Deleveraging from one bubble to another – $6.2 trillion in mortgage debt was added between 2000 and 2008. Since the peak in 2008 $1.3 trillion in US household debt is gone but another bubble is brewing hidden under the rubble of the busted housing market.

- 10 Comment

There is some interesting data on the deleveraging that is occurring with the American household. Since the peak in Q3 of 2008, US households have lowered their outstanding debt by $1.3 trillion. It is important to understand how this deleveraging is occurring. First of all, Americans are largely paying down existing debts much faster and are no longer on a debt binge like they were pre-2007. Yet a significant amount of the deleveraging has occurred via mortgage defaults. So while lower debt is a good sign, it is important to understand in what context this is occurring. Another point that will be highlighted is the amount of student loan borrowing in the US household equation. This segment of debt was untouched by the recession as younger Americans financed their college educations through more expensive debt. After a few years, Americans have pushed off some $1.3 trillion in household debt. Let us examine how this debt weight was lost.

Removing $1.3 trillion in household debt

Without question most of this reduction in debt has occurred because of mortgages being written off thanks to the housing bubble popping. Yet another part of the equation is that Americans have tapered off their borrowing ways and are not back to pre-recession levels. It is likely that this is a structural change given that most of the previous decade’s borrowing came courtesy of a once in a lifetime bubble. Let us examine how this debt was removed via the housing process:

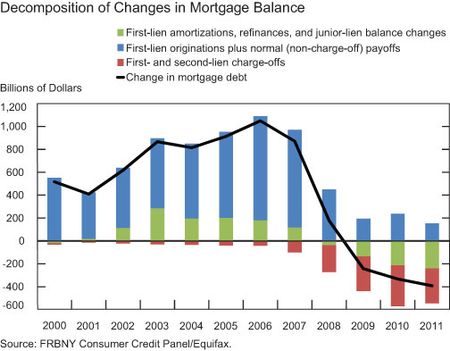

The big increase in US household debt from 2000 onwards was largely based on massive growth of mortgage debt. In 2000 outstanding mortgage debt went up nearly $600 billion. It dropped a bit in 2001 likely in line with the tech bubble bursting. After that, it was bubble city yet again. In 2002 it was well over $600 billion. From 2003 to 2005 it ranged in the $800 to $900 billion category. In 2006 it went over the nutty $1 trillion mark and even in 2007 it was over $900 billion. Trillions of dollars added in mortgage debt thanks to the housing bubble.

To be exact, a stunning $6.2 trillion in mortgage debt was added between 2000 and 2008.Â

Yet in 2008 even with problems emerging net mortgage debt went up. Only in 2009 through 2011 did we see actual mortgage debt go down. $241 billion in mortgage debt was paid down and as you can see from the chart above, a large amount of mortgage debt went away because of the housing bubble bust. All in all $968 billion in mortgage debt has been written off from 2009 to 2011.

Underlying all of this of course is that banks have dealt much better from the bust since the Federal Reserve has helped banks directly with countless programs and bailouts. For example, home values are down over 30 percent from their peak. However banks have not come close to adjusting mortgage debt by 30 percent. Even the chart above reflects this trend and demonstrates that most of the deleveraging has occurred on the balance sheets of US households.  Part of this has come from lower mortgage rates as well.  U.S. mortgage rates are down from August, touching 3.77 percent APR for a 30 year fixed mortgage

The growing student debt

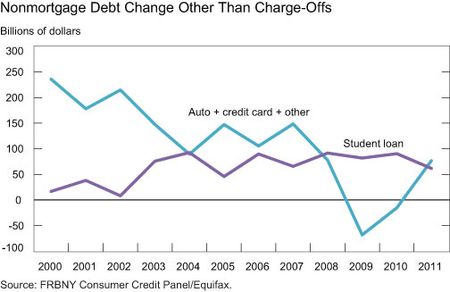

While practically all areas of consumer debt fell once the recession hit, student loan borrowing continued unabated:

While the bubble in housing clearly has caused massive deleveraging in household debt, the higher education bubble continues to rage on. You have mixed signals being thrown out to students that yes, education is going to make you more money in the long-run but this kind of generalist advice provides very little guidance.  There is a big difference between what career you choose and also where you go to study. It is insane that some poor quality institutions are charging students $50,000 per year and the only way this can occur is via the student loan system. Think about the fact that US households are essentially earning what they did in 1995 yet the cost of going to college has gone up even quicker than housing did during the peak of the bubble.

