The next bailout will be with student loans: White House takes first steps in allowing a bankruptcy option for student debt. $1.2 trillion in student debt outstanding.

- 9 Comment

It truly is absurd when you hear people moralizing that people should pay their student debt when virtually every other debt class can be discharged through bankruptcy. You can go to Las Vegas, run up $50,000 in credit card debt for a wild night, and if you are unable to pay it back, no problem. Sure, your credit is ruined but no one is going to garnish your wages. Can’t pay your mortgage? Foreclosure. Can’t pay your auto loan? Repossession. Can’t pay your student debt? Lifelong debtors’ prison for you. Student debt is the largest non-housing related debt class in the US. It makes sense that bankruptcy should be an option here. There is one problem, however. Most of the debt is government backed meaning the bill is going to be taken on by the government (aka the people). This is something that should have been done over a decade ago when total student debt was $200 billion, not $1.2 trillion like it is today. However, rising delinquencies show something needs to be done here.

The push for discharging student debt Â

There is now serious talk to get student debt discharged via the bankruptcy process. Good timing for the 2016 election given a massive number of Americans now carry student debt:

“(WSJ) WASHINGTON—The White House is weighing steps to make it easier for Americans to expunge certain student loans through bankruptcy, opening the door for student debt made by private lenders to be treated on par with credit-card debt and mortgages.

Federal law prohibits student loans, from private lenders and from the U.S. government, from being wiped out in bankruptcy, except in rare circumstances. Other forms of consumer credit such as mortgages, credit-card balances and auto loans face looser requirements for being discharged in bankruptcy.â€

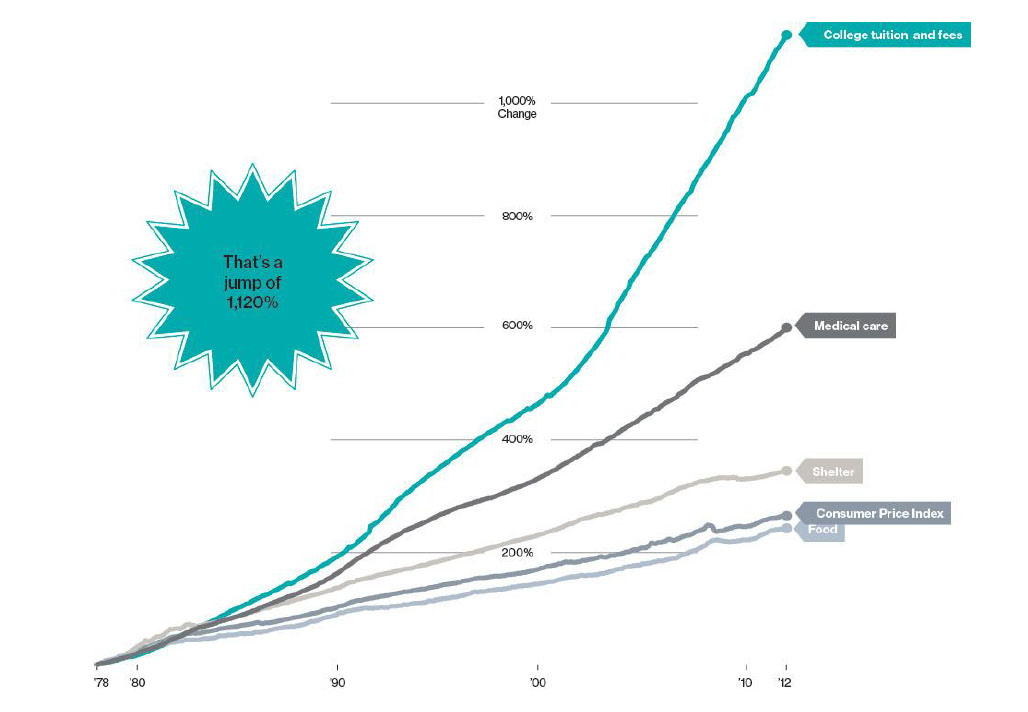

This of course makes total sense. The legislation can be made to circumvent fraud (i.e., those going to medical school and having high earning prospects only to not pay their debt). However, these will likely be rare cases. Today, we have many that got lured into for-profit paper mills and have a degree that is not even worth the paper it is printed on. These institutions are the subprime lenders of the college world. You also have many paying too much for a degree that doesn’t produce a good income in the marketplace. Take a look at how quickly college tuition has gone up:

