially with households already deep into debt in multiple forms:

Credit card debt is now at a record level surging over $1 trillion:

“(Bend Bulletin) The amount of debt owed by American consumers, which receded in the wake of the financial crisis, is again on the rise.

Outstanding credit card debt — the total balances that customers roll from month to month — hit a record $1 trillion this year, according to the Federal Reserve. The number of Americans with at least one credit card has reached 171 million, the highest level in more than a decade, according to TransUnion, a credit-reporting company.â€

This is problematic because stagnant wages are simply adding fuel to the flame and Americans are using credit cards as a stop-gap measure:

“That business model is increasingly lucrative. Many consumers, their wages stagnant and their costs rising, are growing reliant on credit cards for essential goods and services, including medical and dental care. Across the industry, profits rose in the latest quarter.â€

What you have are people simply trying to keep up with a shrinking middle class base. This is fine when you can make the minimum payments but what happens if we have a minor recession? What happens when an inevitable correction hits? The house of cards comes crumbling down again.

The recovery is largely looking like one built on debt spending. We are now in a phase where even a tiny recession will send the system into a severe shock. The credit craze is back again, just look in your mail.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

4 Comments on this post

Trackbacks

-

Cricket said:

Yes, I do notice much more credit card offers and BT checks. I thought it was only me.

October 28th, 2017 at 7:34 pm -

DearSX said:

We need to look for ways to safe guard ourselves and our savings from this mess. I am probably going to invest some money in gold. I may buy a more reliable next car to be in better shape for a recession. Also only buying affordable multifamily in case I need help paying the rent/mortgage plus passive income benefits.

October 31st, 2017 at 10:59 am -

Silver Savior said:

I wish someone would send me some credit cards.

October 31st, 2017 at 7:21 pm -

Princess Luna said:

I’ve gotten so many offers for personal lines of credit and credit cards I just can’t take it anymore. I save them up then spend half an hour in front of the paper shredder every month. The worst ones are the blank checks the bank sends me with a pre-approved $100,000 limit. I never asked for that crap, and if someone got hold of them I’d be screwed. I’ve called them and asked for them to stop sending them, but they do it anyway. Same thing with the newspaper company littering on my front lawn with a newspaper I never ordered every week. I think I’ll stop picking them up and just let the lawn mower take care of them from now on.

November 3rd, 2017 at 7:03 am