The secretive workings of the central banking syndicate – Federal Reserve balance sheet reaches another record. Fighting monetary inflation by creating it.

- 2 Comment

Central banks provide a mystical approach to solving economic problems although they were initially created to solve short-term financial panics. The first central bank was the Bank of England which was established in 1694. It started out as a private institution but eventually took on a monopoly over all banks in England (all private banks either joined or were forced out). The allure of the system is to even out the panics by centralizing power in one place. The central bank of the United States came over two centuries later in 1913 as the Federal Reserve. The Fed has a mission to help moderate inflation and keep unemployment in check. But what happens when the central bank goes from main protector of the economy and becomes a large reason for the financial problem itself? There is little debate that monetary policy at the hands of Alan Greenspan led to the housing bubble. The subsequent bust is leading to our current financial problems. What people forget is that the Fed is designed to protect the banking system even if this is contrary to the overall success of the economy and most people.

Fed balance sheet expands to record size again

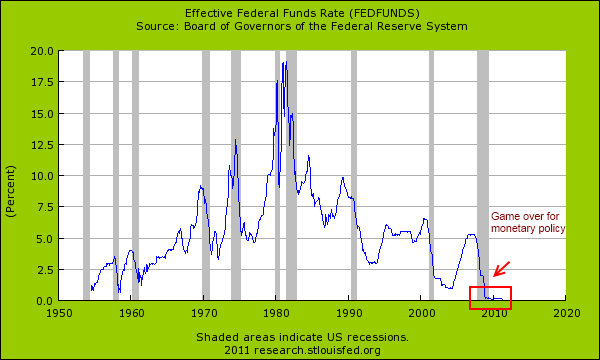

Prior to the current financial crisis the Federal Reserve controlled financial panics primarily through the discount rate and the Federal Funds rate. These two tools of monetary policy were typically enough to even out certain bumps in the road, even it was only temporary. Yet monetary policy is worthless when interest rates hit zero:

Hitting the zero bound renders the discount rate and Fed Funds rate weak or even ineffective in managing banking disintegration. So Ben Bernanke decided to open up an alphabet soup of new programs like the Term Auction Facility (TAF), Term Securities Loan Facility (TSLF), and the Primary Dealers Credit Facility (PDCF) to help the banking system. So how did these programs work? Before this financial crisis the Fed was rather particular in what collateral it would exchange for U.S. Treasuries. The above programs and many others opened the door for member banks to dump their toxic collateral into the Fed balance sheet in exchange for U.S. Treasuries. If this sounds like a suspicious way of doing business, (that is bailing out bad bets from banks) then you would be right. That is why even in recovery the Fed balance sheet is up to a new record:

“(Reuters) The purchase was part of its $600 billion program, dubbed QE2, aimed at stimulating investment and economic activity.

The balance sheet — a broad gauge of Fed lending to the financial system — expanded to $2.759 trillion in the week ended May 25 from $2.742 trillion the prior week.

The central bank’s holding of U.S. government securities grew to $1.519 trillion on Wednesday from last week’s $1.495 trillion total.â€

It is nice to see this make a headline in the press, although a very small one and not with much splash. Ironically it is inflation that the Federal Reserve has caused even though it claims that this is something it fights against:

Source:Â DollarDaze

If you look at purchasing power of a dollar in 1800 and one in 1900 you see that it was relatively stable over time. Only after the Fed took hold in 1913 did we see a steady decline of the purchasing power of the U.S. dollar.

Federal Reserve balance sheet

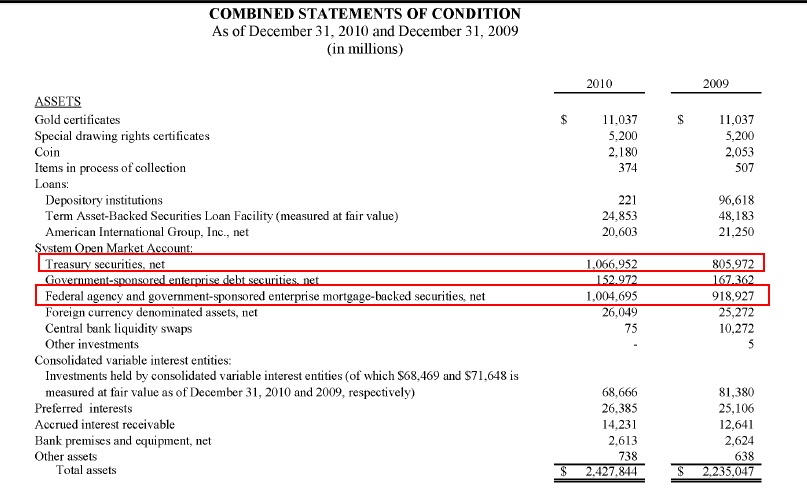

The Fed balance sheet as noted before is at record levels. What is the balance sheet composed of? This is a snapshot of an audit done showing results up until the end of 2010:

