Profits of doom: For-profit colleges are the resurrection of subprime mortgage lenders for the college industry.

- 3 Comment

At a time when the cost of a college education is being thoroughly questioned, there is one area we should all agree on. For-profit colleges are largely a distraction to fixing our higher education system and operate as the subprime lenders in college education. For-profit colleges claim they are trying to provide an education to those shunned from the traditional college system. But this twisted logic was also used in the subprime fiasco. What good is it giving someone a $500,000 loan on a home when they make $25,000 per year? By the time the loan unravels healthy commissions were made and the financial disaster cleanup is left to tax payers and those taking on the loan. If for-profit education was such an obvious deal, why did the industry spend $4.2 billion in marketing in 2009? For-profit colleges provide low quality education with an incredibly high sticker cost that is financed by a lifetime of student debt. If we are serious about tackling the student debt problem we need to first address the for-profit education system.

A degree in profits

For-profit colleges used to be a tiny blip in the overall educational landscape. But once deregulation kicked in, the gloves came off and it was a free for all on financial chicanery. It is no coincidence that the rise of for-profit colleges hit with the rise of subprime mortgage lending. At the core you are giving people a bad product and sticking them with a massive amount of debt. For-profit colleges now enroll over 2.4 million Americans.

Here is a clear stat on the industry: 13 percent of those attending regular community colleges take out student debt. 96 percent of those attending for-profits take on student debt.

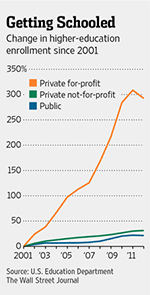

Student enrollment has gone bananas since financial deregulation kicked in:

The above chart is older and doesn’t reflect the current 2.4 million students enrolled. Why are for-profit colleges so bad? First, they provide an inferior product at a ridiculously high price. They are able to do this because students simply use federal loans to finance their education. In many cases, the student is merely a proxy to extract federal loans as revenues into the firms. Teachers get paid squat at these schools and learning outcomes are downright atrocious. Career outcomes? Greece has better employment numbers.

The typical student at a public university carries about $20,000 in debt when they graduate. Compare that to $32,700 from those graduating from for-profit colleges. And many don’t even make it to completion since attrition is radically high at these schools. The industry is designed to pull students from anywhere, including homeless people just so they can extract those juicy federal loans. And you wonder why student debt is so incredibly high?

It should come as no surprise that the for-profit segment has been the fastest growing of all colleges:

There is money to be had. And many of these schools target poorer Americans with no college education not as a way of educating the public but as a means of sucking more money out of an already financially vulnerable segment of our population.

Here is more evidence on this sham. Your regular public college spends about $7,239 on instruction per student (Source: National Center for Education Statistics). Your typical publicly traded for-profit spent $2,050. Yet many of these schools charge $20,000 per year in tuition.

So it should be no surprise that only 20 percent of those enrolled in a bachelor’s degree program at a for-profit completed their degree within four-years.

So what should be done? First, federal loan money should not be going to these schools. The money going to these schools can be better used to fund public universities and getting these students to attend schools where they will actually get a degree that is of value. Second, the student debt system needs to be re-evaluated. There is now over $1.2 trillion in student debt outstanding:

For-profit colleges are making up a big part of the subprime portion of this market. We now hear of countless cases were people are saddled with unworkable levels of debt and thanks to current laws, student debt is not dischargeable via bankruptcy. You can walk away from a home via foreclosure but not student debt. It is time we rethink how for-profits are financed. If they want to operate without federal loans, great. But to use taxpayer backed money as their bread and butter is troubling given how poor of a job they actually do in educating. There is a reason they are called for-profits.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ame said:

“The money going to these schools can be better used to fund public universities and getting these students to attend schools where they will actually get a degree that is of value.”

While I agree students deserve a degree of value, I can’t say funding public universities arbitrarily will help students to choose the traditional university format. Many of the for-profit school know their target audience have need of flexibility. They work during the day, often odd hours and can only attend classes on their schedule, not a brick and mortar’s. Those who need this sort of flexibility are duped into for-profits with the lure of the promise to work around their schedule and at their pace.

January 24th, 2015 at 10:59 am -

Stan said:

Want to fix this? End the federal governments role in all financial aid. No more loans to people who will never pay the money back. These profit schools would have to stand on their merit to attract students. And for all colleges the cost would fall…

January 26th, 2015 at 8:53 am -

maurice carey said:

For-profit colleges, universally on-line, are a dreg on taxpayers, since they always want to tap in on federal loan guarantees. They abandon the hapless student to a lifetime of arduous debt payments. There is no control over their fees nor are there realistic safeguards to insure a quality education leading to a good-paying job and career. Federal loan guarantees are inappropriate for these vultures.

July 16th, 2019 at 2:50 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â