5 charts highlighting the epic housing crisis for Millennials – one third of young adults living at home with parents.

- 1 Comment

Millennials are starting to realize that living at home may be a longer-term proposition. Moving back home is being motivated by heavy levels of student debt and jobs that simply pay a lower wage. These trends run directly into the current reality that rental prices are soaring and home values are once again near peak levels. So you are left with a situation where young adults who try to venture out on their own are finding a market that they cannot afford. So naturally, this has had an impact on marriage and when people plan on starting families. It has also created a big impact in terms of younger adults saving for retirement (most are not saving). What are the implications of this housing crisis for Millennials?

Young adults living at home – a new trend

It should be clear that this is a new trend in regards to young adults forgoing to venture out on their own and starting their own families and households. The figures highlight a unique situation and this will trickle down into a variety of segments of society including buying furniture, appliances, and all the trappings of home life.

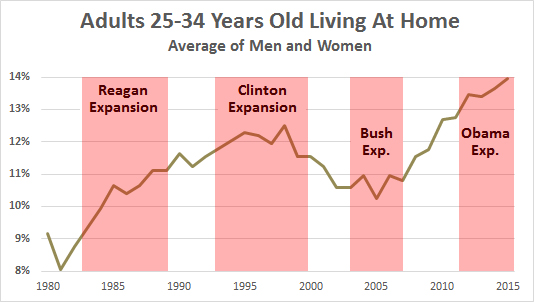

So here is the trend:

It should be apparent that the Great Recession was not the only reason why this happened. In fact, during the bubble days the number of young adults living at home dropped. Of course this happened on the backs of too many people buying houses they couldn’t afford from the banking system that created a casino in the credit markets. Once all of that receded, we were left with the current situation that has been in the making for a couple of decades. It reflects a shrinking middle class.

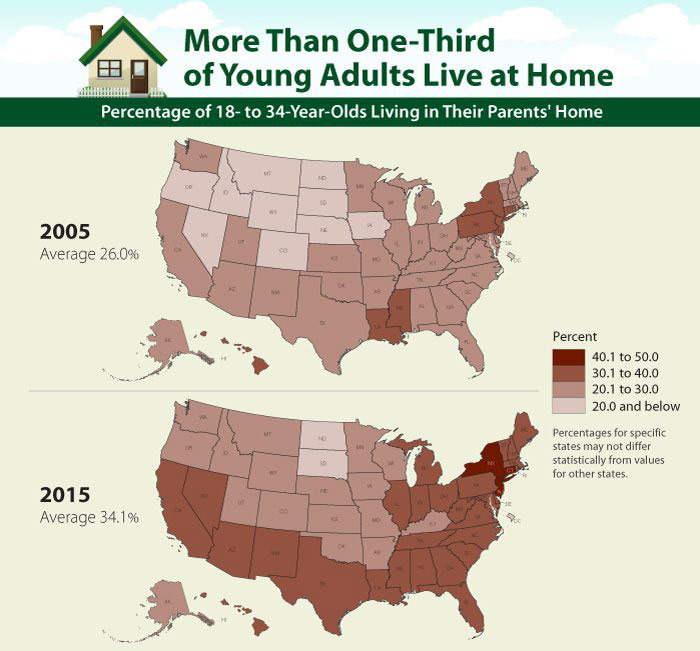

Now you should see that this trend has accelerated in the last decade and follows an interesting path across the country. Take a look at a map of the U.S. showing states where the number of young adults living at home is the highest:

It should be no surprise that more expensive areas have higher rates as young adults are unable to afford rising rents, let alone buying a home. Take a look at rental rates across the U.S.:

