U.S. Treasury and Federal Reserve. Federal Reserve holding over $2 trillion in the Darkest Balance Sheet in Financial History.

- 10 Comment

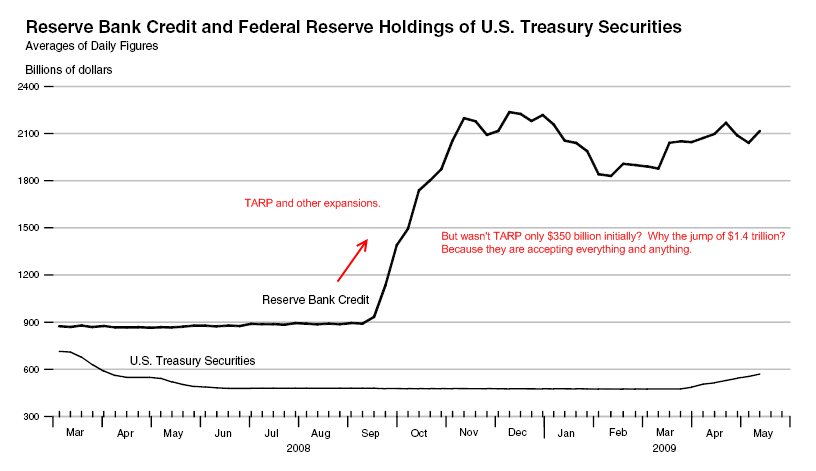

The U.S. Treasury and the Federal Reserve have arguably two of the least transparent balance sheets known to humankind. This wouldn’t be such a big issue if the amount of money funneled into these organizations was small. That is not the case. The Federal Reserve since October of 2008 has held on its balance sheet over $2 trillion in reserve bank credit and also, Federal Reserve Holdings of U.S. Treasuries. This of course is the biggest bait and switch in history because in exchange for U.S. Treasuries, banks can offload practically any collateral (i.e., mortgages, auto loans, credit card loans, etc). The U.S. Treasury and Federal Reserve are creating the biggest put option in the history of the world and the American taxpayer stands to lose big.

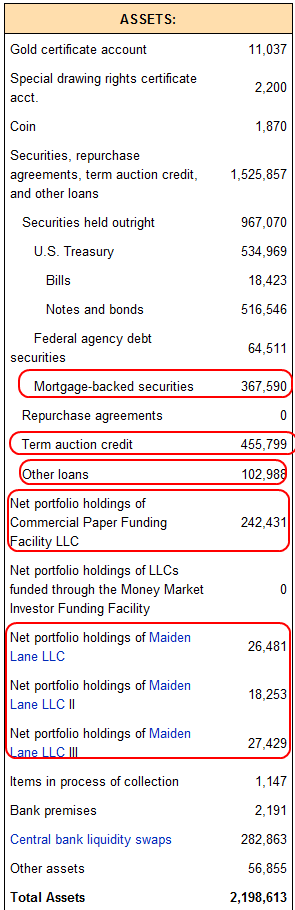

Let us take a look at the Fed’s balance sheet:

The Fed doubled its balance sheet in the matter of a few weeks. It went from approximately $900 billion to $1.8 trillion in lightning speed. And with this speed, the public unfortunately did not know what they were exactly buying into. It is important to take a look at the Federal Reserve balance sheet broken down by category:

Now I’ve highlighted a few of the areas that have seen explosive growth over the past few months. Many are not aware that the Fed already has $367 billion in mortgage-backed securities on its books. That is an enormous amount. Also, the Term auction credit which was designed to be short-term is staying absurdly high at $455 billion. We have “other loans” of $102 billion. We need more clarity beyond this. The public isn’t shown exactly how these securities look. There is a big difference between a 30-year fixed MBS and an Alt-A packet that contains questionable mortgages. These are things we do not know but are fully backing up with the full faith of the American taxpayer. The Commercial Paper Funding Facility backstopped a large portion of the money market accounts when they broke the buck last year. These are not assured either but here we are with $242 billion sitting on the balance sheet. What is the quality here?

