Top 10 percent of US households control nearly 75 percent of all wealth – Average Americans pretend to be temporarily embarrassed millionaires by going further into debt.

- 0 Comments

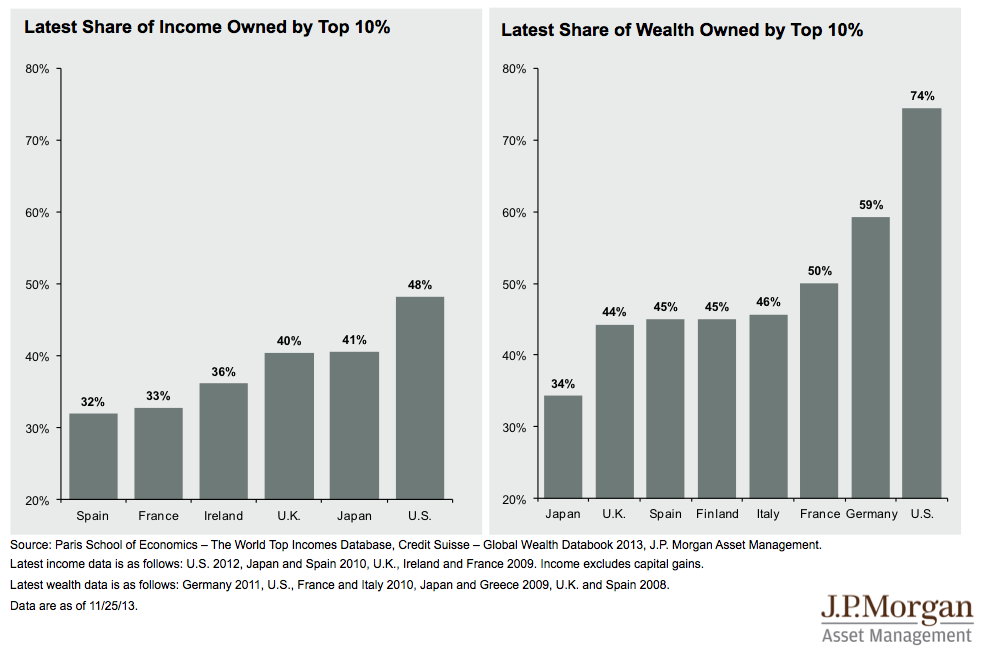

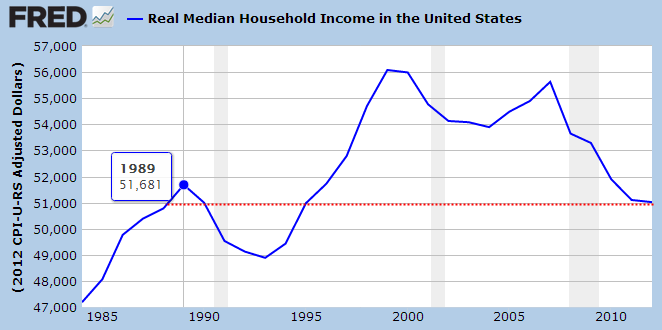

We currently exist in a land of financial contradictions. US household incomes adjusting for inflation are back to levels last seen in the late 1980s. However, holiday spending is going strongly largely by people going into big debt. Many are going to be paying for the holiday season of 2013 deep into years to come. More troubling than spending via debt is the record level of wealth inequality in the United States. We would need to go back to the Gilded Age to find similar levels of wealth inequality. The latest data shows that roughly 75 percent of the financial wealth in America is held in the hands of the top 10 percent of households. Or to invert this, 25 percent of all US wealth is divided up amongst the bottom 90 percent of the population. Wealth is the true measure of financial stability. It used to be the case that housing was the one safe store of wealth for Americans but Wall Street has hijacked this asset class and has converted it to another commodity to speculate on. Yet by looking at spending habits and financial behavior many Americans think they are simply temporarily embarrassed millionaires.  They act against their own interests while wealth inequality rages on.

The most unequal of them all

Wealth inequality is at levels not seen in nearly a century:

Good or not, this is a fact. We have more equality with income compared to financial wealth. However, this distorts figures because a large part of our population is part of a working poor demographic. Sure, they earn income but have zero to their name when it comes to wealth. In fact, many younger Americans are starting out their working career with a negative net worth given the massive amount of student debt.