This is absolutely ridiculous and has only been able to happen thanks to government loans backing this industry and of course, banks and colleges loving the extra income. If you decide to go to a questionable school and have no income, great. The government has tons of financial aid for you. But who really is benefitting here? Many of these schools have no standards that they have to meet or even show their career placement results. Many of the for-profits have been shown to spend more of their budget on marketing than on actual instruction.

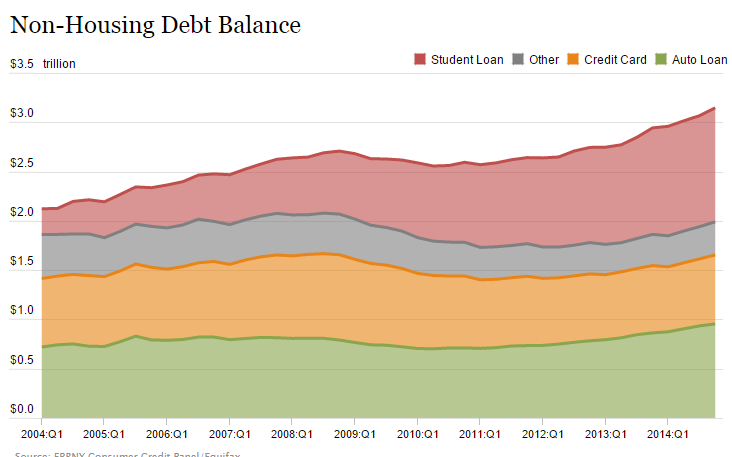

Thanks to this booming trend, we now have $1.2 trillion in student debt outstanding:

Source:Â Federal Reserve

Here is a story from Sunne from New York:

“I have been paying my students loans since about 1997, a year after I graduated from college. Its been over 13 years and my student loan debt is still the same! In fact, it is about $2000+ more than before! How is this possible? I’ve been paying close over $200 every month and I still see no progress. I tried to lower my high interest rate of 8% but I have had no luck because I took the horrible option (it was good option at the time, at least I thought) to consolidate my loans. I was getting 3 different bills for one loan! So it was very confusing. Now, I am stuck with a high interest rate. And to me, it looks like I will never be able to pay my loans back. Its like a forever bill of interest! Because I am a teacher, I thought I would be able to do the loan forgiveness, but since I graduated a year earlier (I believe) I do not qualify. This system is messed up! You would think being a teacher should qualify for some sort of loan forgiveness since it is community service in a lot of ways.

I just wish I knew a way of getting this loan monkey off my back!â€

This is another absurd part of the issue. We are offering 0 percent credit card offers, nothing down options for buying cars, and artificially low rates to buy homes. But for student debt that is fully backed by the government? Rates are high! This simply does not make sense and shows our priorities as a nation of debtors. Many people graduating college are coming out with mountains of debt and are only finding work in the growing low wage economy that is booming. Many young people can barely afford their college payment, let alone purchase a home (this is also a reason for the drop in the homeownership rate).

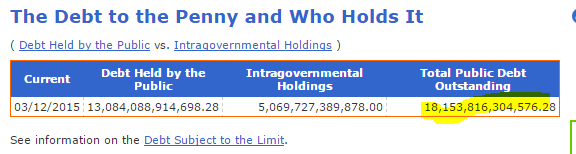

The bankruptcy option makes total sense and needs to be written intelligently. It is politics at its best. More Americans are going to college and graduating with student debt. Like Social Security, talking to this base just makes sense. But nothing comes free. Someone will have to pay for this. It’ll simply be another bailout but of course, the big winners will not be those needing most of the help. Like most subprime borrowers, most were booted from their homes while banks ate up all the profits and recouped losses via bailouts. They used the sad story of the struggling homeowner but that owner is now out of a home (and bank profits are at records). Will that student in need of help really truly benefit from a bankruptcy? Bankruptcy is not as easy as people think. The process is more intense than what the financial industry had to go under for causing the Great Recession (in fact, nothing really happened and they were given even more power). This is something that should have been considered long ago. Now with $1.2 trillion in student debt outstanding, some additional pain is going to hit the system. Then again, this is how much debt our nation has:

