The increasing odds that you will die working: The extinction of retirement and the growing old age labor force.

- 13 Comment

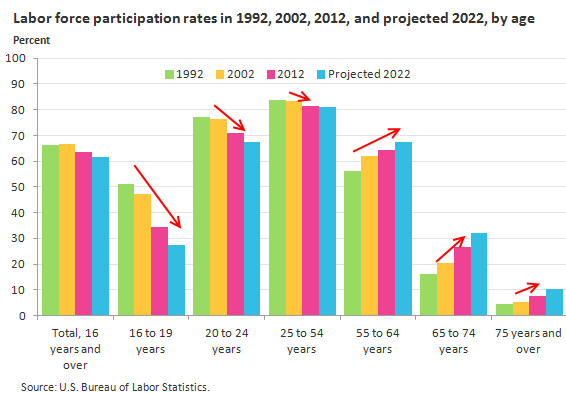

I was greeted by an older gentleman at a local Target store. He slowly smiled and said hello. I nodded and said hello as he proceeded to greet other shoppers. Leaving the store I was greeted by an older cashier. Over the last decade, the retail labor force is seeing a growing number of older Americans. Many don’t envision retirement as working in a low-wage job but that is simply the way of life for many. The BLS estimates that labor force participation rate for those 65 to 74 years of age is going to increase to 31.9 percent in 2022. That is an incredibly high number of older Americans eligible for Social Security still working in the labor force. This is happening as younger Americans make up a smaller portion of the labor force and as many more Americans enter into college. Yet one thing that is rarely discussed is that many older Americans are going to work until they die out of necessity. Not a few. Not a couple. A large portion of older Americans are working deep into old age because they can’t afford to retire.

Working into the grave

The idea of having a long-term retirement of doing nothing aside from sipping margaritas is a relatively new notion. It is a notion that grew out of the post-World War II economic boom and was quickly subverted by the mutual fund idolization that started in the early 1980s to phase out pensions. The cumulative end result is that many Americans were sold the dream but very few have access to this vision.

Take a look at participation rates for various age groups:

Source:Â BLS

This is a big change. In 2002 20 percent of those 65 to 74 participated in the labor force. The trend is only heading up and it certainly isn’t because Americans are suddenly in a better financial position. It is interesting that the trend for younger workers is the opposite. You would expect that teenagers would hold retail jobs for experience but that is not the case.

“(Harper’s) Aging isn’t what it used to be. In an era of disappearing pensions, wage stagnation, and widespread foreclosures, Americans are working longer and leaning more heavily than ever on Social Security, a program designed to supplement (rather than fully fund) retirement. For many, surviving the golden years now requires creative lifestyle adjustments. And for those riding the economy’s outermost edge, adaptation may now mean giving up what full-time RV dwellers call “stick houses†to hit the road and seek work.â€

This decline in old age income security is also seen on how many elderly Americans fully depend on Social Security. The eradication of pensions and low wages has slowly created this crisis with older Americans:

“That means no rest for the aging. Nearly 7.7 million Americans sixty-five and older were still employed last year, up 60 percent from a decade earlier. And while 71 percent of Americans aged fifty to sixty-five envision retirement as “a time of leisure,†according to a recent AARP survey, only 17 percent anticipate that they won’t work at all in their later years.â€

In other words many older Americans are going to be working into their retirement years instead of sipping exotic drinks on the beach as those Wall Street backed mutual funds had led many to believe. What are you going to save when the cost of living is out stripping any stagnant wages? This “recovery†has been very painful for working and middle class Americans. The notion that simply hitting 65 means you will be ready to retire is a giant mirage. Many are hitting 65 and realizing they are going to have to work for many more years. The trend is rather clear and it isn’t pointing to a life of leisure and golf.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!13 Comments on this post

Trackbacks

-

BillK said:

But that is the way pensions were originally set up.

In the UK, government pensions from age 65 for men started in 1948.

In 1948 the UK life expectancy for men was 66 years. So it was fundamental to the government pension scheme that for the majority of men retirement would be a very short time. Otherwise the scheme would have been unaffordable.Longer life expectancy has led to people expecting to receive a longer ‘free ride’ retirement pension from the government. Belatedly, governments are realizing that they can’t afford this and are starting to increase the retirement age. But too little, too late.

September 24th, 2015 at 12:38 am -

Mike Callahan said:

The increasing odds that you will die working? Tell me something I don’t know.

September 24th, 2015 at 7:22 am -

Rascal said:

That projected labor participation rate for 2022 is scary. Today’s sixth graders and older are in this category.

The graph tells me that the current lack of jobs suitable for raising a family upon are not projected to come back even by 2022.

The people taking the low wage jobs that are created use that to supplement the money they have accumulated through their working lifetimes, as well as any social security they get. For them, a low wage job makes ends meet (if they’re lucky).

But those new to the working world for the next seven years are screwed. 🙁

This reminds me of Harry Dent’s book. He uses demographics to predict things and it looks like he’s right on this.

