Social Security supports 1 out of every 5 Americans: Most retirees heavily depend on Social Security for their retirement income.

- 2 Comment

It is great that people overall are living longer but adding years to your life can get costly. Retirement can be a long time. For some, retirement can last as long as their working career. With a pension people didn’t have to worry about longevity as if this was a bad thing. Yet pensions are rare in our current low wage environment. Social Security has become the backbone of income for millions of retirees. Numbers can be daunting but as I dug deep into the Social Security figures, we now have more than 64 million Americans receiving some form of Social Security. In other words, 1 out of 5 Americans is receiving funds from a system that heavily relies on those actually working. The challenge is now emerging where many young Americans are being pushed into low wage jobs while older Americans scrimp by on their monthly benefit payment. Things work until they don’t and math eventually catches up.

The Social Security system is facing some strain

You usually hear about people kicking the can down the road when it comes to Social Security. Since the problem seems so far away, they simply choose to ignore it. The problem however is that this is the primary source of income for many of our older citizens. When the problems do hit, it is going to be the equivalent of millions of people losing their jobs if benefits need to be adjusted.

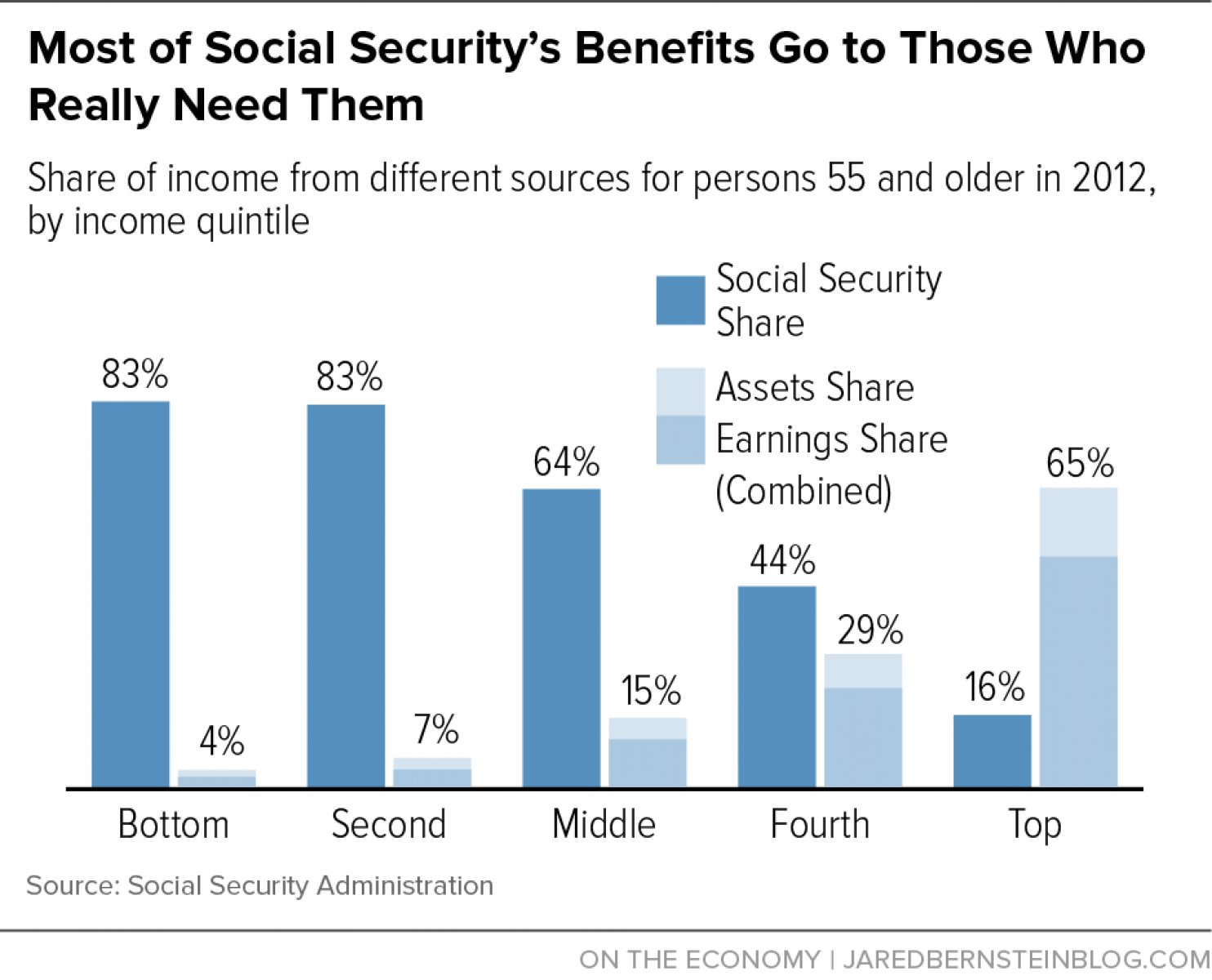

Take a look at how heavily older Americans rely on the Social Security system:

Is the system working? Sure, if you mean that today payments are going out. But Social Security was never intended to be the main source of income for many Americans. For nearly half of retirees, Social Security is their retirement plan. As you can see from the above chart, many older Americans heavily rely on Social Security into old age.