As a nation our total public debt is $18.15 trillion and growing.  Do you have any doubts we as a nation are addicted to debt? The bankruptcy option for student debt (like it exists for mortgages, credit cards, auto loans, etc) just makes sense. Of course, all we have is talk and nothing has happened so far.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Joe said:

At the age of 18 when I couldn’t legally gamble, or drink I was herded into a room at my college and told by both the college and 3 bank representatives that I should take out the maximum allowed student loan. This happened on a yearly basis and we were never told about the pitfalls of the loans comming due years later.

Fast forward to my graduation with a masters degree and I was told my payment would be almost 700 dollars a month. I’ve paid that amount since 2001 and my total due has barely gone down.

Last year I lost my job, I’ve run out of ways to defer the loan or will soon and still have no way to make the money. I’ve been forced to decide if I’d like to eat or pay off the loan and eating is winning. I will become a default loan payer soon. At this point I no longer care, the banks and wall street walked away with billions and almost no one was punished in the last collapse.

Al Sharpton owes over 4 million in taxs yet still visits the White House, Hillary Clinton takes millions in donation from countries that abuse women, the bankers walk away from the scene of the crime with a check in their pockets..yet I’m suppose to be an upstanding citizen and a good little debt slave for the rest of my life…..nope

I’m out, I’m done a big F you to the banks, to the system, to the power monger elites. You can take 15% of my social security if I ever live that long but not a cent more from me. I’m done playing your game, I’ll go have a smal but happy life and never worry about a banks need for my cash again.

If we all quit now the system would collapse, if no one pays then everyone but the bankers and The belt way wins. Collapse the system, live free!

March 16th, 2015 at 12:38 am -

MoralHazard said:

The answer is not to include student debt into the other debt forgiveness programs, but to stop almost all other debt forgiveness programs. The way everything in the world seems to be going is that people make hasty/bad decisions and if it doesn’t work out, expect someone else to bail them out. If people are too lazy to look into which jobs are available now, the forecasted job availability, and the cost for education … well, then you will learn a very expensive lesson. Cut expenses, increase income, or a combination of the two. But please don’t expect me to pay for your mistakes – I’m all tapped out after paying for my own.

March 16th, 2015 at 5:37 am -

Pierre said:

Actually not paying credit card debt etc will lead to garnishment of ones wages and either arrest or confiscation of property. I have been harassed by collection agencies who have hired NYC “Sheriffs” and those sheriffs garnished my wages. It seems like a racket as the Sheriffs get a “cut” of the collection. They treaten me with arrest and confiscation of my property (home cars etc).

March 16th, 2015 at 6:56 am -

Jim Deal said:

The subsidization of student loans sounds eerily similar to the subsidies of the AcCA, except those subsidies are not loans, but direct payments to insurers.

With no proving of insurability, this sounds familiar to not proving income for student loans.

Will Exchange premiums have a similar future of price rises as that of college costs?

Jim DealMarch 16th, 2015 at 9:40 am -

Ame said:

Excellent article. I agree this form of debt should be treated no differently than any other.

Today on The Keizer Report, Max made a statement that those who loan money to students are carrying NO RISK because that loan is not dischargeable through bankruptcy. Who else can make loans without risk factoring into the decision to accept the application or not?!

So, they are handing out the loans like candy to whomever applies. (Sounds like the home loan sub-prime lending, right?)

In other words, these colleges are taking complete advantage of people who they darned well know will not likely get a job for which they are being “educated”. But, hey, who cares! We have them by the short hairs and the government is backing us up!

