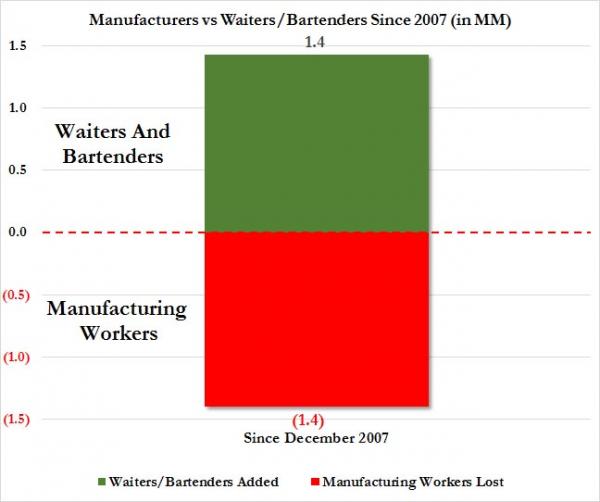

Trends in low wage America: 1.4 million waiter/bartender jobs gained while 1.4 million manufacturing jobs lost since 2007. Top 4 employment sectors pay $10 an hour or less.

- 1 Comment

The media pundits are scratching their heads as to why two political outsiders are garnering all the attention. You want to know why? Both are addressing the low wage epidemic plaguing the country. Now we can debate their policies since both stand at the extreme opposite ends of the spectrum but their message is clear – the reason you are going broke is because of the way things are and the deep capture of the financial status quo. And when we look at data, the trend is unmistakable. For example, since 2007 we have lost 1.4 million manufacturing jobs. During this same period, we have added 1.4 million waiter/bartender jobs. It is really no surprise that our top 4 employment sectors in the US pay $10 an hour or less. Keep in mind that with talks of the minimum wage being pushed up to $15 an hour, all of these employment sectors will be impacted. We are still seeing a dramatic growth in low wage jobs across this country. It also doesn’t help that true inflation is hitting people directly in their slimmed down wallets.

The service economy

It shouldn’t come as a shock that we continue to expand on the service sector jobs since these are positions that can’t be outsourced. But how many college graduates can we have working at Chipotle or Starbucks? It would be one thing if these positions were staffed by older teenagers or those going to college to earn a little extra to pay the bills. It is another thing when graduates are working here in the millions trying to get by.

Since 2007 we’ve added 1.4 million waiter/bartender jobs while losing 1.4 million manufacturing jobs:

I’m not sure if this is the kind of job growth we are looking for. Yet this is another reason why wages overall are stagnant across this nation. We’ve gone into great detail regarding inflation since the BLS data continues to show only modest movement when in reality, people are dealing with big price changes in the things that matter like housing, cars, college, and healthcare.

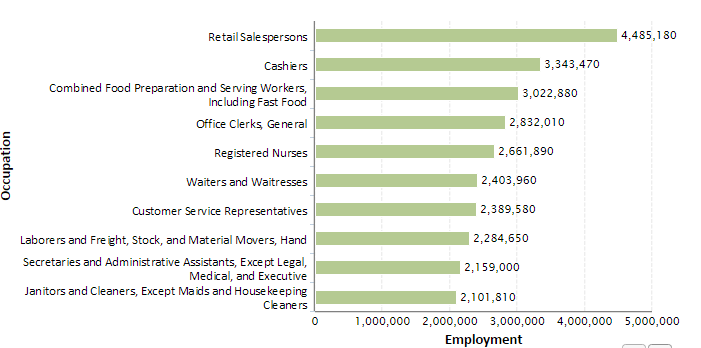

The top 4 employment sectors in the US pay less than $10 per hour:

If the minimum wage is boosted to $15 per hour, it will impact all of these positions. Now keep in mind these are industries where profit margins are low. So guess what? Costs are likely going to rise. If we are truly talking about reform we need to address the crony capitalist movement with their entrenched interests with the banks.

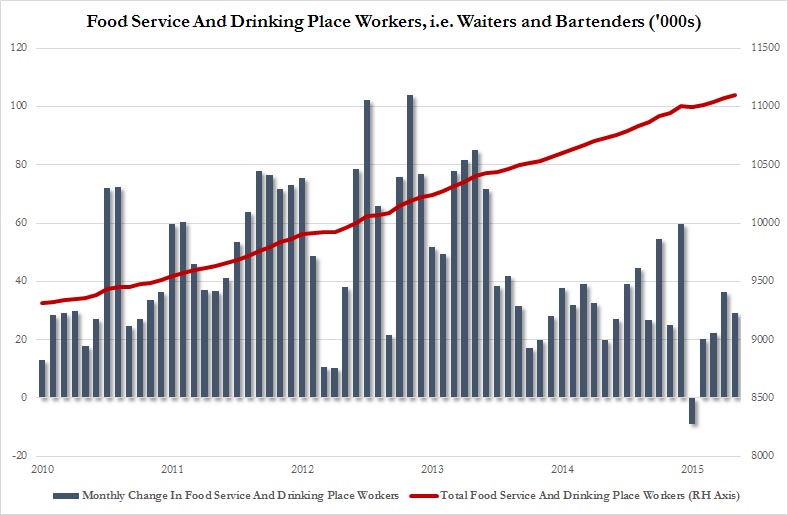

The growth in waiter/bartender jobs has been excellent:

Is this really what we want to see? Not exactly especially since our manufacturing sector continues to come apart. These were skilled and higher paying jobs. They are now being replaced by jobs with no benefits and little pay.

We are also seeing signs creeping into the economy of a slowdown. Take a look at inventories:

Inventories are building up meaning businesses are miscalculating the true demand in the market. The last time inventories shot up this high was in 2008 leading into the Great Recession. Now that the stock market is slowing down to reality, there is likely to be an adjustment in the system.

Bartenders for manufacturing jobs. This isn’t really the idea of a recovery when people think about it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Klemmster said:

The economy is really doing good when 1.4 bartenders and servers jobs are added as folks now have money to wine and dine and entertainment activities.

August 12th, 2015 at 6:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â