September 24th, 2015 at 4:23 pm -

Rascal said:

Has anyone noticed the latest commercials targeting seniors regarding reverse mortgages? There’s this educated-looking man speaking about how he “thought he knew” what a reverse mortgage was, and how he discovered he had old information, etc. etc.

Just a guess, but this is the wave of the future.

September 24th, 2015 at 4:31 pm -

Puckles said:

Quite frankly, that is my situation, but primarily by choice. What the devil is one supposed to do with oneself after a lifetime of work, play tiddllywinks? Shuffleboard? Golf? Yuck. I can’t fathom a retirement such as that endured by my grandparents. I have transitioned to something a bit less demanding overall, although admittedly I have less free time. But that’ts OK. The difference in stress is worth it.

September 24th, 2015 at 4:33 pm -

Roddy6667 said:

In America, at Pratt & Whitney, a large aircraft engine manufacturer, retirement was generous. You had Social Security and a very good pension after retiring from a good paying job. However, it was called the “Eighteen And Out Club”. The average retiree died in a year and a half. It’s easy to promise a high monthly check when it won’t be for very long.

September 26th, 2015 at 8:35 am -

Hildegard said:

Reverse mortgages were invented by banksters to try to keep you from handing off a paid-for house to your child. That child wouldn’t be a very good debt slave.

September 27th, 2015 at 2:12 am -

William Ripskull said:

Old age financial security will continue to be a fantasy as long as the Fed and US government destroy the dollar faster than people’s incomes and investments rise. Literally, 20 years ago you could count on $1Million producing $50K of low-risk income per year, and $50K was a livable salary. Today, with that same $1Million would earn you less than $1K of low-risk income, which amounts to less than $12K of annual income, equivalent to working full-time at $6/hr, less than today’s minimum wage. With the way the value of the dollar has been debased in the last 20 years, you would even struggle today if you could earn the $50K.

September 27th, 2015 at 10:28 am -

Jack said:

Much of your comments are correct, but, a lot is also very incorrect. I am 73 years old and retired. I retired at 65 from medicine. I do not play golf, bridge, tennis, go fishing, volunteer ( a very good reason and another story) or travel ( without my wife). Said wife is 10 tears younger and loves teaching kindergarten.

I work 20 hours a week– Mon-Thur 7 am til noon. Why? Boredom! We cancelled cable because we had 200 channels of crap. I watch the Weather Channel, PBS, History and Speed Channels. Cancelled because I can get all this with our Roku box and Netflix.

Try working all of your life and then STOP. Sure I am happy, have great health, 6+++ figure income, 2 homes, etc. I make less than $10/ hr. So don’t be so snide in your comments. Many of the people I work with are in their 80s and even 90s. Money is not NECESSARILY the reason we work– it is the loneliness during the day or perhaps being a widow or widower that we work. It keeps us sane and needed.September 27th, 2015 at 1:22 pm -

Slvrizgold said:

That’s right William. If you want to save better do it with silver and gold and not dollars, which are just worthless govt paper.

September 28th, 2015 at 1:16 am -

laura m. said:

The older ones (unless self employed) need to retire from the work force so younger generation can fill these jobs. Greedy old geezers never seem to get enough…how much is enough for them anyway, they spend and don’t save. Give the younger folks a chance and go back to mandatory retirement age at 65. He retired at 62, have a 401k and put the max in. We live conservative, yet have what we need. We don’t buy on a whim or change furniture every few years either. We chose to be childfree as both of us worked and kids cost a bunch.

September 28th, 2015 at 6:56 am -

Chris said:

I’m going to run counter here and say that only those who choose to remain ignorant about personal finance / don’t take charge of their situation will remain in poverty in America. I’m a citizen and everywhere I look I see people buying trucks that cost more than their salary, houses too expensive, credit card bills paid only at the minimum, etc. Enough claiming these people are victims. This is the result of their own choices.

It’s not statistically reasonable that everyone just barely doesn’t make enough… please stop contributing to the fallacy that people aren’t responsible for their own situations. This kind of “it’s not your fault, you’re a victim” enables the masses to continue to avoid taking responsibility.

And, yes, of course some people have bad things happen. I’m painting with a broad stroke here so please do the same.

April 10th, 2016 at 12:49 pm -

deimos said:

I guess I was lucky to have grandparents that reared children in the Depression and told me about that time. My parents also talked about it a lot. After 20 years of hearing “save your money, don’t go into debt, pay cash as much as possible” the lessons sunk in. We lived our lives simply, didn’t fritter away money on stupid crap, ate at home and lead a healthy life style. We saved hard and invested carefully so now two years from now I will retire with about $1.1 million, more than enough to live on forever since we have the habits of frugality. It’s not rocket science but if anyone wants sympathy about not doing the right thing, it’s in the dictionary right after shit and suicide.

February 11th, 2017 at 8:07 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â