The focus on 401ks has destroyed the retirement for millions of Americans over the last generation.

- 9 Comment

Over the last generation there has been a shift from pensions to do it yourself 401k plans. The idea was pitched during a time when the stock market was in a bull run and Wall Street was excited to open up additional streams of revenue. But now a generation later, the results are rather clear. The 401k has simply not lived up to the promise for millions of Americans. Where pensions had a forced saving mechanism, the 401k with absurd fees, buffet style choices, and complicated structures simply kept many Americans out of the system from investing. This also meant decades of lost compounding and now that millions are entering retirement, they are looking at paltry nest eggs. How did the 401k destroy retirement for millions of Americans?

The 401k fantasy versus reality

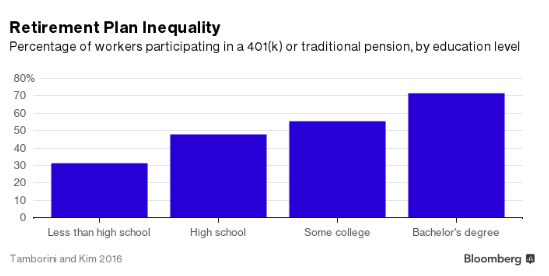

The big advantage of traditional pensions was that it was automatic. People had a set amount yanked out and it was managed by professionals. Most had to participate in this plan and in the end, it allowed for a nice amount to accumulate. But the 401k was opt-in for many and the litany of options left many Americans out in the dark. The results are terrible especially for Americans with less education:

For those with less than a high school education, about 30 percent participate in a 401k or pension. For those with a high school education, it rises to near 50 percent. But keep in mind that most Americans do not have a college degree. And many that do get a college degree are then in a position of being mired in deep student debt.

The problem is that as a working career ends, the chance to save money becomes more difficult as costs rise in areas like healthcare. Social Security has become the default backup and the primary source of retirement income for millions of Americans.

Here are some figures:

1980:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 38 percent of private sector had a pension

19 percent had a 401k

Today:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 15 percent of private sector have a pension

43 percent have a 401k

This shift has resulted in many Americans being completely ill prepared for retirement. During a record stock market run from the 1980s to today, many Americans don’t even own one stock. The typical 401k for those that actually have one is ridiculously low. This is why many people are now on the new retirement model: working until you die.

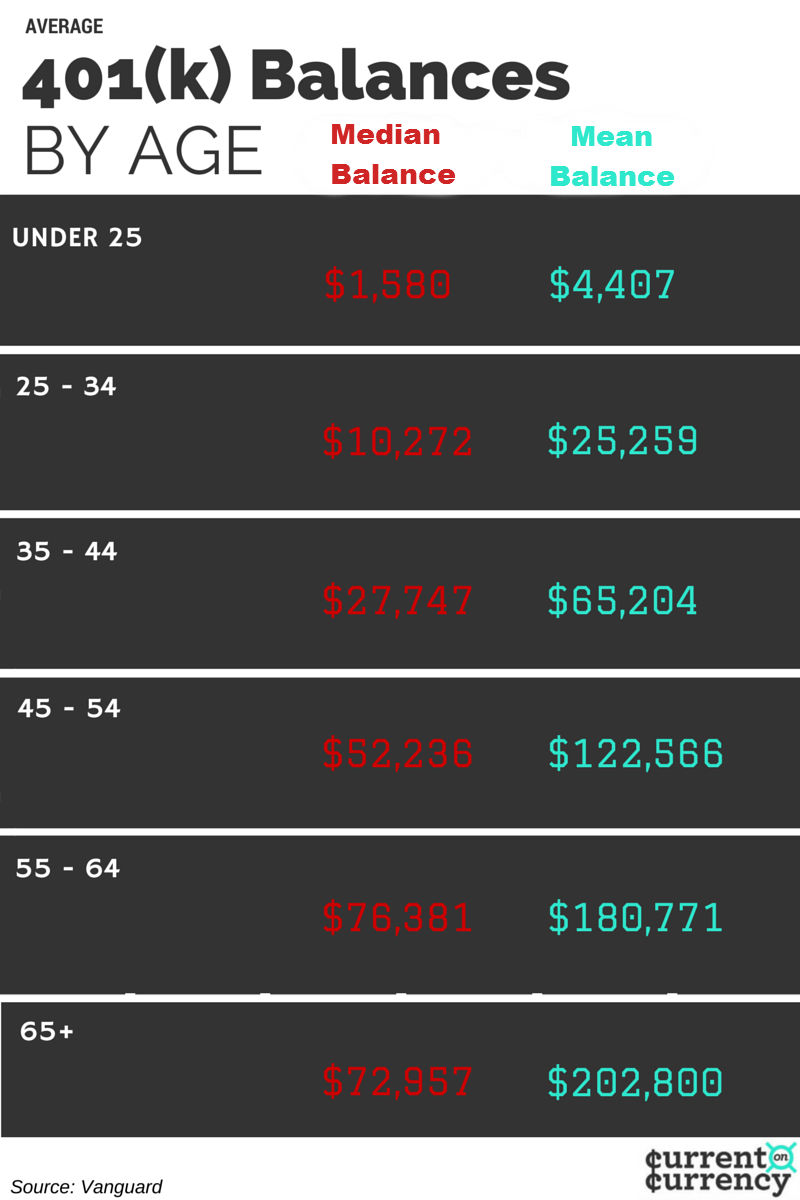

So set aside that most don’t even have a 401k. How are people doing when they do have a 401k?

