Student debt becoming a larger albatross for economic growth: $1.2 trillion in student debt is outstanding and many college graduates working in jobs that don’t require their degree.

- 7 Comment

There was a time when going to college made sense in every feasible way. It made sense professionally, economically, and many college graduates have a wonderful time in the process of completing their degrees. Most would argue that learning is vital in growing and moving forward. Yet students need to ask whether their return on investment is really worth it? Many people go to college in a compulsory fashion. This is simply the next step after high school. This was an easy decision to make during a time when the costs of going to college were affordable. Today, many schools charge $40,000 and $50,000 per year for a basic undergraduate degree. That is problematic. A large number of recent graduates are now working in positions that don’t require their specific field of study. In other words, they are employed in a field different from their undergraduate degree but still carry forward with mounds of debt. The total student debt market is now well over $1.2 trillion. It might be worth it to take a course in Student Debt 101.

Growing student debt

There are no signs or hints that the student debt bubble is likely to slow down in formation. To the contrary total student debt has been on a mission upwards in the last decade or so. When you saddle a nation of young people with mountains of debt don’t be surprised when first time home buying reverses or discretionary spending slows down. That seems to be another problem for another day in debt world.

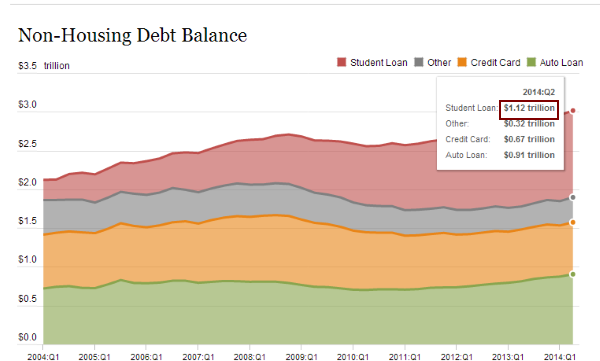

Student loan debt used to be a smaller part of non-housing related debt. Today it is now the largest consumer debt being held outside of mortgages. Take a look at the growth:

Keep in mind student debt started at roughly $200 billion about a decade ago and has now become a problem for parents and families to carry. It is an odd vision to see student debt so high. There is now data showing that student debt is hindering bigger purchases like those for homes, electronics, or furniture and kitchen appliances. We stepped off the debt based treadmill in 2007 in dramatic fashion and it seems like the public is ready to dive back in to spend.

Parent’s could ease some of the burden by helping their kids pay for college but when you look at the amount of money saved by older Americans you fully understand why so many parent simply let their children go into massive debt so they can fight their own economic battles.

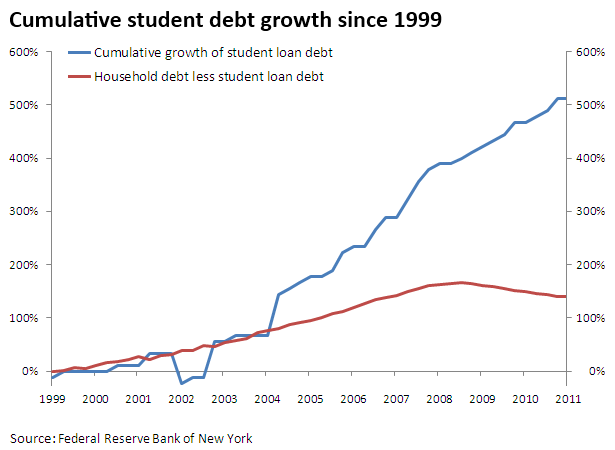

Take a look at inflation in student debt. The chart below shows how out of control college debt has become:

Student loan debt growth is out of control. There are very few things in this world that allow you to borrow so much with no collateral at all. We’ve done that a few times and it rarely ends well. With college debt, you can easily hide under the guise of helping others to educate and grow but there is an extremely high level of poor spending inherent in the system. Debt seems to be the narcotic for all. It is interesting to see people come on through various media sources and mention that they were expecting debt levels of $30 or $50 thousand dollars and that this amount was unexpected. There are of course massive tradeoffs and going to college is not a simple no brainer. You have to run the numbers.