Spending is going strong for the holidays in spite of household incomes dragging out:

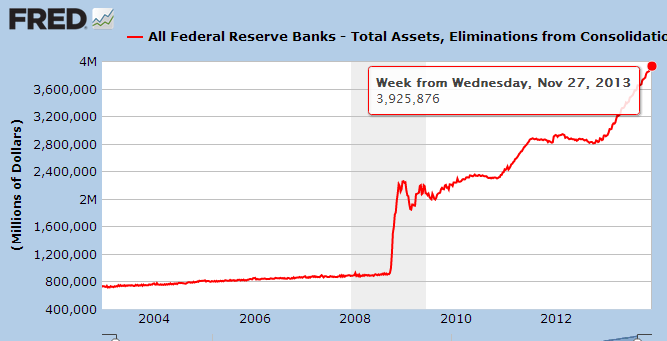

The spending again is coming largely from people going into debt repeating history. The stock market is up but over half of Americans don’t own stocks. So this has been largely a charade. Yet some people favor policies that are now largely coming back to bite them in the rear. For example with bailing out the banks, those low rates are largely out of the grasp of a typical family. Hedge funds and large banks can speculate and rig the game with low rates while your typical household is still paying double-digit rates on their credit cards. Bigger risk? Do we need to go back to what risk the banks laid upon the global economy? The biggest risk takers are also the biggest beneficiaries of the Fed’s actions. Surely the economy has improved by the trillions of dollars funneled into the system. Right?

Jobs are still scarce

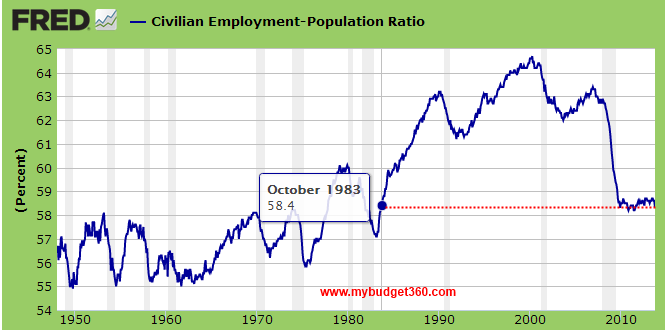

The job picture has not improved as much as the headline reports would indicate. First, we have a much smaller portion of our population working:

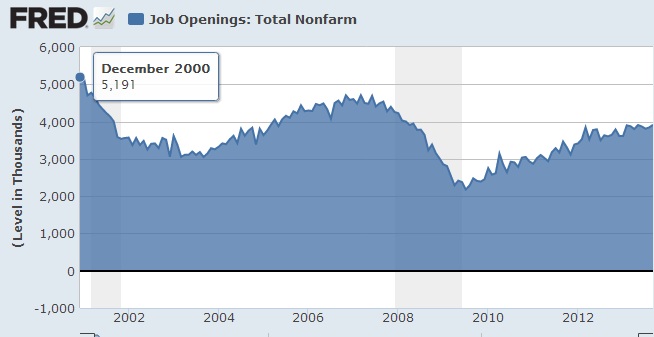

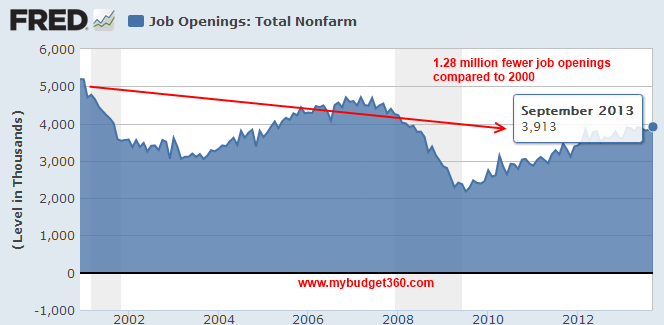

For a variety of reasons including demographics, younger Americans in schools, and those opting out of the workforce the unemployment rate is severely understating the working conditions most Americans are facing. Take for example job openings:

The recession ended officially in the summer of 2009. The results? Record inequality and 1.28 million fewer job openings than we had back in 2000. Many of the new jobs are also coming in the form of low wage opportunities with massively reduced benefits. The bigger message behind this expanding wealth inequality is the slow hollowing out of the middle class. We have a growing population of poor Americans fully dependent on items like food stamps and disability and another small class of financial giants dependent on corporate and political welfare. The middle class is being squeezed in this unfortunate wealth splitting sandwich.

There are massive levels of risk being introduced into the system because of this as well. The Fed now has a balance sheet approaching $4 trillion:

$4 trillion is only a month or two away. And student debt is about $1.2 trillion. The end results show a market driven by massive debt and growing inequality. This was the end goal. Under the guise of “helping the middle class†the opposite occurred. Sadly many Americans fail to look at the statistics and simply pretend as if they were millionaires and then wonder why everything is more expensive, it is harder to get ahead, and good jobs are scarce.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!