Bankruptcy MUST be an option, but I also think all student loans should be retroactively and from now on set to a low 1-2% interest rate, with a further discount for early pay-off. That will lower payments and give those paying on their loan a light at the end of the tunnel.

March 17th, 2015 at 10:43 am -

stan said:

Joe, how much did you borrow? To pay 700 a month since 2001 and not reduce the principle meaning you only paid interest on your loans must mean a massive balance. Did you have a car payment since 2001? How about a cell phone? Did you eat out any? Why did you not cut your lifestyle to you had money to pay back your debt? You are saying you made the minimal payment due and now are mad that you still have a balance. Why did you not pay the loan off? Did you work 80 hours a week? Get a second and maybe a third job to pay the principle off early? Nope you spent every penny you made and now you blame everybody but yourself. You are a bankers wet dream…

March 17th, 2015 at 5:33 pm -

Nichole said:

The rising cost of education is another war waging against this country. Ironically, we are at a peak in the transmission of information through the internet.

There is so much confusion about what one should do. Some of the most valuable skills are no longer taught in schools namely critical thinking. This is the only way I can reconcile how students can willing pay these inflated tuition costs instead of using the public library.

The average American has no common sense. He/she does not understand asset vs liability, un/secured debt, or collateral. We are a society that no longer understands what “ownership” is. Everything is a note or line of credit, even the dollar.

It really is a shame that there are so many people in this situation, however I do not agree that the majority of taxpayers should support a cascading default on all these student debts.

Let’s get down to the core. Deposits are actually loans that we make to the bank so they can in turn perpetuate more loans. They make more interest than we do guaranteed. Always will. Bankers made the game up and they will always win so long as we keep coming back to play. We were weak. We got distracted by all the shine things like houses, cars, and ivy league paper.

Here are 2 solutions I cannot take credit for (Im not that smart… I didn’t go to college):

1. To discharge a student loan without any changes from congress, one could save as much possible by living modest means placing all living expenses on credit cards, paying the minimum each month. Then, pay down the student loan with the cash and file bankruptcy after the student loan is paid off.

2. To deregulate the our currency for day to day transactions we could start currency clubs. We would have this new specific currency (Food coin, Auto Coin, Child Care Coin) along with dollars as a hedge against inflation and other forms of crisis. Society will look very different, but we will no longer be slaves to the banks. We will have a new game and it will be controlled by the small clubs we create. Check out the Meta-currency Project. We have the technology to do this now.

March 18th, 2015 at 6:14 pm -

Jonathan said:

By the time I got out of school in 1991, I had 22k in student loan debt and 4k in credit card debt. I got a job paying 25.6k/year. I needed a way to pay the debt off, so I looked around for second job at night and got one with a restaurant. I answered an ad in the Recycler for a roommate and moved into a house with 2 guys I didn’t know for $400/mo. In 8 months i’d paid off the credit card debt and in another year i’d paid the student loans down to 15k. I still had time to meet a girl who is still my wife. At that point my grandmother decided I was resposible enough and kicked in the remaining 15k, but I would have paid the debt off on my own in 2 more years, and I kept the night job for 4 more years to save money (quit when I got married). So, while I have sympathy for those with loans, I often wonder if they’re doing everything they can to pay the loans off. I also know a guy with a computer programming degree who ran up 30k+ in wedding expenses, filed for ch. 7 BK a few months later while out of work, and then promptly got himself a 60k/year job once the debt was discharged, so I envision a similar gaming of the system if student loans are dischargeable, despite any measures to prevent it.

March 22nd, 2015 at 10:01 am -

Ed said:

Quote: “Bankruptcy is not as easy as people think.”

For a 22 year old fresh out of college with no assets, no income, no job, no marriage, bankruptcy paperwork is pretty easy. Since the only jobs out there for them are low wage, crap jobs, it will take them 7 years to get a decent job anyway. Might as well declare bankruptcy right out of college and start with fresh clean slate.

It will be dumb if this passes. People should be held accountable for debt for life, it will force people to make better decisions.

March 25th, 2015 at 6:59 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â