We are also now seeing more online degrees from reputable schools and competence based learning where edification is measured through application, not just showing up to class. One immediate item we can remove is the blanket statement that going to college always produced a great return on investment. But compared to what? We rarely hear about the other options until it is too late. You are already seeing the drag of that $1.2 trillion. Less disposable income is available after servicing the debt. There is no free lunch for the public, only the well connected on Wall Street.

I believe we are going to see the face of higher education change over the next ten years. Total student debt outstanding is over $1.2 trillion and only growing! So much for a simple little bill.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

suezz said:

It is because of this globalization crap. We are told by the globalists that the right employees for science and technology is coming from the far east. I don’t see it they might be able to evaluate an algorithm but they couldn’t design a system without vendor intervention.

When I went to school fro data processing we designed systems from scratch. Math was only part of the equation. It is about the data and now with all this data scientist crap we are just going back to the same thing.

This outsourcing crap has to be stopped. It is bad business and bad for society. Just because a country is overpopulated doesn’t mean they provide the best workers.

September 2nd, 2014 at 7:45 am -

DDrake said:

My Great Grandmother finished the 8th grade in the early 1900s. In those days that was equivalent to 2 years of College today, or even 4. So the education being SOLD today is equivalent to the 6th grade 100 years ago. Total SCAM. We now have a bunch of 6-8 graders running around thinking they are educated

September 2nd, 2014 at 11:35 am -

Arizona said:

I KNOW ENGINEERS WITH PHD’S who are wrapping candy bars in new mexico,HAS AMERICA LOST ITS MIND……YES,politicaly correctness has destroyed this country and now your wonderful leader will take the whole country to hell and everyone will glady follow him…..boy aren’t you guys smart,get ready to meet your NEW daddy satan,CAUSE he’ll be waiting for you,at your new home in hell…AND YOUR BUS TICKET HAS BEEN PUNCHED,by the local police gang,who will be your EXCUTIORS,kiss your ass goodby ,IT WON’T BE LONG NOW……….

September 2nd, 2014 at 1:01 pm -

Arizona said:

ALL YOU YOUNG ADULTS,TAKE THIS SERIOUS,…FIND OUT “WHO” THE RETIRED ARMY RANGERS ARE IN YOUR AREA,and then stick to them like glue,THEY WILL SHOW YOU HOW TO SAVE your self from the IDIOTS who call themselves your parents,THIS COUNTRY IS ABOUT TO BE AT WAR,and you’ll be glad you were friends with an ARMY RANGER,because you guys will be the only survivors when its over…AND DON’T ALLOW ANYONE TO PUT A CHIP IN YOU OR THE MARK..(TATOO) OF THE BEAST ON YOU………….

September 2nd, 2014 at 1:10 pm -

Ame said:

I’ve noticed many universities are building state-of-the-art facilities and sports arenas. Is this because the students they are targeting demand such luxury? After all, who wants to go to a school that has a 1980’s football field and an even older dorm?

Imagine this: Let’s say a school is inexpensive to attend, and the teachers top-notch. Let’s say the tuition students pay go for quality education (as reflected in high pay for the teachers) and not for fancy facilities. Would the average high school Senior be excited to attend such a place? Or would they be so embarrassed with the outside appearance they would downplay the outstanding education the school provides?

I’m afraid so. So many kids are materialistic and “only the best” will do. So, this is why college is so expensive, in my opinion. It’s all about impressing people with a slick exterior. Parents are guilty of teaching their children to expect the best no matter the cost and that has given schools the green light to charge ever higher tuitions.September 2nd, 2014 at 4:49 pm -

William Ripskull said:

As long as the government keeps stepping in with greater and greater load amounts for students, universities will have no incentive to hold tuition costs in check. Universities raise tuition, the government let’s students borrow more to cover the increases, and in turn, the universities raise their rates. Its an endless cycle that will end badly. Students will be wiped out financially, as well as much of the financial world when it all comes crashing down.

September 5th, 2014 at 8:33 pm -

Bud Wood said:

What a “con” job: Get a loan, buy a college degree and live happily ever after in a big paying job.

This deal is actually a pay-back for the college people who support the collectivist agenda of big government. Not many people firgured that this deal would turn out so badly, but collectivists typically have a tough time of putting cause and effect together.

September 8th, 2014 at 9:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!