A debt inspired milestone – US Public Debt to GDP ratio over 102 percent. In the early 1980s public debt grew at one point by 20 percent. We hit that point in the 2000s yet GDP did not come along.

- 3 Comment

What is the significance of having too much debt? Does it even matter? It seems that politicians understand something must be done but while the bickering occurs, the status quo remains. We recently surpassed a milestone when it comes to our debt. Total US Public Debt to GDP now stands at over 100 percent. That is, we have a larger public debt than what we produce per year as an entire nation. The last time this occurred was during World War II. Europe is dealing with massive debt as well and many countries within the union are in depressions like Spain and Greece. There now seems to be a marginal impact on the real economy with every increase in the public debt. There isn’t a fast rule of thumb as to what is the maximum level of debt but going over 100 percent of our GDP is not exactly a good starting point.

US Public Debt to GDP

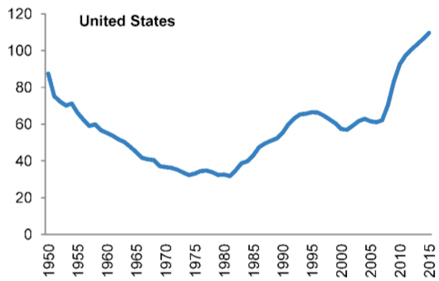

To put this debt growth in perspective, we should look at the debt growth over time. We should look all the way back to the 1950s:

Source:Â IMF

The decline in debt as a percentage of GDP brought along some of the strongest growth to US households and a vibrant middle class. A strong US dollar also helped most Americans. This is important to keep in mind as we see pundits make the argument that somehow massive debt and a weak US dollar are somehow good for US households. Since we purchase much of our goods from abroad, this merely means we will be able to buy less for more. Think of oil that is sold and bought in global markets. Even though prices are starting to come back down, they have remained elevated for many years in combination with falling or stagnant household incomes.

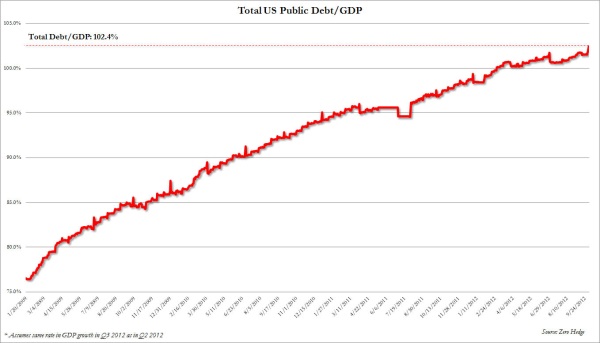

It might be useful to put the growth of US public debt into a more recent context:

This isn’t exactly a positive sign. Ideally, you would want to see stronger GDP growth and more moderate (if any) growth with the public debt. Yet this is a pattern that has been going on for many decades at this point. Starting in the 1980s the growth of public debt in relation to GDP was astounding. In essence, we built solid credit as a nation for many decades only to spend it on a credit card starting in the 1980s.

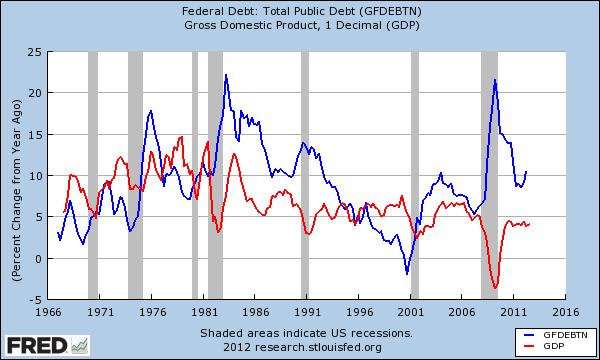

We can see this very clearly by comparing GDP annual growth versus the debt annual growth:

Early in the 1980s US public debt grew at one point above the 20 percent annual rate. We hit that again in the 2000s. The big difference this time is that we had strong GDP growth during that time as well. This time, GDP has been slowly coming along. There are a variety of reasons for this but one of them is the low wage employment system we now have in place.

