Can the young Atlas support the heavy burden of an aging population? 58 million Americans currently receiving Social Security Benefits. Over half of elderly beneficiaries receive 50 percent or more of their income from Social Security.

- 0 Comments

Social Security was never designed as a long-term retirement plan. According to the Social Security Administration for elderly beneficiaries, 53 percent of married couples and 74 percent of unmarried persons receive 50 percent or more of their income from Social Security. This is an incredibly high number that depend primarily on Social Security and also reflects a default usage of Social Security as the main retirement “plan†for many elderly Americans. Yet Social Security needs a constant stream of payments from current workers and this usually comes from the younger workforce. Young Americans are heavily burdened by the massive cost of higher education and are also paying into the system more than they are likely to get out when they reach retirement age. There is some generational debate between the young and the old but one thing is clear and that is many older Americans did not prepare for retirement and are now left with only Social Security as their primary source of income. Whether this is justified the young are saddled with a large burden moving forward and it is only going to get heavier as 10,000 baby boomers hit retirement age each day.

The massive growth in Social Security beneficiaries

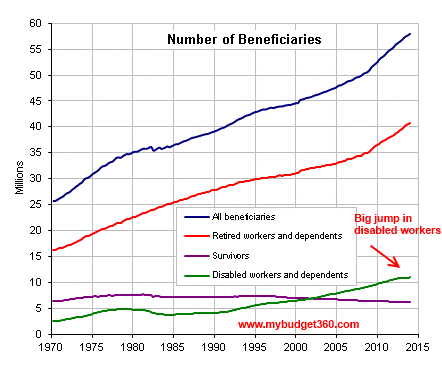

The number of Social Security beneficiaries has expanded dramatically in recent years as more baby boomers hit their retirement years. What is also impacting the number of people receiving benefits is the number of those receiving “disabled workers and dependents†benefits. This figure doubled over the last decade and part of this is the emergence of a new low-wage workforce. We now have well over 10 million of the 58 million beneficiaries receiving benefits from a program not intended for long-term usage. This only adds a further challenge to those paying into the system.

Take a look at the growth in beneficiaries:

Source:Â Social Security Administration

“The number of total beneficiaries has increased by 28 percent since 2000. However, the number of those on disabled workers and dependents benefits has gone up nearly 100 percent over this same period. In contrast the US Population since 2000 has increased by 13 percent.â€

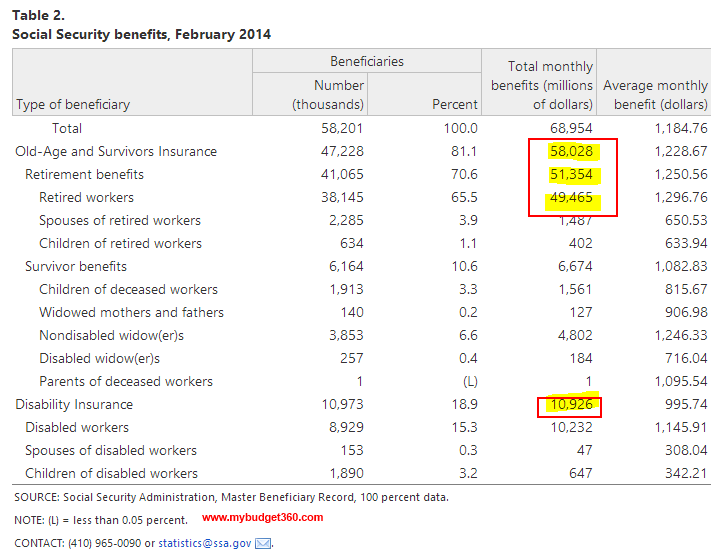

Structural issues are deeply ingrained in this new economy where low-wage work is dominating. Retirement is likely to be a struggle for many. Let us look at benefits data more closely:

Roughly 47 million Americans are receiving old-age and survivors insurance. What is more troubling for our economy is the nearly 11 million receiving disability insurance. This figure has gone up nearly 100 percent since 2000 but is really reflecting structural changes in our economy. Many are simply opting out of the workforce for a variety of reasons. Some people argue that people are receiving too much here but the average retiree is getting $1,228 per month while the average person on disability is getting $995 per month. Going back to our initial data, that $1,228 a month is virtually the bulk of income for most elderly Americans. Pensions are now becoming more of a relic to the past so we can only estimate that this issue is going to grow.

Young supporting the old but already in debt

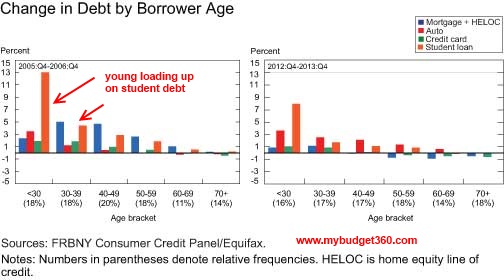

The young disproportionately are carrying a massive debt burden. Most of this burden is in the form of student debt. Student debt has become a major issue starting in the late 1990s. Over $1.2 trillion in student debt is outstanding largely carried by those in their 20s and 30s. Take a look at debt growth in various sectors:

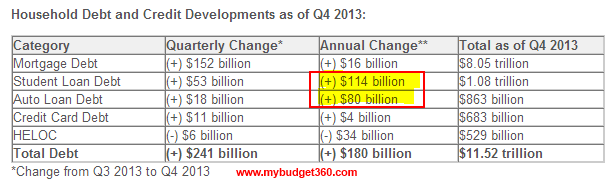

Notice that orange line in the first chart for those under 30? The young are going into deep debt to finance their education. It is either that, or compete for a job in low-wage America. Even last year, the bulk of debt growth came about thanks to student debt and auto debt:

Of the $180 billion in debt growth over the last year, most of it came in the form of student debt and auto debt with student debt being the biggest gainer.

Going back to 1937 to 1949, employees only paid 1 percent of their total wages into Social Security taxes. Today, that figure is seven times higher at 7.65 percent. Keep in mind that employers pay the other side of taxes bringing the total up to 15.3 percent. This is a tough challenge for the young that are already facing the following:

-Massive student

-Cash strapped in low-wage America Â

-Paying much higher Social Security taxes than previous generations for a much smaller payout

How long can this upside down math last? Hard to say but few are looking out for the middle class. What the data does show is that most young and old Americans are fully unprepared for retirement. The new retirement is no retirement.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â