The End of the Decade of the American Consumer. The Regime of new Austerity and Consumer Economic Feedback.

- 5 Comment

The American consumer has become addicted to easy access to debt. This has gone on for so long that debt is now as vital as air to the survival of our consumption based economy. This is probably no revelation to you or for those that you know. Yet the great taboo of American culture is that we rarely openly talk about money. We talk about religion, politics, sports, and other topics but when it comes to money people seem to grow uneasily quite. People see someone driving a new Mercedes and assume an association to wealth but little do they know that the person has a $700 monthly lease and is living paycheck to paycheck. Yet the visual impact causes many American consumers to suffer from the Keeping up with the Joneses complex. Unlike Prozac, there is no pill for spending more than you earn. However, if we look at local port traffic and the amount of empty containers we realize that the American consumer is broke.

I was listening to the radio yesterday and the topic was student loan debt. A student called in and was talking about her $100,000 undergraduate student debt. Aside from the fact that this is simply too much for an undergraduate degree, the student said something that nearly knocked me over with a feather. “Why doesn’t the government just forgive my debt?” The U.S. Treasury and Federal Reserve have created the biggest moral hazard in the planet. As insane as this claim is, the student had a point. Why give trillions of dollars to banks and not give money to the American citizens propping the system up? The problem with this kind of reasoning is that banks just like the student actually gained something for that money. The student we can presume received an education that during her time, she viewed as worth $100,000. She has already consumed this item. This is like going to a rock concert, hating the concert and then wanting your money back. No one forced you to buy the ticket or for that matter, pay that much for a college education. Many people decide to go to state schools and do not have that amount of debt.

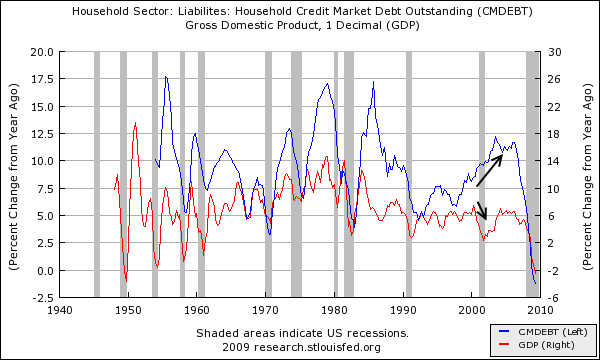

Banks also gained from access to this debt. They made trillions of dollars during the bubble. But when the losses came they wanted the taxpayer to socialize all the losses. You can see how this precedent can infect a society. The average American consumer is trying as much as possible to make ends meet in this deep recession. Now that access to credit is shutting down, it is apparent that for the past decade consumption was subsidized by easy credit. In fact, we can see this on a chart with near perfect correlation:

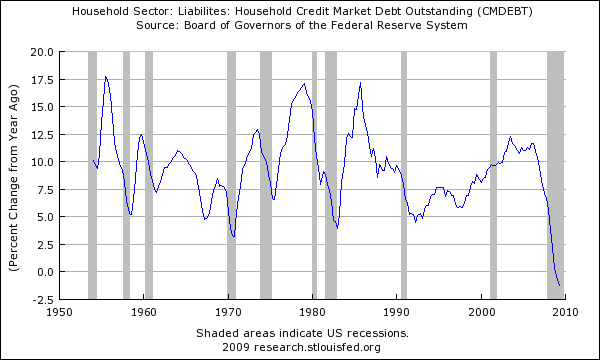

Since the Great Depression we have never seen such a strong contraction in household debt. This is the first time that we have seen mortgage, credit card, student loan, auto loan, and all other forms of debt contract on a year over year basis since data started being tracked in 1950. We would have to go back to the 1930s to see a similar scenario. If you want to see our economic growth, let us tie the above chart with GDP growth:

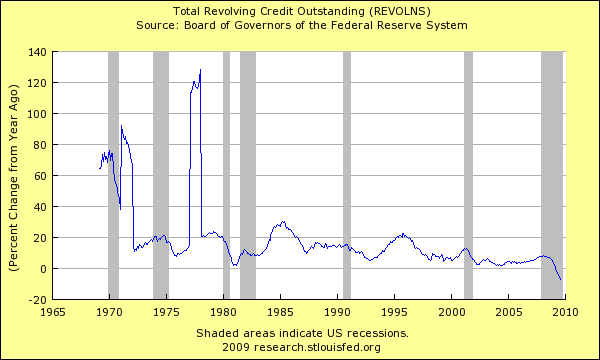

This is an interesting chart. If you notice, typically GDP growth will be followed with a growth in year over year debt. The correlation is clear. But this impact has been weaning over time. It reached a culmination point in 2000 where GDP declined however household debt increased sharply. In other words, this decade was fueled by debt and gave the illusion of a healthy economy just like that person driving the luxury car. If you don’t believe this just go to a site like Swap A Lease where people are aching to unload their lease to someone else. It can be said that this recession was over a decade in the making. The housing bubble simply reached an epic proportion and popped it all. If you really want to see why consumption is tanking take a look at access to revolving debt (aka credit cards):

