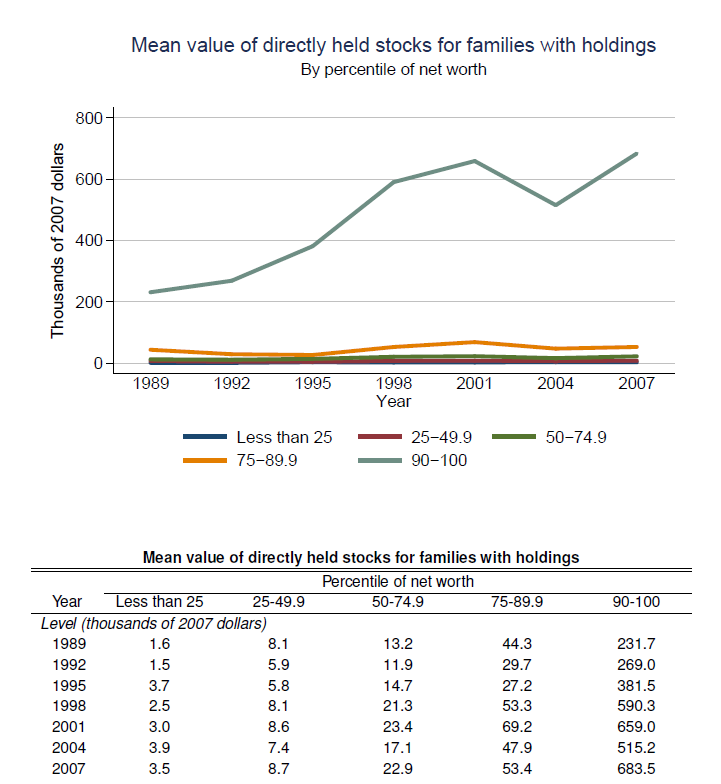

The debt end game – Top 10 percent of families own an average of $700,000 in stocks while the next 15 percent own an average of $53,000. The other 75 percent are insignificant players by Wall Street standards.

- 4 Comment

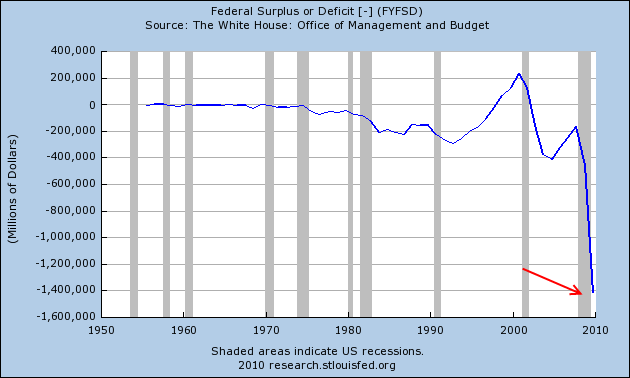

The government recently announced on a slow Friday a $1.29 trillion budget deficit as if it were no big deal for the completed fiscal year. In fact, this was spun as grand news since the previous budget deficit topped $1.4 trillion. We are now reaching a nationwide tipping point of debt. The U.S. Treasury and Federal Reserve are gearing up for another round of quantitative easing that will surely depress the U.S. dollar further. Does anyone outside of the enclosed circle of the Wall Street crowd actually have any faith in the Fed? This is the same organization that dropped rates to historical lows and fanned the blistering red flames of the housing bubble. And keep in mind that the first round of quantitative easing of buying up mortgage backed securities (MBS) did very little for the working and middle class. What is going on is a giant busload transfer of wealth and this should be the headline story everyday on the news until the financial crisis is resolved.

