The Commercial Real Estate Default Wave is Here: Commercial Mortgage Defaults Now at 16 Year High. 3.4 Percent of all Commercial Real Estate Loans in Default.

- 2 Comment

What has been lost in the housing talk recovery is the grim statistics that commercial real estate has fallen 37 percent in value in the last year. This wouldn’t be such a big problem aside from the tiny detail that some $3 trillion in commercial real estate loans are still outstanding. The commercial real estate debacle is already happening with defaults reaching 16 year highs. This is already occurring before many of the commercial real estate loans reach their refinance dates. In some instances banks are simply ignoring non-payment and giving borrowers a few more months or even years. Why? Because they can still claim the note is current and claim the asset at inflated values.

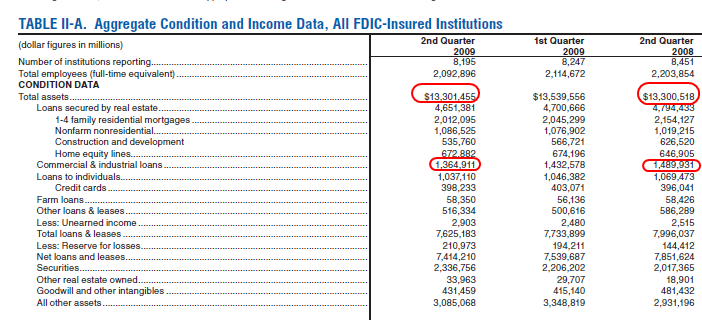

Yet this is a game we are all familiar with. Suspending mark to market has always been a method for the U.S. Treasury and Federal Reserve to skirt any real accounting from Wall Street. If we look at the current FDIC insured bank balance sheet, we can see that many more problems lie ahead for commercial real estate:

Of the $3 trillion in CRE loans $1.3 trillion is directly with commercial and industrial loans. These are loans for retail properties but also for businesses. Well with few employers hiring and people cutting back it is clear that many businesses will have very little need in expanding in the next few years. Another $535 billion is in construction and development loans and many of these are in horrible shape. CRE projects take years from start to finish. Can you imagine how many CRE projects took off in 2006 and 2007 at the peak of the bubble only to go live in 2009 and 2010? It is a case of the worst timing in the world.

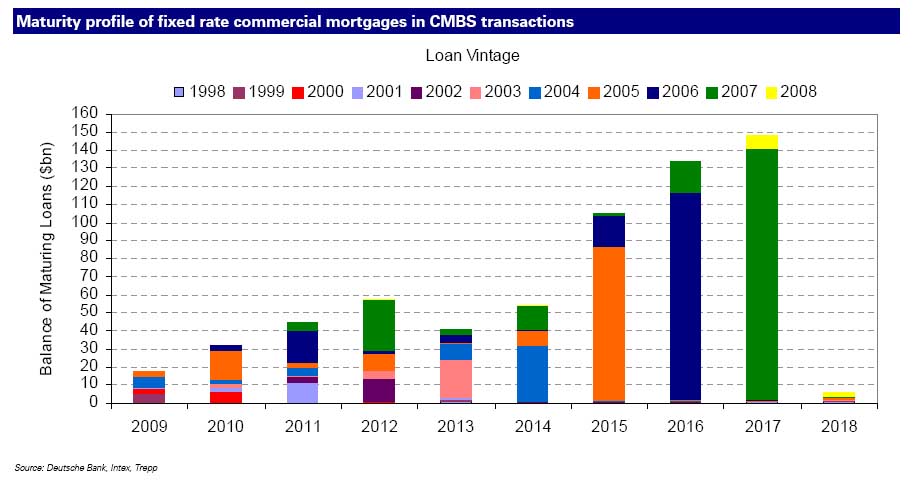

We are entering a phase where commercial loans will need to be refinanced for nearly a decade:

Source:Â Zero Hedge

In reality, the CRE implosion is going to take down hundreds of banks in the next few years. Residential lending became a key part of the too big to fail banking model and smaller regional banks simply were unable to keep up. So instead they funded local CRE projects that are now ticking financial bombs on the balance sheet of hundreds of banks.

We’ve discussed before that 70 percent of the banking assets sit with approximately 100 banks. So 7,900 banks can fail and the bulk of the system is intact. That is the dictionary definition of too big to fail. With so many people out of work and companies not hiring, how will borrowers pay back the CRE loans?

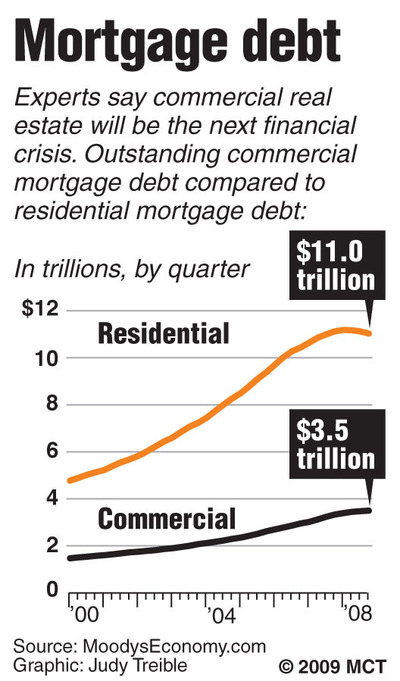

Commercial real estate is a big game and much of the problems are yet to come:

Source:Â McClatchy

This is an enormous market and people are going to be less agreeable to a commercial real estate bailout especially with bailout fatigue setting in. The U.S. Treasury has already planned a preemptive bailout for the industry with Plan C but much of this has been stuffed deep into page 10 of the mainstream media reporting.

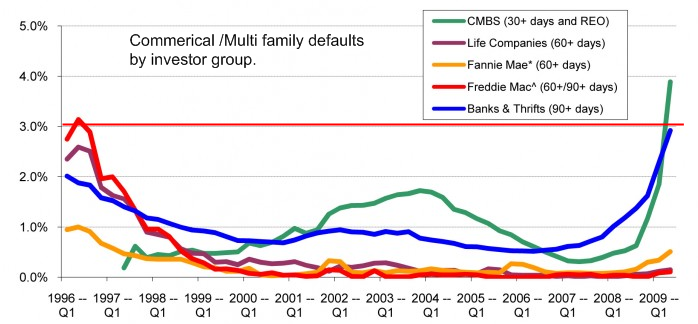

How quickly are things spiraling out of control? Exponentially:

Source:Â MBA

So gear up. It looks like 2010 is going to be another banner year for bailouts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

vinny said:

Bernanke and the Wall Street boys that caused this mess are still at the helm! How can the outcome be anything be failure?

December 17th, 2009 at 3:18 pm -

Tom Dennen said:

THE SHIFT IN WORLD ECONOMIC PREDOMINANCE

“All long-term credit cycles end with asset crashes in the markets of the leading economy. Measuring from crash to crash the dates of the modern credit cycles are as follows:

“Span Duration (starting with the South Sea Bubble)

1720 – 1772 52 years

1772 – 1825 53 years

1825 – 1873 48 years

1873 – 1929 56 years

1929 – 1990 61 years“The crashes and resulting depressions appear to be less intense and traumatic when the end of the cycle does not coincide with a shift in world economic predominance.” – The Great Reckoning, James Dale Davidson & William Rees-Mogg, 1993.

The depression following the 1990 crash is fully – and globally, not just the leading economies – upon us and, because we are in the middle of the biggest shift in world economic predominance, we will not see the end of it for a long while.

December 18th, 2009 at 12:51 am