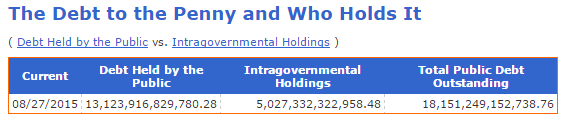

The retirement system was designed for Americans to rely on three main sources for retirement income: Pensions, 401ks, and finally Social Security. As we’ve noted, half of Americans don’t even own one single stock. Pensions are going the way of the dinosaurs. So for many, Social Security is the one item left standing. Yet this system relies heavily on the currently working. I usually get people talking about how we have funds stashed away but if you haven’t noticed, we are in giant debt:

Source:Â US Treasury

The US owes $18.15 trillion and this number just keeps going up. We are simply borrowing into our future. People will then say that we have the Fed and that they can print as much as they want. Well guess what? That is exactly what we are doing and you are seeing the big inflation hitting in big ticket items like housing and college tuition but of course, much of this is hidden from the consumer.

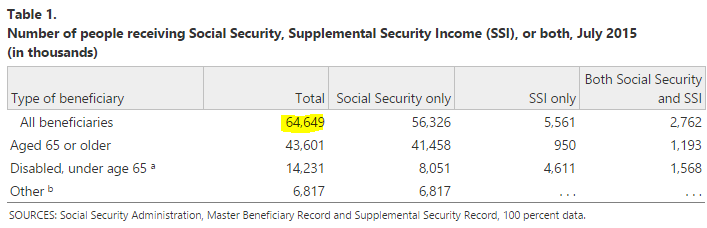

However you slice it we have a lot of Americans depending on Social Security:

Source:Â SSA

And with 10,000 baby boomers hitting retirement age every day, this number is only going to boom. What can be done? Well you really have three options:

-1. Do nothing. Basically our current course forward and amounts to kicking the can down the road.

-2. Cut benefits. If you don’t have enough you need to pullback. Good luck getting this to pass.

-3. Raise taxes. You can raise taxes. Good luck on getting this to pass.

This is really all you have. You already see the economy starting to contract realizing that something is amiss in the market. You have central banks all pursuing similar strategies and industrialized nations are seeing major challenges with having a good portion of their population being older people. These are modern day problems. Even the US has 1 out of 5 Americans depending on Social Security. This is why we have coined the adage that the new retirement means working forever.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

2 Comments on this post

Trackbacks

-

Securing Social Security said:

Everyone acts like this is such a mystery. Lift the cap of social security contributions and Medicare to the first $250K, or don’t even limit it with a cap at all. Problem solved.

What other taxes have a cap on them?

August 31st, 2015 at 11:30 am -

Rascal said:

We have another option. Immigration of new workers to America who contribute.

I know many think immigrants come only to take, but many come to contribute and that is good for America and it’s SS beneficiaries. America NEEDS new workers. But how to get new jobs FOR those workers; that is the question.

Social Security was meant to be a supplement to pensions, etc. The problem is, when workers were forced to have their paychecks docked for SS, they often had to cut back on savings, buying appreciable assets and stock. They became dependent upon their future SS earnings and any pension their company may have provided.

Those who had a future pension to rely upon, thought things looked really bright. Not only did they have the good ol’ company looking out for them in retirement, they also had the government. Some actually got this sweet deal. And the gold watch for thirty years of loyal service!

Soon, companies realized they no longer HAD to offer pensions because the government was now the new pension dispenser.

Now many senior citizens are left with only paltry pensions (if any) and their SS benefit.

This seems to be the way things go when new money is supposedly to be doled out.

Case in point: The State Lotteries

How many lotteries were sold to voters as a way to give more to schools? When the lotteries were voted in and the cash started to flow, suddenly the same amount in funds set aside in the state budget for schools dried up. (After all, they have so much coming in from the lottery, why do they need full funding from the state when that money could go instead to something else? Like a new stadium, for instance. Goodness knows, we need more of those.)

Kids and Seniors deserve to be supported. They depend upon able-bodied working adults to do so. We have been failing miserably and will pay the price.

Perhaps American kids who are getting short-changed by school budgets would, if they could only get a decent education, bring new life to American industry and thus contribute to job opportunities for the world. If we don’t change, foreign talent someday will not find competitive career opportunities in America unless they bring them over, and so will take their taxable income to other countries. (This is assuming America will have a “friendly” environment in which to establish new industry in the first place…another can of worms!)

So we come full-circle, don’t we?

September 1st, 2015 at 1:56 pm