Census data shows a record 46.7 million Americans live in poverty. Over 40,000 dollar stores now permeate the United States.

- 2 Comment

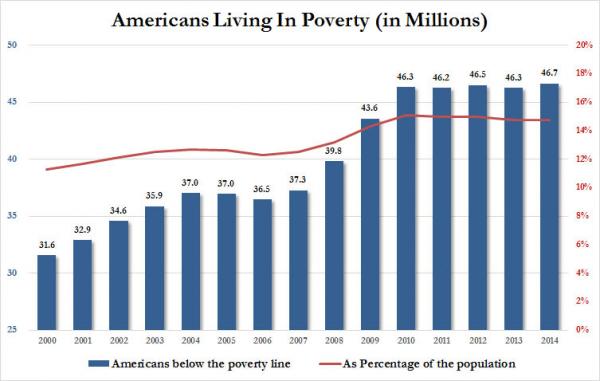

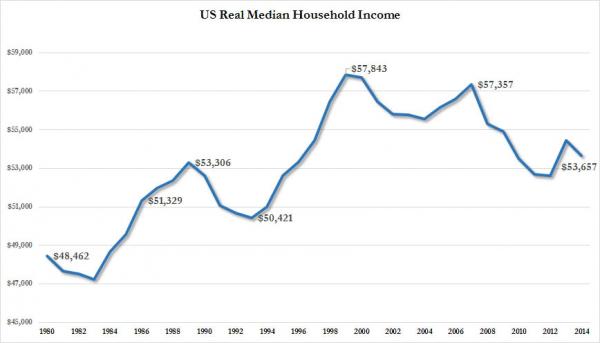

Census data is always released in September for the previous year. As far as comprehensive data goes the Census is one of the best measures that we have. The latest Census figures merely reflect an economy that is crushing the American Dream. It also helps to highlight why so many people have profound doubts regarding this so-called recovery. The latest Census figures show that a record number of Americans now live in poverty. The total number of Americans living in poverty is 46.7 million. We also have a large number of Americans working in low-wage jobs and being perilously close to being in poverty. This is not what people have in mind when we talk about a recovery. The problem, of course, is the financialization of the system where a massive bull run in stocks simply went to consolidated wealth into fewer hands. Big banks got bigger while household income reverted back to where it was in 1989.

A record number of Americans are in poverty

The annual Census data did not reveal a broad base recovery. What it did reveal was that we now have a record number of Americans in poverty. 46.7 million Americans live in financial poverty and struggle to get by on a day-to-day basis. What is even more troubling is you have a large number of Americans living in poverty that actually work. Many of these people are stuck in low-wage jobs and are what we consider the working poor.

If you look at the trend, it doesn’t really look like a recovery for many Americans:

Making the connection with the mega student debt bubble, there is now a record number of people with a bachelor’s degree in poverty. This number rose from 3 million to 3.4 million over the last year.

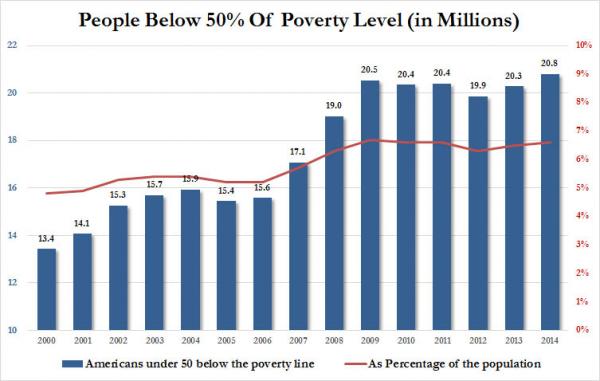

The number of Americans living in extreme poverty also rose:

Extreme poverty is measured by looking at those in poverty at the middle mark and below (those making 50 percent or less the defined poverty line in the sand). It is hard for some in the media to imagine how challenging it is to live in poverty let alone 46.7 million Americans. Yet those are the numbers.

Inflation has had an impact on the way people live. Adjusting for inflation household income is now back to where it was in 1989:

Things cost more but people are simply not earning enough to cover the increase. So what do they do? They go deeper into debt to purchase homes, attend college, and purchase cars. We are now back to seeing subprime lending increase as creditworthy customers tap out of the market and financiers seek out other avenues for profit.

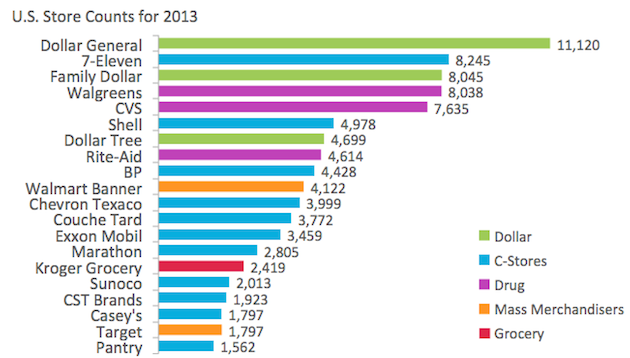

Are we surprised that a record number of Americans are in poverty? No. All we need to do is look at the record number of dollar stores throughout the country. In fact we have over 40,000 dollar stores across the US:

One thing that was prevalent in the last decade as we went through the crisis is how many dollar stores suddenly started selling a large amount of food. It should be no surprise that 46 million Americans are on food stamps as well so these stores have done exceedingly well since the crisis hit since all of a sudden there are millions of new customers.

The Census data is abundantly clear and offers a counter-narrative to the recovery based on easy Fed money that flowed into the stock market. First, half the country doesn’t even own one stock. Second, half of the nation doesn’t have any savings. More to the point, we have 46.7 million Americans simply trying to keep food on the table. Does this sound like a recovery? Who really got bailed out here?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Uncle Frank said:

In terms of types of financial wealth, the top one percent of households have 35% of all privately held stock, 64.4% of financial securities, and 62.4% of business equity. The top ten percent have 81% to 94% of stocks, bonds, trust funds, and business equity, and almost 80% of non-home real estate. Since financial wealth is what counts as far as the control of income-producing assets, we can say that just 10% of the people own the United States of America.

http://www2.ucsc.edu/whorulesamerica/power/wealth.htmlSeptember 21st, 2015 at 6:26 am -

Rachel said:

What irritates me is the large number of uniformed people, educated and not, who simply say getting a job or getting an education are the ways “out” of poverty. Many people in poverty are educated if not actual college professors (yes, some of them are collecting food stamps and more) and those who are among the working poor are often not be able to afford college, let alone go to college and work one, two, or more jobs simultaneously. It really is a stark contrast between the haves and have nots.

September 22nd, 2015 at 1:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â