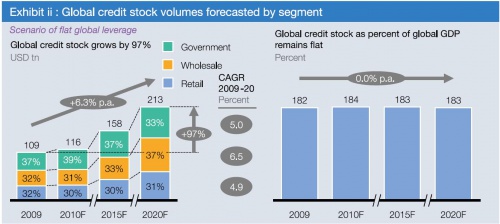

The tipping point for global debt – total global needs to grow to $213 trillion by 2020 just to sustain current growth.

- 7 Comment

Every so often markets forget that too much debt is a bad thing. We are already seeing inflation in many items and the standard of living being pushed lower for many Americans thanks to policies that crush the US dollar and allow the Fed to expand its balance sheet without congressional approval. There are consequences to all these actions. We are also quickly approaching the debt ceiling, again. Does anyone think that $16 trillion will ever be paid off? Total global debt is at a silly number no matter how you slice it. The problem is you get a diminishing level of return and you can see this in places like the Euro-zone that is bailing out banks and countries left and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Total global debt addiction

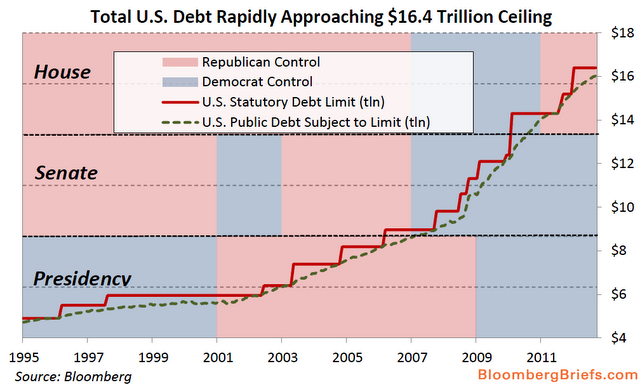

The US is on a fast pass to breaching the debt ceiling yet again. This is bi-partisan type of event:

The issue above is that our total debt is now higher than our actual GDP. That is a problem. People sometime point to countries like Japan as an example of a nation with massive debt (around 200 percent of GDP) and use this as a best case. How is that? There economy has been stagnant for more than 20 years. They have major demographic issues hitting. Has anyone looked at their stock market?

The Japanese stock market is lower today than it was in 1984. Is this really the example we want to use as a “too much debt†doesn’t matter argument? Plus, they are a nation of savers and we are definitely not (1 out of 3 Americans has zero dollars to their name). The fact of the matter is we are globally on a debt addicted path. It is hard to remove debt from the market once it is already introduced. That is why the Fed with QE3 will need to keep adding program after program because now, the market is conditioned to mortgages rates that really defy any sort of open market program. Yet this action is having other reactions like crushing the standard of living of Americans merely for the sake of bailing out banks.

Total global debt is on an unsustainable path:

Global debt is going to need to grow a stunning 97 percent in the next few years up to $213 trillion just to keep up with recent growth projections. Now this would not be an issue if GDP actually came hand and hand along with it. But that is not the case. Debt spending does not have the same impact as normal sustained growth. This is why in China you have millions of empty apartments and horrible investments in real estate because hot money is flowing everywhere just for the sake of growing GDP. This bubble will burst just like every other bubble has burst. In Europe you are seeing deflating housing markets from Holland, Ireland, and Spain.

Total global debt is now the drug of choice for growth. Central banks are powerless without this tool and their massive use of it has created a market where everyone is dependent on this one central authority. Just think of the Fed with QE3 announcing they will buy nearly $500 billion of mortgage backed securities over the next year with no congressional authority. The public goes up in arms over billion dollar projects yet this goes unquestioned or even unchallenged for debate? It isn’t like this was an urgent or novel action (after all it was phase three of quantitative easing). It is just simply another action of this debt addiction.

The above chart shows that total global debt is going to grow at a rate of 6.3 percent. There is little evidence to believe that globally we will be able to sustain that kind of growth especially when it comes at the expense of easy money. The markets have forgotten for the moment that too much debt does have a tipping point.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Bob Greene said:

The Blloomberg graphic is incorrect on the Senate Democratic span. The Senate did not become blue until 2009 (election of 2008), whereas the House became blue in 2007 (election of 2006)

October 6th, 2012 at 2:23 pm -

Bob Greene said:

No, few would argue debt is as inconsequential as Cheney insisted in his infamous retort to Treasury Secretary Paul O’Neill– “You know, Paul, Reagan proved deficits don’t matter.” But what did Cheney know?

After all, Cheney is the guy who claims to believe in the Laffer Curve, the magic point at which giving capitalists more money results in exactly the same or (amazing!) even more revenue. A fiscal perpetual motion machine which loses no input energy, and in fact, returns more than invested.

But debt does matter, so Keynesian management principles tolerate great debt for only a brief period of strong stimulus. Or, failing that, tolerate a longer period of deficit spending for milder stimulus, if that is all that can be had. The objective is to compensate for a failing demand side, until recovery occurs. Even Bernanke pledged to play by these rules until recovery is confirmed, not merely when vital indicators return.