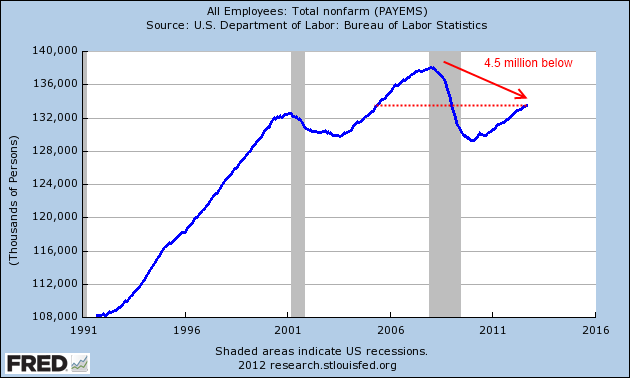

While we are now adding more jobs each and every month, we are still a good amount of jobs away from our peak level of employment:

We are 4,500,000+ jobs away from our peak employment level and each month the population grows. To get back to that level we would need to add the following:

100,000 jobs for 45 months

150,000 jobs for 30 months

200,000 jobs for 22.5 months

Those thinking that this will be an easy recovery are simply ignoring macro indicators for our economy. The EU is the biggest trading bloc in the nation and will have a drag if things do not improve. China’s economic growth is also slowing down a bit. In the end, our global system is highly interconnected and we’ve all followed the same path of peak debt. Most nations with central banking always have the tempting desire to increase easy access to debt when things go poorly. We are already into QE3 and looking at buying nearly half a trillion dollars of mortgage backed securities just to keep Americans buying homes at high prices so banks can offload their high levels of inventory. This seems to be the solution to every crisis.

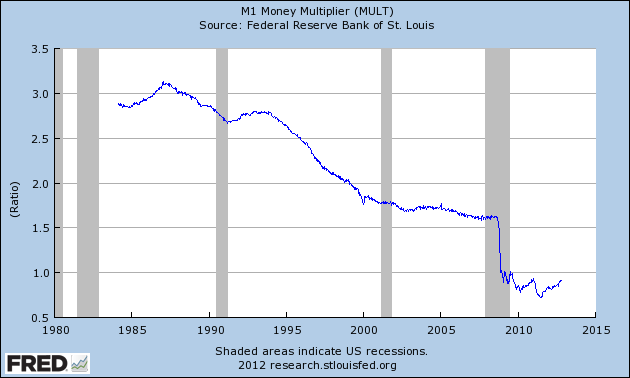

We can also see how slowly money is changing hands in the economy:

If the economy is in bad shape, with high unemployment, weak home prices, then generally people are afraid to spend their money. So this drives up the demand for money that slows the velocity of money. GDP is a reflection of how quickly money is flowing in the system and it is only slowly picking up.

The slow employment growth is not positive. It is certainly better than the months where we were losing above 500,000 people. Is this a new model for our economy? Only time will tell but don’t expect any serious change regarding the debt to come until the election season is over.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et AL:

The other day someone said that Nancy Palosey thinks that unemployment checks going into OUR economy is great but not a dime of the unemployment funds comes out of her pocket does it? To her the unemployment money is on of the top economic stimulators right behind Social Security checks. This is a good example of politicians living in their own self made la la land where, as long as their incomes are not affected, political policies will suffice; even when those policies are completely destructive overall. Sure, when people spend their unemployment chekcs and/or their Social Security checks, they stimulate the movement of goods through the marketplace but unemployment money is not earned money but taken from a reserve poole of funds as is Social Security money as well. The same could be said if either the State or the Federal Government sent everyone a check for say $2,000 a month without anyone having to work for it. Yes!, as the money is spent into purchasing goods/services into the economy that would stimulate OUR economy alright but it would still be spendable funds achieved without producing anything. In the case of the unemployed, they don’t produce anything of real substane plus they don’t pay any taxes either from their unproductiv lives do they? We went out of the FREE LUNCH BUSINESS long ago didn’t we? Speaking of taxes, we are all over taxed by the subtleties of the never ending inflation tax that’s eating out OUR $’s purchasing power year after year. Real taxes produce real results that we can measure in our every day lives like roads, bridges, overpasses, FREEWAYS, National Parks etc.; while what do we have to show for paying OUR inflation taxes except the loss of OUR buying power in the general market places for goods & Services?

RUSS SMITH, CALIFORNIA (One Of OUR Broke States)

resmith@wcisp.comOctober 29th, 2012 at 8:17 pm -

therooster said:

The economy needs liquidity but liquidity without the associated debt of debt-currency. Assets need to be circulated to support liquidity so that debt can actually be drawn off, not redistributed. Debt can thus be retired. This is why gold and silver should be remonetized but we cannot expect this from the apex of power. Precious metal monetization has to be an organic, market driven co-operative effort from the grass roots.

October 30th, 2012 at 3:33 pm -

laser cuting said:

we have to show for paying OUR inflation taxes except the loss of OUR buying power in the general market places for goods & Services?

November 8th, 2012 at 2:14 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!