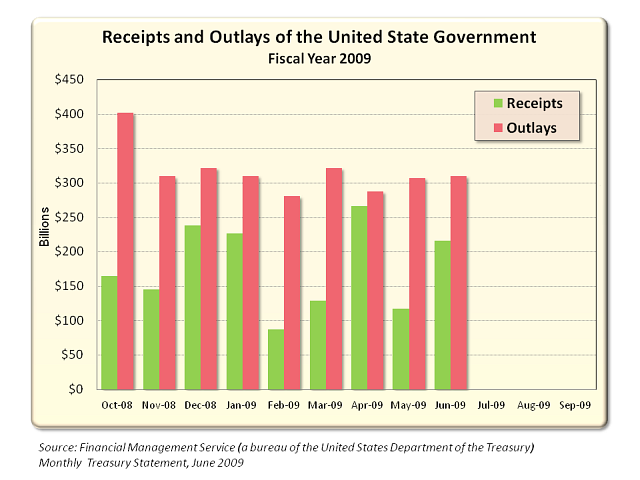

Again, for the first time since the Great Depression Americans are seeing revolving debt decline on a year over year basis. Revolving debt isn’t new. People financed Ford cars back in the 1920s and 30s in installment plans. They also had installment plans on refrigerators and other items. So this monumental contraction tells us that the American consumer has reached an apex in debt consumption. Depressions usually bring this out. And with unemployment at record levels, the government is collecting less money and spending more:

Source:Â Perot Charts

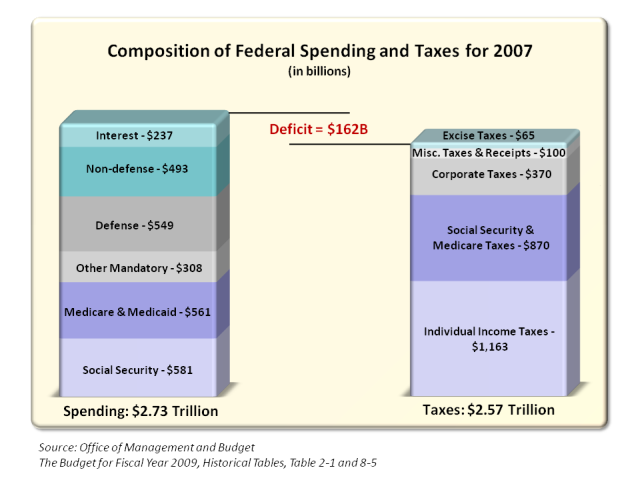

The above is a fascinating chart. This isn’t anything new. But take a look at a month like February. The government brought in under $100 billion yet spent over $250 billion. With the national debt at $11.8 trillion is the consumer and the nation reaching a simultaneous inflexion point of debt? And our interest payment alone in 2007 was $237 billion:

In reality it is this simple. We are spending more than we take in. Not only on an individual level but at a governmental level. Yet this has reached a critical point. The American consumer now no longer has access to easy credit and it is having ramifications in our consumption based economy. The U.S. Treasury and Federal Reserve can print as much as they like yet the average American does not have this option. Our U.S. dollar is worth less and less as time goes by. There is a reason for this. Most sensible observers realize that we will never pay off the $11.8 trillion in debt. Like many underwater consumers, their only way out is through bankruptcy. That is why we have seen these skyrocket in the last few quarters even though bankruptcy legislation now makes it harder.

The American consumer of the decade is now gone and will likely never ever return. However, the real challenge that we face at this point is we risk our own national balance sheet. The stock markets have been on a tear but this is due to the U.S. dollar falling by 15 percent since March and also a systematic gaming of the Wall Street casino. The average American on the street has gained very little in this respect while some folks, a very small number, are making billions on the suffering of our working citizens.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

bob said:

Excellent research. Thank you! The charts do tell a sad story.

September 24th, 2009 at 2:38 pm -

PC said:

Presumably an undergraduate education that leaves a student with a six-figure debt is an education from some elite private school. I’ve not priced one recently but I assume that four years at a state school is still possible for a much more modest sum, though just room and board for four years is still a significant expense and today many students are on a five or six year plan.

Is the private school education worth the difference? That really is a tough question. Let me add that I view this from the lens of someone whose own education was at a low-cost state institution, but also someone who has taught at an expensive private college. There is certainly a difference in atmosphere and, given the choice and an unlimited budget, I would probably opt for the private school experience. However, this choice is not based on the educational value. It is not at all clear to me that the private school necessarily provides even as good an education as the less expensive state school.

However, students at the private school do get more personal attention and the experience is not doubt a much better experience from an emotional and cultural standpoint. Without doubt, the students make contact with people who can be of more help in later life and they emerge with a more prestigious pedigree. These are not advantages to be sneezed at. From a lifetime earnings standpoint or from a lifetime achievement standpoint, the greater cost of a prestige degree may indeed be worth it.

September 24th, 2009 at 3:58 pm -

silver said:

Party like it’s 1999 cause we have seen the last of the good old days………revelations is knocking on our door with his cousine armagedon and his nephew chaos.

September 24th, 2009 at 9:59 pm -

alan turner said:

excellent -all your blogs give me an overall picture of what is happening to us citzens.THIS EFFECTS EVERYBODY ON THE PLANET BECAUSE OF THE SIZE OF us ECONOMY

EXCELLENT

September 25th, 2009 at 12:07 am -

jturner said:

Excellent article and analysis on the future of our country and the fate of the consumer. I think one of the main ways to at least try to improve the situation is to try to educate the average person on the dangers in the economy, and to inform them that there are investment opportunities outside of plain vanilla mutual funds to preserve and grow his/her wealth. I think one of the few alternatives that currently is attractive is gold, given the Fed’s efforts to try to avoid deflation at all costs. I recently read some good articles at http://www.goldalert.com that discuss the Fed’s Keynesian policies and potential effects on the dollar, the gold price, and specific gold mining companies with leverage to the gold price. There are many unintended consequences of our govt’s reckless spending habits, and these will continue to have big effects on fiat currencies over time.

September 25th, 2009 at 12:16 pm