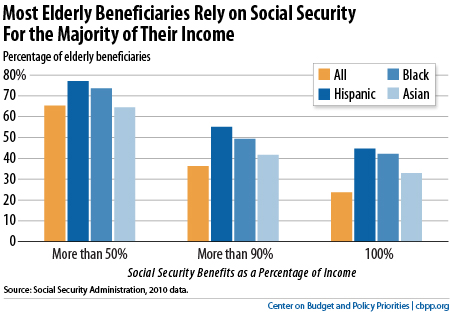

A demographic tsunami looms: By 2020 we will have 20 percent of our population 65 and older. Half of elderly Americans would be in financial ruin if it weren’t for Social Security.

- 5 Comment

Kicking the can down the road has a nice appeal. It is the same allure that comes from procrastinating. Putting off the dirty work for another day. This seems to be the approach we have taken for deficit spending. So it is no surprise that older Americans have followed in the same footsteps and many did not prepare for retirement. It is startling to realize that over half of elderly Americans rely on Social Security for most of their income in retirement. We also know that over the next decade the percent of Americans aged 65 and older is going to boom. So this trend of financially living on the edge is going to be troublesome. Younger American workers are having a tough time in the current economy so it isn’t realistic to have this group support the incredibly large number of retirees. So what are we doing? Just ignoring the issue for another day. We are heading to some challenging times and many older Americans are simply not prepared for retirement.

The reliance on Social Security

Social Security was never intended to be a long-term retirement plan. Yet this is how millions of Americans are treating it. Unfortunately many older Americans are entering retirement age with little to no retirement savings. You might look at the stock market and wonder how this is possible but in reality, most Americans don’t own stocks. The biggest asset for most is their home but this does not throw off income or provide food.

Social Security has become the default retirement plan:

Over half of older Americans would be in financial ruin if it were not for Social Security. And then we somehow expect our large low wage workers to support this structure? Are they putting money away for a rainy day or living paycheck to paycheck? Unfortunately, they are living day to day so we can expect this group to face a similar predicament when they enter retirement. Do you hear the can rattling down the road?

The country is getting older and there is little doubt about this:

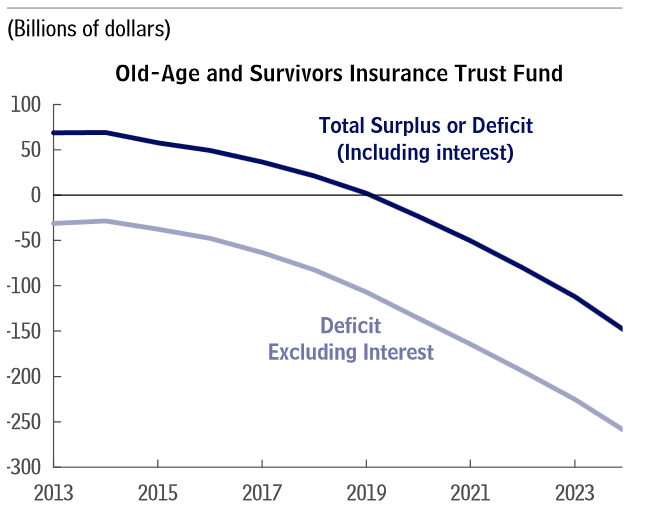

And take a look at the funding structure:

“(CRFB) Over the coming decade, Social Security spending will climb steadily (6 percent on average per year) due to the nation’s growing elderly population and rising benefits. Under current law assumptions, Social Security outlays will encompass 5.6 percent of GDP by 2024. CBO’s analysis shows that in the near future, both Disability Insurance and Old Age and Survivors Insurance will face major funding challenges and will need to be addressed.â€

Of course the assumption rests on not having any further recessions. We had a major one with the tech bust in the early 2000s and the Great Recession that kicked off in 2008. Yet somehow, the projections seem to feel it will be smooth sailing from here on out. These kinds of assumptions create long-term transformations that appear in inflation data.

Is it good that half of the elderly rely on Social Security as their primary source of income? Good or bad, this is fact. Yet we continue to move forward spending more than we have and underfunding a program that is only going to grow in costs. Of course no politician would dare imply any changes to Social Security so this gets swept under the rug. Easier to use the national credit card to pay for this.

You can’t have it every way. It might feel easy to buy a $1,000 television on a credit card but the pain comes in paying it off. At some point, payment is needed but when things get so big, people tend to ignore the massive ballooning issue right in front of them. Unfortunately we can’t escape the fate of demographics.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Paul Verchinski said:

The Congress can not even get the Older Americans Act passed!! Social Security needs a fix as was done by the Greenspan commission in the 1980’s where the cap on earnings should be raised to $250,000. Less than 10% of the over 55 crowd has Long Term Care Insurance. Why? Well the insurance policies are so byzantine – no one understands them plus major insurance carriers no longer participate plus rates have gone thru the roof. At some point, with no savings for retirement, older adults will join the homeless ranks. A sad state of affairs.

February 17th, 2015 at 7:50 am -

crawlars said:

Someday, perhaps, enough of the public will understand that the US is monetary sovereign, it cannot run out of money. As such, the cry that Social Security is broke or will be broke is a lie.

The Fed (or Treasury) can fund social security with electronics entries to bank accounts, no taxation necessary.

For the public at large, those of us in the 99%, this would actually be a better way to more widely distribute cash into the productive economy….through seniors who would spend this money on food, shelter and care…employing a wide variety of workers. This is far better than the banks deploying only 80% of the money they create into non-productive enterprise (commercial loans, home mortgages and speculation…all of which should be either interest/profit free or not done at all by banks…whose mission to profit for themselves does not deploy the public’s money to the benefit of society in general.

Read up on the Big Lie and Monetary Sovereignty.February 17th, 2015 at 9:49 am -

Rufus T Firefly said:

Too freaking bad, baby boomers. You had 30 years of bull markets to prepare for when you were 64 and far too many of you didn’t. Enjoy your miserable retirements, living on ramen noodles and bloviating on how special you were.

February 17th, 2015 at 6:36 pm -

jsmith said:

That’s the ticket crawlars! I’m going to go to the local social security office and see if they can increase my monthly electronic deposit to my account by $1000.00. I’ll let the agent know that all she has to do is tell the Fed to approve it, and that I’ll make sure they know that in turn I’m going to take those $1000.00 tokens and exchange it for food and maybe throw in a new car, which by the way with an extra $1000.00 I can probably make $400.00 payments per month, thereby keeping auto workers working and paying taxes. What a marvelous idea! Of course I’m going to buy an American car. It’s the right thing to do.

February 17th, 2015 at 7:25 pm -

ame said:

Supposedly hyperinflation is coming this year and so that will be a game-changer, right?

((shrugs))All I know is, “Debt is dumb, cash is king and the paid-off home mortgage has taken the place of the BMW as the status symbol of choice.”

(Quote: Dave Ramsey)Take good care to the best of your ability your friends and family. They are where your wealth lies.

February 20th, 2015 at 3:09 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â