If we look at the trade deficit (or rare surplus) the chart below is downright stunning:

You might wonder what happened in the 1970s. What occurred here is the Nixon Shock doctrine and was the starting point of allowing the U.S. dollar to becoming a purely fiat currency. A big reason for this was brought on by the cost of the Vietnam War. It is no surprise since that time that the dollar has tanked and that is where the above chart starts showing this impulsive deficit spending behavior. The war with Afghanistan and Iraq have not come with no tiny price tag. The U.S. has enjoyed four decades of spending on a credit card. But now what? Even with interest rates at historically low levels, Americans can’t borrow because the economy is in shambles. Instead of buying up over $1.25 trillion in MBS don’t you think there could have been a better economic benefit by directly applying the funds to working and middle class Americans? It is no wonder that the U-6 unemployment and underemployment rate being at 17.1 percent is near the peak even after all this supposed historic stimulus. Yet the stock market is up. Too bad this has little impact on the overall economy:

“(Sudden Debt ) If stock ownership was even somewhat evenly distributed amongst Americans I would have no real problem with this picture. But, it isn’t – not by miles and miles. The richest 10% families owned in 2007 a mean $700,000 worth of stocks, while the next 15% owned a mere $53,000. The rest, i.e. 75% of the people, owned next to nothing at all (see chart and table below).â€

Source:Â Sudden Debt

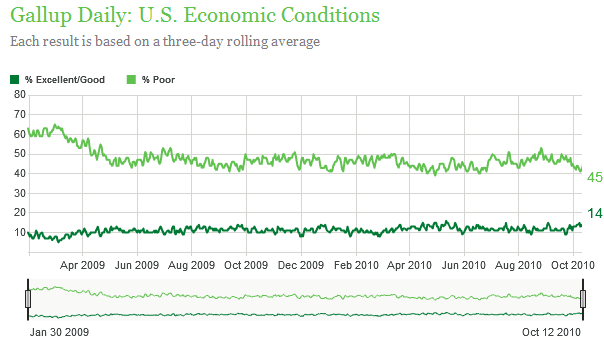

This is an interesting point. The richest 10 percent of families in the U.S. own a mean of $700,000 worth of stocks while the next 15 percent own $53,000. So that leaves roughly 75 percent of American families standing on the sidelines looking in to what is now a disconnected casino from the actual real economy. The recent announcement of big banking bonuses again must ring like sweet music to the majority of the population. This is exactly the reason that as the DOW now jumps over 11,000 (a long way from the 6,600 reached in March of 2009) consumer sentiment is still largely negative:

Source:Â Gallup

Only 14 percent of Americans think that the economy is good (interesting how this closely relates to the top stock holders in the country). The problem is a deeply seated psychological one. Talking about finances is taboo, at least with colleagues and family. You might see your neighbor with a BMW and a nice home but you have no idea that he is in debt up to his eyeballs and has a few thousand dollars in the 401k. In fact, he may be underwater on his mortgage like millions of others. This isn’t wealth. This is a life based on a debt mirage. Yet somehow, people tend to think that stock market wealth is more evenly distributed in our society. It is clearly not.

The problem with our current economic system is one in which perverted incentives now reign. Even only a few decades ago, banks had a duty to ensure that the mortgages they originated went out to borrowers who had the means to pay the loan back. It wasn’t so much because of charity but because the bank had capital on the line as well. This kind of incentive system makes sense because housing markets are localized so who better to know a local market than a local bank? The added benefit of having skin in the game makes the lender more prudent in the process. But that system was turned on its head with the Wall Street casino machine.

All of a sudden lenders had no desire in holding onto the loan. Wall Street managed to setup a system where toxic mortgages came in, were separated from localized housing markets, were placed into complex bonds, a triple-A rating was placed, and then sold off to unsuspecting global investors. Over the decades our financial institutions had built up a reputation and that is why many got away with the triple-A rating even though they were selling bonds that were backed by empty subdivisions in the middle of the Arizona desert. Yet all of that was squandered away in this financial mess. This will now be a major branding issue for our country. If you were a foreign investors, would you trust U.S. financial institutions and their advice? Even the American public has little faith in the banking system and with this paperwork fiasco, the mess only gets worse.