The more troubling of the two big line items above is the over $1 trillion in mortgage backed securities. Mortgage backed securities brought the system to a halt yet here we are loading up the Fed balance sheet with them. Why is the desire to keep housing inflated such an important objective? Did the American public have a chance to vote on this? Of course not since the average American is drowning in debt and is being forced to bailout the banking system through the perverse costs of inflation and debasing its currency.

People that have lived through horrible periods of inflation would not welcome the Fed’s caviler attitude in bailing out banks. In fact you can look at Belarus to see the problem of high inflation right now:

“(Naviny) Prime Minister Mikhail Myasnikovich said on May 20 that he opposed calls for freezing consumer prices in Belarus amid high inflation.

“If prices are frozen, people will simply bring carloads of goods out of the country and there will be panic demand for goods,†the government’s BelTA news agency quoted him as saying at a news conference in Minsk.He warned that the government must instead seek to achieve a “reasonable balance†between households’ incomes and spending

“It’s no secret that such rampant consumer lending against the backdrop of incomes limited to wages and fairly low labor productivity has led to a situation where households have much cash at home and in deposits and want to spend it,†he said, adding that gold and other jewelry worth some 1.1 billion rubels had been bought at stores in Minsk on May 19 alone.

He said that households should not rush to hoard food. “There are no risks of goods disappearing from the food and non-food markets,†he stressed. “But if people want to, let them buy. It is playing into the hands of enterprises, which are getting [increased] proceeds.â€

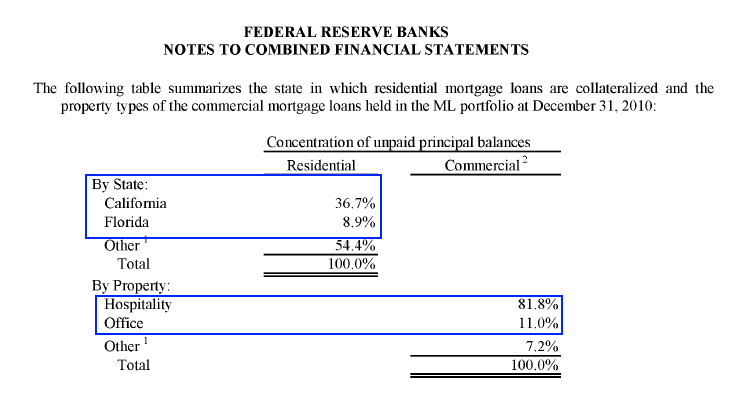

Inflation does not resolve anything although the Federal Reserve is happy with inflation drawn out over time as the above chart in dollar purchasing power reflects. Because the Fed is mainly concerned on protecting member banks even when they are the reason for the financial crisis, the temptation to create massive moral hazards is elevated. We need only look at the balance sheet again and pick out the Maiden Lane facility:

This unique program bailed out commercial real estate loans in some of the worst performing states. Close to half of the Maiden Lane loans sit in California and Florida and over 80 percent are loans in the hospitality industry. We have shown information highlighting assistance to empty malls in Oklahoma to Hilton properties with these programs. Now how did bailing out these loans help the country where the average American makes $25,000 per year? You also have the case where one out of three Americans has no savings whatsoever.

The Fed views itself as doing a greater good here but in reality it surrounds itself with pinstriped bankers mainly concerned with their own bottom line. Their opinion is clouded by the company they keep. They have little sense of what is happening to the 44,000,000 Americans on food stamps or the close to 20 percent of Americans that are underemployed. We also have no deeper knowledge of many of the trillions of dollars of debt on the Fed balance sheet. There is a big difference from having a mortgage that is underwater by say 10 percent versus owning the $50 million paper on an empty hotel. The Fed keeps expanding its balance sheets because member banks have figured out that they can use the Fed as some sort of escape hatch. Dump the loans and ignore them until something or some other crisis forces an acknowledgment of the decades of bad loans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

flow5 said:

The FED targets interest rates. The FED should target legal reserves. All the boom-busts since 1965 have been due to the FRBNY’s trading desk pegging the FFR.

May 30th, 2011 at 5:42 am -

ordaj said:

We are an oligarchy.

June 1st, 2011 at 8:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!