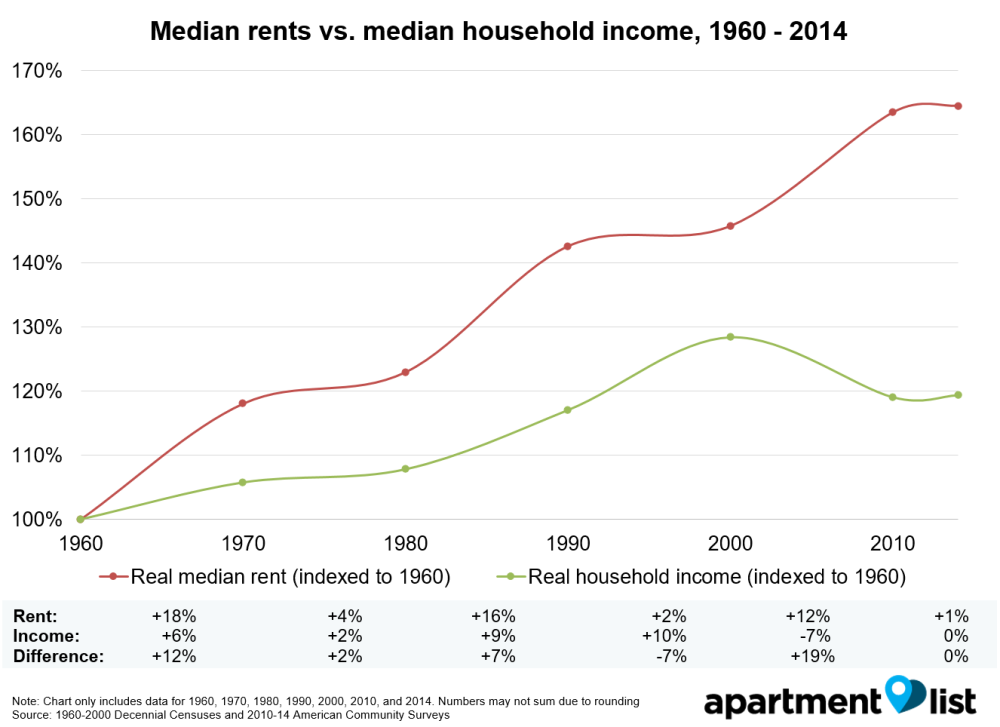

Real rents are rising at a much faster pace than household income. So one underlying reason why we are seeing this trend is that young adults are simply making less money and their dollars are not going as far in the rental market (inflation is a very real thing). The above chart highlights this dynamic clearly. You can see that there is now a clear disparity between income growth and rental values. Here is another look at rents showing a clear growth rate:

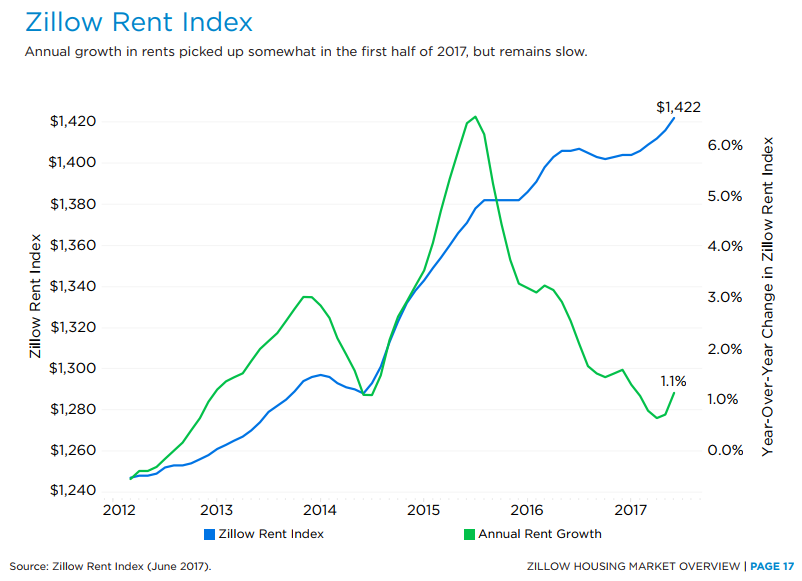

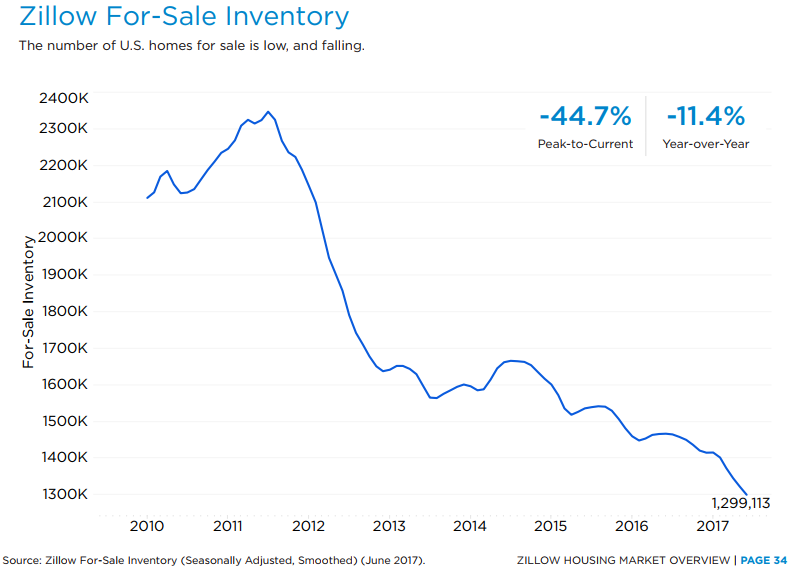

Now some of you are thinking if the market would self-correct in these instances. Well it actually is. Young adults are living at home. Also, you need to remember that home building went from ridiculous unsustainable levels during the housing bubble to a near complete shutdown. So now, housing is at a premium and inventory is still low. Take a look at this chart:

So Millennials will continue to live at home for the foreseeable future in large numbers and the housing market will continue to be very expensive for many Americans. There is a crisis in the sense that the American Dream of owning a home is becoming much more restrictive and the future middle class is shrinking.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

1 Comments on this post

Trackbacks

-

Jimmy @ CC Bank said:

Who would’ve thought that tricking young 20-somethings into taking on 5-6 figures worth of debt to get degrees that end up being more or less useless for most of them would result in such negative consequences for those people?

And best of all? They can’t even declare bankruptcy. They’re essentially indentured servants to Fannie and Freddie for the next 20+ years of their life.

October 12th, 2017 at 3:58 pm