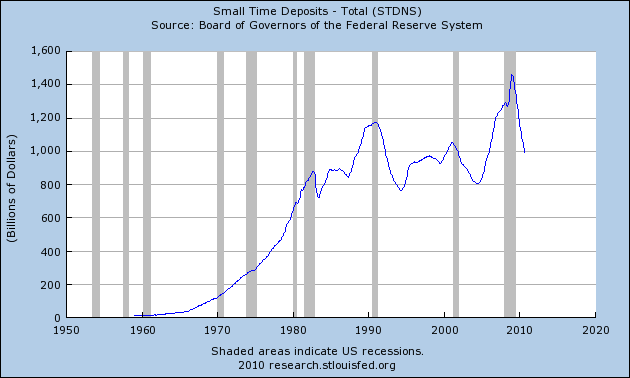

A good measure of the mom and pop household is with small time deposits. These are basically deposits at banks and thrifts under $100,000. Contrary to what we are hearing this number has gone down:

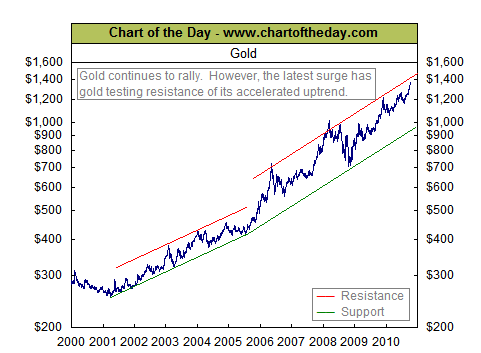

Why has this gone down? Because the economy is still in crisis for the majority of people and they need access to this funding to pay for expenses. The Wall Street gains flow mainly to a small group of people. The problem though is many think (or want to believe) that they are part of the bigger game. They believe that their $10,000 will turn into $1 million over 30 years if they just keep chipping in money into the casino. Until serious financial reform takes place including breaking up the too big to fail banks, the money thrown into the stock market is like taking a wild gamble and you might as well try your luck on scratchers or a round of craps. There is a reason gold has done this over the decade:

Source:Â Chart of the Day

I view the above more as a destruction of our U.S. dollar brought on by the banks, the U.S. Treasury, and the Federal Reserve. It is amazing that even after the above has taken place over an entire decade where our economy flew off a cliff, few in the mainstream media even want to discuss why this has occurred.  There is only so much debt a system can take. It is interesting that in the 1970s a similar gold rush occurred but was popped when former Fed chief Paul Volcker hiked up interest rates (there is no sign that we are even going this way). Now that QE2 is openly talked about, what do you think will happen with the dollar? Given the massive amount of debt and the liabilities coming down the pipeline, it is no wonder why so many are angry this election season. Don’t be fooled by the Wall Street propaganda. The only solution will come when the middle class is restored and that means getting people back to work and producing goods for the economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ken Moberg said:

If I read the article correctly the first graph/table/facts pertain to individually held stock ownership.

How much do these graphs/tables change if Mutual Fund holdings are included? Those are an equity position in the stock markets.

October 16th, 2010 at 9:34 am -

CompassionateFascist said:

Interest rates cannot be raised, would kill of what little is left of the real-world economy. All the PTB can do is print, print, print, in an effort to postpone the inevitable mother of all crashes for yet another day, week, month. After all, we all live in the present. Finally, the future arrives….and you can kiss all this goodbye.

October 16th, 2010 at 8:13 pm -

Clint Matthews said:

Interesting article. My only disagreement was that CDOs were sold to “unsuspecting global investors.” While CDOs were purchased by global investors, they were also purchased by US hedge funds, investment banks (including Goldman, Morgan, Merrill, etc.), banks, pensions, etc. Next, these were not poor “unsuspecting” investors. While CDOs were complicated, these investors (all of whom were professionals) should known have better. Nobody was looking closely at these investments.

The best example of this is AIG. AIG was essentially writing insurance on these CDOs (the infamous credit default swaps) without actually knowing what type of debt the CDOs contained. This is not hard to believe and it was not uncommon. From 2005-2008, CDO purchasers repeatedly said that these CDOs were safe because housing prices hadn’t fallen nationally since the Depression. Of course, they never looked carefully at the what type of mortgages were in the CDOs. If they had looked they would have realized that most of the mortgages were originated in California, Nevada, Arizona, and Florida. You didn’t need a national decline to wreck these CDOs, you only needed of those four markets to collapse.

People are that stupid, even these investment professionals.

The recent economic crisis isn’t an example of conspiracy, but of pure stupidity.

October 21st, 2010 at 9:43 am -

Florence Pesce said:

I didn’t have a broker money was removed from my accounts and invested by bank employees without telling me.

March 2nd, 2016 at 10:35 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!