While it is true that US households are in the painful process of deleveraging, banks are once again levering up and speculating in all sorts of markets. The Federal Reserve is essentially handing out free money to member banks so they can continue to speculate in whatever they see fit. Of course the unforeseen changes are coming via hidden inflation and a declining standard of living. Need we remind you that the Fed was largely at the core of the initial housing bubble? With no real changes to the financial system the Fed is essentially funneling billions of dollars each month into the housing market to try and re-inflate asset values. US households have a firm grasp on what is happening with over 46.5 million Americans on food stamps and nearly half of Americans too poor to pay any Federal income tax.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

ted Kramedas said:

The sooner the system collapses, the better. Only then can we

begin to rebuild a better world, hopefully learning from the

mistakes made by The Fed and the Government.September 24th, 2012 at 6:01 pm -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

What would be interesting would be another article showing where OUR present economy would be under the disciplines of OUR golden Constitutional Standard found in Article 1; Section 10 which calls for only minted. specie gold & silver coins as OUR money which is an automatic death trap killing all reasons for the existance of the Federal Reserve System which reaches trillons of miles past a mere act of auditing the Fed.? What does auditing the Fed. have to do anyway with OUR money being limited to minted specie based gold & silver coins only? The point of an audit of the Fed. illudes me; except for a waste of OUR time.

RUSS SMITH, CALIFORNIA (One Of OUR Broke States)

resmith@wcisp.comSeptember 24th, 2012 at 6:15 pm -

Frank said:

Money grows on trees! Money grows on TREES!!!! I just graduated iwth an MS in Gender Studies and I owe $100,000!!! But its ok cuz Money Grows on Trees!!!

September 24th, 2012 at 7:09 pm -

JD said:

Still lots of deleveraging required. Banks shadow inventory large and on books @ incorrect inflated values. If marked to “market price” they would all collapse.

Not sure how we delever the student bubble…@ the minimum they should be allowed to default, but even that starts them out in life hosed!

September 25th, 2012 at 7:06 am -

David W. Young said:

What should also be pointed out here is that our illustrious Federal Reserve has expanded its own balance sheet by some $3 Trillion since the housing bubble started bursting in late 2007. WHO DO YOU THINK IS ON THE HOOK WITH ALL OF THE MORTGAGE BACKED SECURITIES and OTC Derivatives THAT THE BANKS HAVE OFF-LOADED ON THE SOPHOMORIC FED??!! YOU, YOU, YOU, the American taxpayer will foot the bill when this garbage is finally marked-to-market in real world accounting. The Fed has been the enabler extraordinaire in this whole housing bubble, now trying to keep the banks afloat by progressively taking worthless paper off their books, supposedly so they can start lending to the economy again, VERSUS INCREASING BANK EXECUTIVE COMPENSATION! History will not be kind to Greenspan, Bernanke, the GSE’s, FHA, and all of the regulators WE pay $Billions for each year to protect the public interest. The Banana Republic Corrupt Government Business Model if there ever was one. And now Bernanke is on his way to killing the Value of the Dollar with unlimited/unrestricted money printing to save the banks again, not you and I since we are not in control here.

September 25th, 2012 at 1:55 pm -

joey2times said:

A related graph most here will find interesting:

http://lreichardwhite.blogspot.mx/2012/09/fed-graphs-end-of-economic-world.html

September 30th, 2012 at 3:39 am -

zaybu said:

The effect of people deleveraging, paying off their debt, is a contraction in the money supply. Left unchecked, this would throw millions of people out of work. Considering no possibility is available for fiscal expansionary deficts due to political gridlock in Washington, the Fed had little choice to offset the negative effect of deleveraging and consequently implemented its recent QE3 policy. Bernanke was basically saying that the politicians weren’t doing their job.

September 30th, 2012 at 7:48 am -

Terry Moore said:

Thanks for all your research! Is the pay down on the debt due to loans defaulting and becoming written off by the banks? Or is it actually consumers paying down their debt?

September 30th, 2012 at 10:03 am -

Anthony Eller said:

I would like to know what the amount of debt was when the housing bubble busted ($1.3Trillion?). I want to compare the $1.2 Trillion Student Loan Debt

bubble that is going to bust the question now is when. Tuition is increasing on average 8% and if changes are not made will double in 9 years. the latest report from the Wall Street Journal has the student loan debt now up $40,000 hard to believe I have been using $27,500 for the last year!October 9th, 2013 at 12:09 pm -

Anthony Eller said:

Can you tell me the amount of debt was it $1.3 Trillion when the housing bubble busted? I want to compare it to the $1.2 Trillion student loan debt bubble.

October 9th, 2013 at 12:13 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!