The big banking sham and how the recession is over for the top 1 percent – Top 1 percent of banks control 80 percent of banking assets while household net worth is down $12.3 trillion from the peak.

- 1 Comment

The headlines read that the recession is over. In fact, the recession has been deemed over since June of 2009 by the National Bureau of Economic and Research (NBER). Yet the fact of the matter is working and middle class Americans are solidly in a deep recession. There was a town hall that was televised where a Wall Street “worker†was telling the President that he was tired of being treated like a “piñata†because Wall Street is directly linked to Main Street. It is not. Wall Street has turned into a giant vampire leech that is sucking every ounce of productivity out of the real economy. The big banks have grown bigger yet unemployment remains elevated near peak levels. The net worth of Americans is still over $12 trillion below the peak reached only a few years ago. Home values are still in the dumps. Why is the recession over? Because GDP has grown and other random indicators that really just pertain to the top 1 percent.

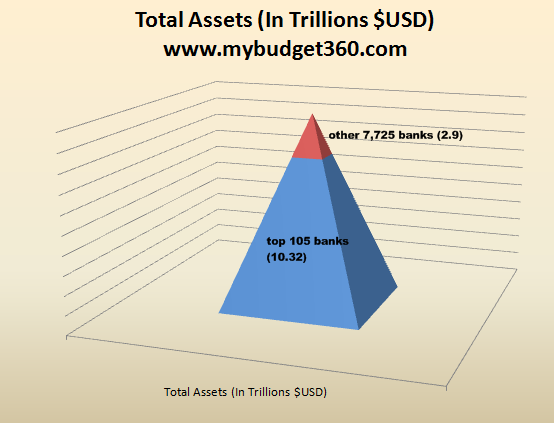

The FDIC has interesting data on the banking system. They tell us that we have close to 7,800 banks in the U.S. but the asset break down is really as unbalanced as it can get:

Source:Â FDIC

105 banks (about 1 percent of the total banks in the U.S.) control close to 80 percent of all banking assets in the U.S. The top 105 banks control over $10.3 trillion in assets. Keep in mind banks can call things assets like commercial real estate loans and questionable real estate loans as well. The FDIC backs this system up with an insolvent reserve fund. All it would take is one of the bigger banks to fail to cause the system to shut down. Of course, this wouldn’t happen because the FDIC has a $500 billion lifeline to the U.S. Treasury just in case this should happen.

As we move forward and forward it is becoming more apparent that Wall Street and Main Street especially with our current banking structure have completely opposite motives. Big banks are pushing capital wherever it can go for cheap labor, less regulation, and frankly less law to game the system. Keep in mind the money they are using right now is backed by taxpayer dollars. Many of these banks would be sitting with Bear Stearns and Lehman Brothers if we were to follow a free market approach but they are corporate welfare recipients and have pushed their propaganda out to Main Street. Yet public sentiment has now shifted. Many now don’t believe in these real estate and stock fantasies.

First let us look at some metrics to see how healthy the economy is today.

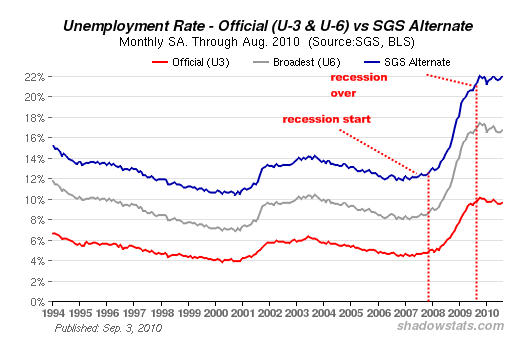

(Un)Employment

Take a look at the above chart. Does it look like the employment market is better? It is clearly not. In fact, the unemployment rate is near the peak since the recession supposedly ended last year. It is apparent that someone with no job is not growing their income. That is why we now have 43 million Americans in poverty and this number has grown throughout the entire recession. Many of these people fell out of the middle class category. If we are not in recession then we must be in growth at least by a strict definition. Yet who is growing here?

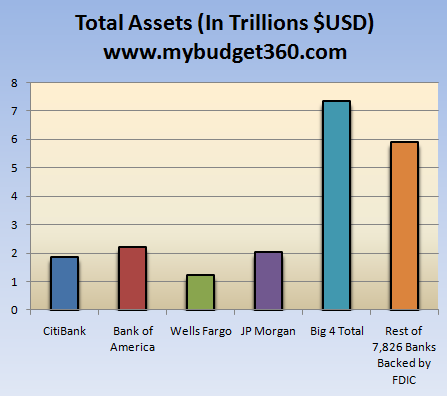

Big banks grow

The too big to fail banks are growing while the banking system consolidates. In fact, as of Q2 of 2009 when the recession was marked as over we had 8,195 banks in the U.S. Today we have 7,830 which signify 365 fewer banks. Yet total assets remain steady. What has occurred is the too big to fail have gotten bigger with their government lifelines. The banking system is becoming even more inherently dangerous in terms of setting up for another crisis. If too big to fail is an issue, then why make these banks even bigger? The top 1 percent controls much of the financial wealth in the U.S. and right now they are protecting their own.

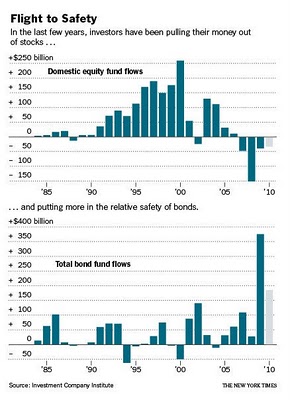

Small time investors flee stock market

Maybe small time investors have jumped back into the stock market?

Source:Â NY Times

In fact, the few working and middle class investors that do have money are rushing into safer products if they even have extra money to invest. The money flowing out of stocks has gone one way. Right now Wall Street is one giant casino for the wealthy and people are waking up. The attempt is lure back in more sucker money so they can then off load their junk to more suckers (think of subprime, CDOs, and all that other waste). By the time retail investors bought into the propaganda from the get rich quick Wall Street it was too late and they were left holding the bucket. This is how Wall Street plays the game through investment banks. Right now no actual real wealth is being created. In fact, with days like the flash crash in May a trillion dollars in paper money was wiped out in one day for a few hours. Basically half of the yearly GDP of California was shed in a few hours of trading. There is a big disconnect from Wall Street and Main Street. The fact that economists are claiming this recession over when we have:

-26 million unemployed or underemployed Americans

-43 million Americans in poverty

-The median household income under $50,000 (stagnant for over 15 years in real terms)

-Home values near their trough

-Household net worth down $12.3 trillion from the peak

Yet GDP is growing? If the working and middle class aren’t getting any more of the pie, who is?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Joe Blow said:

How many R’s in revolution. Apparently the filthy rich conveniently have Alzheimer’s when it comes to history. It will repeat itself soon!

September 23rd, 2010 at 8:53 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!