The Maiden Lane facility, is the holding company that was created when the Fed brokered the JP Morgan and Bear Stearns deal. The Fed expects to lose $2 to $6 billion on this deal. The other Maiden Lane holding companies are setup to bailout uber financial failure AIG. Do these sound like quality assets to you?

There are petitions and now, a realistic push to open up the books at the Federal Reserve. After all, if we are being asked to bail these institutions out we have a right to know what kind of collateral we are receiving. It is not typical for the Fed to be taking on so much onto their balance sheet. But they are. The bet they are taking is that this thing will blow over and Recovery 2nd half 2.0 is going to take hold. Yet that put option is being squarely put on the shoulders of the American people. We are already going to lose money but the question is how much? Take a look at Fannie Mae and Freddie Mac. They went into conservatorship last year and we were initially told it would cost upwards of $25 billion in the worst case scenario. Recent estimates now put it at $177 billion.

The Fed balance sheet has exploded:

This is where things get fascinating. What is really in those other assets category? That is the question many now in Congress are trying to get at. But the Federal Reserve has the darkest balance sheet of any organization in the world. They tell the public enough and convolute things enough where people are snowed over. How can we not demand to know what is in that $2.1+ trillion balance sheet? They only have that because the public has allowed it. They give categories names such as Maiden Lane which sounds much better than garbage can holders for Bear Stearns and AIG.

And recovery 2.0 is not assured. The unemployment claims remain at record highs and as we have stated, with nearly 25,000,000 Americans unemployed or underemployed things are not going to turn quickly. For example, Californians just voted down propositions that would increase taxes to fund state programs. The vote was rather astounding. So now, the biggest state in the nation is gearing up for major cuts. This will push up unemployment. GM is next up on the chopping block and that will produce more job losses in the summer. Ultimately there has to be a convergence between main street and what is occurring in the stock market. The recent rally has benefitted financial companies the most but the public is still largely left to see very little benefit even though we are now approaching the 2nd year anniversary of this crisis.

The U.S. Treasury and Federal Reserve are pushing things and the public is demonstrating a fatigue. They do what they think they know best and that is banking and they are protecting their own. Let us put this in perspective. California with the propositions was looking to increase revenues and taxes by $6 to $10 billion. A total uproar. The Fed just lists on one of its line items “other assets” and it is up to $100+ billion? Do people really not see what is going on? We need to follow the money and the U.S. Treasury and Federal Reserve have it all.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

10 Comments on this post

Trackbacks

-

factsnews said:

I totally agree. We need to audit the fed! Bill HR1207 has 175 CO-Sponsors!!! Google “Audit the Fed” and join the movement to open the cloak of the Fed.

May 22nd, 2009 at 6:36 am -

omg said:

By all rights they should be audited. But it may be a little late now. They should have been audited periodically all along. But they’ve never had their feet held to the fire before, so they have felt they have license to do whatever they wish. Auditing them now might just cause mass panic. Well, that’s bound to happen sooner or later, because “your sins will find you out”.

May 26th, 2009 at 12:56 pm -

rom said:

We the people must actually repeal the 1913 Federal Reserve Act which is completely unconstitutional in it’s formation and passage by corrupted big business politicians….also the supreme court’s ill-gotten decision in 1894 that recognized incorporations as seperate entities as per the Constitution must also be revisited. How, in this day and age a corporation has Constitutional rights above and beyond a Citizen is beyond me. Lastly our Gvt. should coin our own money, via platinum, gold, silver and copper to tie real value to “our” money. This Federal fake-ass note (toilet paper) has no worth, yet the international bankers (not the U.S. Citizens) collects the interest of the notes usage and it’s funneled out of the country. If the Gvt. printed it’s own currency, it would collect the interest from said currency and run itself (as per the Constitution), therefore no more need for Federal income taxes, which are also Unconstitutional. So We The PEOPLE can deep 86 the FED and the IRS and while were at it the STATE DEPT (no need handing “our” money out to the world with nothing in return, except for the corporations, RIGHT) and this mess would clear up real quick.

