The return of the stock market bubble: In a world with clear risk, investors are acting as if the market is completely risk free.

- 4 Comment

Some investors tend to believe the stock market is a perfect and balanced barometer of the underlying economy. Even with the recent bubbles in technology stocks and real estate, some still have this misguided assumption that stock values are always priced right. Most of the movement in the market is being driven by institutional investors since roughly half of Americans own absolutely no stocks outright.  It should be rather obvious to those that read a few newspapers outside of the country that there are some major risk factors hitting the world right now: the Ebola outbreak, the conflict between Ukraine and Russia, and the Middle East. You also have anemic economic growth in Europe. In the US 92 million Americans have dropped out of the labor force. Yet somehow, the stock market is making new highs. Why? A large part of profits have come from firing workers, slashing wages, cutting benefits, and using cheap QE funding to juice up stocks. The market cares only about profits, not long-term sustainability. Yet if you were looking at the volatility index you would think that there was absolutely no risk in the current market. This market is looking very bubbly.

Bubble trouble

Bubbles are hard to define and spot. Bubbles are largely driven by psychology and emotions and move in an eradicate fashion. A bubble occurs when an asset, commodity, or stock for example moves up in price with very little economic fundamentals to support it. For example, real estate moving up with no actual income growth but people using leverage to go deep into debt. Some tech companies today are looking very bubbly based on their earnings.

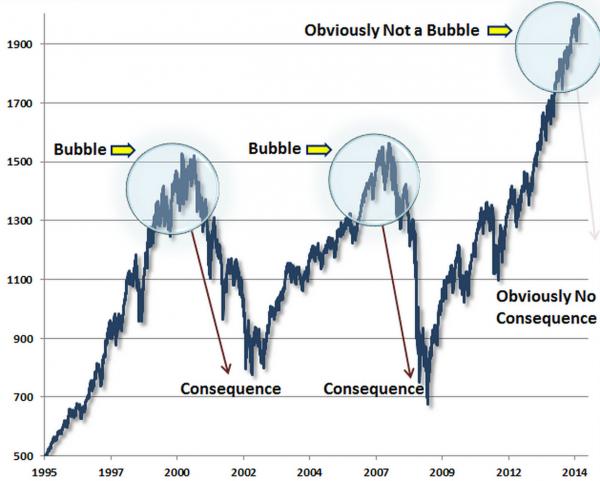

The stock market is looking extremely frothy at the moment:

The market seems to be saying that there are no risks on the horizon. This just isn’t logical given what is unfolding in the world today. In the US inflation has already eroded the standard of living for most middle class families. The S&P 500 hovers around 2,000 and is about 28 percent higher than it was at the peak in 2007. What has improved so much in the underlying economy that warrants a 28 percent hike from the peak reached in 2007 when valuations were already sky high?

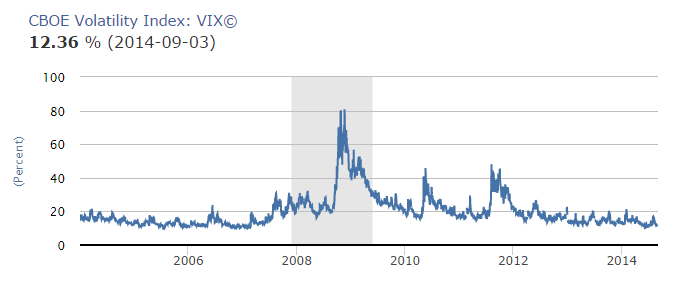

The volatility index is also registering a very Pollyanna view from those engaged in the market:

This is incredibly low. Near record lows. Given everything that is unfolding in the world today does this make sense? The market seems to have full unbridled faith in the Fed and central banks to somehow juice up prices higher and higher. Yet previous bubbles have popped in dramatic fashion. If anything, this is a confidence based bubble since underlying fundamentals do not justify a S&P 500 at close to 2,000.

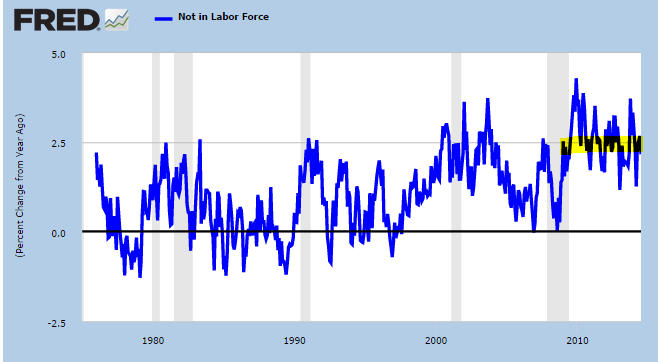

For example, we now have 92 million Americans not in the labor force. The rate of increase in this category has been high over the last decade:

Part of this comes from the aging of America but a large part of it is coming from discouraged workers and those simply opting out of the workforce. The funny numbers are making the economy look better than it should and this is why in many surveys Americans have pessimistic views on the current economy yet the stock market is near a record high.

The stock market is in bubble territory. The fact that volatility is so low is baffling but then again, it isn’t Main Street that is investing in the stock market. You have large investors betting on the Fed somehow controlling global events that clearly it has no control over. Bubbles occur when too much faith is placed in the wrong sectors. This becomes obvious to those only when the bubble begins to unravel.

No volatility in the current market? No risk on the horizon? All you need to do is crack open a global newspaper and you will find that there are plenty of major events that remain unresolved that can throw a giant wrench into this market.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ame said:

I was bored on afternoon and so tuned in to public tv to watch Suze O. I’ve seen her schtick off-and-on over the years and was curious whether since the market crash of ’08 her advice had changed.

She is still advising people age 20’s through 40’s to “invest” their money into a 401K. She does this while admitting that the stock market will have some years where it is down 40% but is quick to say that some years it will be up 25% and so you “ride it out”.

Well, that is a simple game of musical chairs. Do you want to run the risk of the music stopping on your go-round like it did to millions in ’08? Then go for it.

September 7th, 2014 at 8:23 am -

major said:

Bubbles are not random events caused by market conditions. They are deliberately incited by government and Wall Street propagandists and further encouraged by cheap credit caused by money printing and pumping. One goal is to create a the false impression of a strong economy for election purposes. The other is to cause a giant transfer of wealth from the many to the few when the time comes to dump the market.

September 7th, 2014 at 4:45 pm -

David Young said:

Fed-induced speculation, not a novel result since Greenspan’s bail-out in 1998 of LTCM. Artificial stimulus to a financial or economic system do not work, yet we have Central Bankers around the globe setting new records in money printing to attempt to rejuvenate a dead-in-the-water global economy. In fact, many signs point to recession in the U.S. again after the Fed adds $3.8 Trillion to its balance sheet since late 2008. Thinking you can sell at the top or get out before the herd goes over the cliff, thing again. Brokerage servers are going to crash during the upcoming CRASH. Got Gold, got Silver!!

September 8th, 2014 at 9:52 am -

Tamir Zoltovski (Co-founder of Moneta International UAB) said:

A type of economic bubble, which takes place in stock markets is when the market contributor drives stock prices over their value to some scheme of stock valuation. Behavioral finance speculation attributes stock market bubbles to cognitive preconception, which lead to groupthink and herd performance.

October 25th, 2019 at 1:54 am