In any case, something bold must be done to bring the economy back, since non-economic (political) factors may be a large part of the problem. It is no secret that the past four years of declining job growth reveals a silent compact among US corporations to choke the life out of the economy. According to plan, Obama will have nothing to show for four years, Romney will rush in to save us, flip a switch on Wall Street, and the lights will come back on, all over the world.

Is Romney a genius, or what? (You need not answer that.)

October 6th, 2012 at 2:53 pm -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

Shouldn’t we look towards the collusion between Congress; The White House & The Federal Reserve to destroy their debts through non stop $ destruction/depreciation? Looking @ The American Institute For Economic Reseach’s Chart book, the first chart is a chart representing the remaining purchasing power of the US $ which has fallen from a peak of around 140 pennies per $ to the present around 2 pennies per $ which is a loss of around 138 pennies per US $ in terms of real world buy/purchasing power or a loss of around 98% isn’t it? Their telephone number is: (888)528-1216.

This means that a stock previously purchased for $10, when each of those $’s was worth 140 pennies, would have a total purchasing power of around 1,400 pennies but, as our $10 stock rises on the Dow chart reaching $20 but with a purchasing power of only 2 pennies each US $, our stock though rising on the Dow Chart now only retains 40 pennies of real world buying power with with a loss in buyimg power of 1,360 pennies. Now, please tell me whoever you are how you can get ahead in that kind of economic environment with or without a job? And all we have to do to double check our figures here is go to the gas pump once in awhile to buy fuel as it rises like he Dow Chart but against the $’s loss of buying power as measured by the AIEF’s Chart Book. Hostory explains clearly that each fiat curency will finally achieve its’ intrinsic value which is zilch. Gold & Silver on the other hand can not be rendered worthless can it? How long can Warren Buffett hold on to his $’s as they continue to devaluate their purchasing power under the collusion being implemnted by Congress; The White House & The Fdderal Reserve System of US finances? What takes the place of the US $ when the $ dies?RUSS SMITH, CALIFORNIA (One Of The Broke States)

resmith@wcisp.comOctober 7th, 2012 at 7:00 pm -

brad coons said:

Does GDP include government purchases of desks, paper, xray machines and salaries of those providing “government services”? How about bombers and dones? Are they included?

October 8th, 2012 at 7:26 am -

clarence swinney said:

so very very very important

JOBS–ONE OF BEST

THE BETRAYAL OF AMERICA’S MIDDLE CLASS WAS A CHOICE, NOT AN ACCIDENT

BARTLETT-STEELE TRUTH-OUT.ORG

These two have been writing it since 1992 Book–â€America-What went Wrongâ€

How have things changed since then for the middle class? They say “straight downhill-

Thanks to the few ruling class which is having its way.â€

Wages stagnating and going down, benefits jeopardized or disappearing, and our country being divided into a nation of have-mores and have-lesses. Public policy gave incentive to corporations to outsource. They say high wages excuse is malarkey. They say main reason is incentives provided by foreign governments and, then, when companies bring their product back there is essentially no tariff on it. Trade deficits=lost jobs. The ones remaining should be sayingâ€Look, we are really working for the best interest of American workers here and we need some helpâ€.

“The problem is, you have the mindset in Washington, in Congress and basically with every administration, that trade should be unrestricted.â€

Recent Example: Hanesbrands—biggest hosiery -men’ underwear—Winston Salem NC-

In 2010, Chinese government built them huge modern plant. All US plants closed.

Check the current retail price look for much lower price. Ha Ha Ha

The four page article tells us so much about what happened and tough choices to recapture/keep our jobs. Bartlett-Steele are Icons on Jobs. Bless them.

Tariff on imports.October 8th, 2012 at 8:56 am -

clarence swinney said:

JUST ANOTHER CHANCE TO SAY THANKS YOU ARE SO GOOD

October 8th, 2012 at 8:57 am -

clarence swinney said:

MITTNUTS

My first act will be to defund Planned Parenthood. Darn. They prevent more abortions than any unit in America. Mitt loves abortions? PP provides preventative health care for millions of the poorest of poor women. Do not Mormons worship Jesus Christ?My first act will be to repeal Obamacare. Darn. I thought it is a law of the land passed by Congress.

Mitt now a dictator who can do as he pleases.My Five Trillion Tax Cut will not add to the deficit. I will pay for it by eliminating tax break loopholes for my rich backers. Sho nuff!

Obama took 716 Billion out of Medicare. Cutting payments to Mitt insurer pals is bad bad bad.

Half of green jobs firms he financed went bankrupt. Less than 10% is not 50% except in Mitts math.

I oppose Dodd-Frank. His ultra rich pals said the same thing.

I will not cut education budget with my trillions for more killing machines. Sho!. Mittmagic.

October 10th, 2012 at 8:08 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!