May 26th, 2009 at 8:38 pm -

Helicopter Ben said:

You had your chance to vote for Ron Paul, but no, Obama is the cure.

May 28th, 2009 at 4:11 am -

spacecynic said:

As with many major disruptions in history, they are not foreseen widely before they happen. I believe the solution to this problem will occur when the generation that gets stuck with this debt next (either in the coming decade, or worst case in the 2020s) simply says, “no, thank you” and defaults on all US debt, wiping the slate clean.

At that point we can refocus our productive capacity on building the nation again, rebuilding infrastructure, upgrading to the latest technologies in power grids, renewables, etc., without the specter of tens of trillions of debt (and the trillion plus in debt service) eating away at our national treasury.

May 28th, 2009 at 7:02 am -

Raptoreyes said:

I agree the Federal reserve must be abolished. History records that the Founders once ran their own central bank and that bank created the first hyperinflation in America during the middle of the Revolutionary War. With huge welfare state spending (yet another negative social artifact encouraged by fiat money and Central banking) global military expenditures abroad we are set to repeat history much to the grief of United States citizens and all freedom loving people everywhere.

May 28th, 2009 at 2:00 pm -

Yeah! said:

Amen rom!

The problem is that most people in this country don’t even know what’s going on. There’s only a handful of people who understand why we have these problems. I guess the education system has done its intended job.

May 28th, 2009 at 4:39 pm -

hazel said:

we the people need to take back our banks

.the federal reserves intentions were to make the people think the central banks were ownded by the people,when they tricked us by cleverly using the word” federal” to make sure the average americanwould fall for this trick. it worked.August 1st, 2009 at 6:30 am -

abolish the fed said:

Ron Paul if elected and tried to get rid of the FED would have been taken out by now. You can say you want to get RID of the FED, but to actually do it is another ball game. We are slaves to debt, and will always be as long as the FED exists. Just think about it for a second, Bernanke cannot even tell Congress who they have given money to, it is not the FEDs money it is our money, we are on the hook for it not them and we should demand to know who is getting it. The first and second central banks were opposed severely and thier charters expired. Mayer Rothschild even said something like give me control of a nations money supply and I care not who makes its laws. That is where we are at now America, the constitution is being disregarded by wimps in office who are afraid to stand up for this country and what is right. The FED was brought to be in secrecy by a terrible progressive Wilson. Once the FED was in place they created the progressive income tax which was supposed to never go higher than 1% for those making 20,000 or less back in 1913 which was most of the people then. Look at where its at today, whose interests do these politicians serve? THE FED, are they helping you or looking out for you, The Federal Reserve was incorporated in 1914 and has been creating a completely unnecessary national debt ever since. In simple terms, the Fed creates money as debt. They create money out of thin air by nothing more than a book entry. Whenever the members of the Fed make any loans, that debt money is our money supply.

Do you think WWI was a coincidence, I think not. The FED was just created, now lets create debt therefore WWI, now how do we pay off that debt, created a progressive income tax, wake up people

February 17th, 2010 at 11:01 pm -

Peter Dash said:

America will have to reinforce its democratic roots. That includes taking back control of the Fed and Congress. But I think many people would prefer to download video games and partake in other escapist devices. Hence, collapse may be necessary to knock people out of being sheep-like zombies that prefer to shop till they drop hand have government burn their money. You want to run with the herd, then do not complain when you are faced with the end-game of the poetical slaughterhouse. The establishment feeds on your gutlessness. Consider most of the population as their red meat? That is why bankers get most of whatever they want from the Fed.

August 5th, 2012 at 3:14 am