The median amount for those 55 to 64 is $76,381. That is not much when you consider one health problem in the hospital for a few days can wipe out that entire amount in one swing. And keep in mind the above table is for people that actually utilize the 401k which is a minority.

In the end, the 401k simply did not have the intended impact and people would have been better off with a pension like forced savings.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Scott said:

No I disagree with your conclusion. People need to take responsibility for their own retirement. Pentions bleed out company profits and even force company’s into precarious positions, sometimes to restructuring or closing its doors.

I say no to Pentions but increase the salary of employees and encourage employees to get an investment education. You can learn if you have the desire.

When employees retire the company should not have to keep sending them money. However if they were wise with there resources they might be able to leave earlier than planned and give someone else an opportunity for work.August 28th, 2016 at 5:07 am -

laura m. said:

He retired with just over 200,000 in a 401, along w/military pension for E-7 20 yrs in svc. I saved on my own (spouse) as self employed put money in /c.D.’s and gov. I bonds. He retired in June 2004 at 62. We live modestly, simple and traveled much when younger, people don’t save like they should. Parents don’t instill values like they used to in their children.

August 28th, 2016 at 6:24 am -

droubal said:

Most defined benefit plans are underfunded.

Unfortunately, underfunded defined benefit plans will not do much better than 401k accounts.Big municipal plans are at greates risk. Watch Chicago, they are doomed to fail.

August 28th, 2016 at 6:55 am -

BIG JIM IRON WORKER said:

I started having custom work boots made due to a wide foot. After my 3rd pair I ended up talking with the boot maker and I stated I like his boots and it is worth the extra price as they last longer than any other boot I have used in the past.

I continued to state that when I wore Timberlands my feet would STINK>>>>BAD. He proceeded to tell me that the corporate manufacturers decided that they would use swine skin to cut costs. These pigs are not even fit for eating he stated.

He continued to explain that the pigs hormones mix with yours in the boot and produce that “Garbage Smell”. I said “exactly” it smells like garbage! My feet don’t smell like that. He stated that pig and human hormones don’t mix.

In his cow leather boots it always smells like leather until they have served their useful life.

Corporate boot makers have descended into making you pay premium money for pig feet.

Pay the extra money for well designed stitched soles (not liquid nail glued) and long lasting leather workwear.

You also employ your fellow American

August 28th, 2016 at 8:05 am -

Paul said:

The problem is that the last 22 years of absurdly low interest rates and inflation that is not counted. All savings have been robbed of purchaseing power. Forceing people to take absurd risks with funds.

August 30th, 2016 at 5:14 pm -

Icarus said:

Let’s face it. 401k’s were doomed to failure from the start. The big moneyied interests benefited from their introduction, NOT the common man. Companies benefited because they unloaded expensive pension liabilities, and Wall Street because they could make a fortune managing the sheeples money. The big money wins this contest every time. 401k’s were doomed to fail for one simple reason: A pension plan only has to save for the AVERAGE life expectancy. When you go 401k, everyone has to save like they will live to 95…because they might. The Pooled actuarial death age of defined pension plans made the money required for pensions a lot less than then the pooled assets required when you add up 401K’s. Now throw in DECADES of zero interest rates and no compounding, and Houston we have a problem. Retirement for the masses is now officially over. Those days are gone………….

September 1st, 2016 at 7:44 am -

David Krenshaw said:

Defined Benefit Plans (traditional pensions) work better because they can run for years being underfunded and nobody figures it out until it’s too late and the company eventually then just dumps it onto the PBGC (i.e., taxpayers’ back). This is the story with most municipal pensions right now.

With a 401(k) (Defined Contribution Plan) it’s more difficult to conceal the lie.September 1st, 2016 at 9:42 am -

Jon said:

@Scott (Walker presumably)

So many people fought, and in some cases died for workers rights, including the right to form unions, and collectively bargain

https://www.unionplus.org/about/labor-unions/36-reasons-thank-union

September 1st, 2016 at 3:19 pm -

Don Levit said:

Icarus

You are exactly right about the pooling effect of defined benefit plans

We are using similar actuarials for our non insurance funding vehicle which pre funds first dollar medical benefits to cover deductibkes and out of pocket expenses

If a cash based product like a Health Savings Account, a small fixed interest rate is credited monthly

Instead we build IRS code section 213(d) medical dollars which are pooled based primarily on the 80-20 rule: 20 percent of the people account for 80 percent of the claims

This allows us to credit an increasing multiple each month

Account balances double in 35 months, less claims paidSeptember 2nd, 2016 at 2:19 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â