The young, broke, and indebted American: 45 percent of 25 year olds carry student debt and the median net worth of those 35 and younger is one month of expenses.

- 5 Comment

It is clear looking at economic data that young Americans were not sent the memo regarding this economic recovery. People do realize that the “Great Recession†officially ended in the summer of 2009, right? We’re heading into year six of this recovery but many are simply seeing lower paying jobs, a deeper reliance on debt, and inflation hitting in important segments of our economy. For example, some of the top employment sectors in our country are in the form of food services and retail that tend to hire a disproportionately large amount of young workers. But with more people going to college and taking on record levels of debt, working retail is not going to cut it. Back in 2000 about 25% of 25 year olds carried some form of college debt. Today that percentage is up to 45%. That is a major jump and shows that for many, simply going to college requires some form of debt assistance. And that is why we now have over $1.2 trillion in outstanding student debt across the country. But young Americans are also seeing hits to their net worth. Let us look at the “recovery†for young Americans.

In debt we trust

We now seem to be programmed into debt dependence. Need a car? Take on an auto loan even if it means getting a subprime loan. Want a home? Take on a big mortgage with a low interest rate to hide the fact of the big amount. Need an education? Student loans are there to help you, regardless of your income level. All of this has created a heavy reliance on debt. And with 45% of 25 year olds now carrying student debt, the young person with no college debt is looking like the exception.

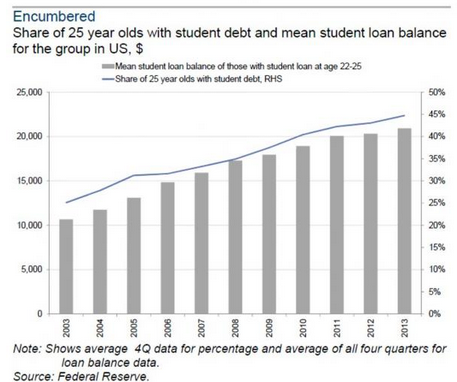

Take a look at this growth in student debt:

The number of students and the amount borrowed has ballooned. Nearly half of those 25 year olds are carrying some form of college debt. And the average amount of those between 22 and 25 is over $20,000. This is the key age range of when people actually exit college and hit the workforce.

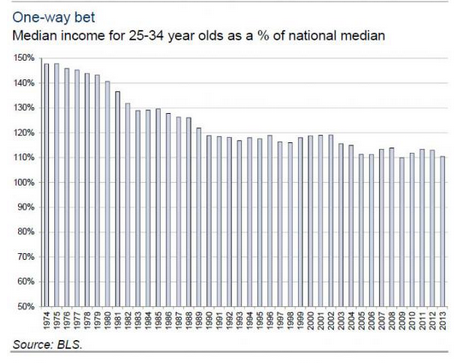

Having this much debt before even earning a paycheck makes it tougher for young people to save for retirement. Many are simply living paycheck to paycheck. Young adults used to earn good money relative to the national median income. That trend has reversed dramatically over the last decade. Take a look at this data:

In 1974 those 25 to 34 years of age earned 150% of the national median income. Today it is down to 110% and heading lower. What is problematic is this is a good portion of your entering workforce and this group in the past largely drove economic activity in housing, large goods buying, and producing changes in demographics. This is where the future growth of the country will occur. What is happening is more of a two-income trap with many working in the low wage portion of our system.

Even if we look at net worth data, younger Americans are having a tougher time today than in the past:

The median net worth of those 35 and younger is $3,662. This essentially amounts to one month of living expenses in most large metro areas of the country. When you see information like this it isn’t hard to believe that half the country is living paycheck to paycheck. And many want to assume that people are choosing to live one step away from poverty.

So what are the solutions? First, overall productivity is not trickling back down to the average American worker. While the economy grows and recover, most gains are going to a very small portion of the population. Nothing wrong with merit based benefits but we have corporate welfare helping big players in a non-competitive way. For example, big banks buying up single family homes and crowding out regular buyers. These big banks took advantage of bailouts and low rates and now are becoming one of the nation’s largest landlords. End result? Rents are up and so are home prices but incomes are stagnant. All that happens is more disposable income is sunk into a largely ineffective portion of our economy. Step one is to stop this welfare for the financial system.

The next step is for younger Americans to be wiser about their financial lives. Take charge early on. Be careful about the kind of debt you take on. There are plenty of great used cars you can buy on Craigslist or other places for a fraction of the cost of a new car. Don’t be tempted by the lure of hot wheels to take on big debt when you are planning for your financial future. Next, choose a college and major wisely. This may be difficult for young people to do but it is crucial. If you have doubts, community colleges are the way to go for your first two years. Most of time you are doing general education classes for your first two years. Then, you can transfer to your dream school and focus on whatever major you want to do. For young people these are likely the two biggest steps you can take to start off on the right footing. Otherwise, you are looking at being young, broke, and deeply in debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Ame said:

Good advice to the college bound.

A family member of ours wants to go into the health care field. They have been working at a nursing home in the cafeteria as they are taking classes paid for by the hospital connected to the home. In addition, they are taking community college courses to get an AA. Not a lot of sleep or goofing around, but so far debt-free. The plan is to save as much as possible to pay for the first year of instruction in the health care field and work-work-work to pay their way. Will they graduate in four years? Probably not. Will they graduate with no debt? I guarantee it. Big pay off is coming because they are willing to work and be sensible about expectations regarding spending money now.

March 10th, 2015 at 3:48 pm -

Dave said:

But, but, but….the 1% Republican corp has said to better ourselves go to college and make ourselves more valuable…..

March 11th, 2015 at 3:14 am -

gman said:

“We now seem to be programmed into debt dependence.”

we always were debt dependent – the dollar is nothing more than fiat ponzi debt. the debt dependence has always been there, what you observe now is nothing more than that debt dependence spilling out into open view. debt dependence was always the plan, the goal, and the intent.

March 11th, 2015 at 8:57 am -

Rufus T Firefly said:

The main reason why millennials are worth less than before is they are stupid. They have 52% of their investments in crash and only 28% in stocks. Cash in todays market is almost as stupid as gold. Millennials are squandering the most powerful force the universe: the power of compound interest over time. Don’t worry about a downturn, embrace it and buy…get ready for the next inevitable bull market!

March 12th, 2015 at 8:00 pm -

Jean said:

The denominator for the national median income could be skewed by higher population of the baby boomer generation. In other words, the chart could look that way because there are more of the older age group around to hold onto higher paying positions and continuing to age, not necessarily that they had higher income relative to their elders compared to the current 25-34 group.

March 29th, 2015 at 12:10 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â