The American Dream deferred: Looking at the 4 horsemen of middle class destruction. Student debt, household income, low wage jobs, and FIRE economy dominance.

- 4 Comment

The angst that is being manifested in the political arena is largely being brought on by economic uncertainty. There is a general underlying anxiety of living in a United States with a weakened and invisible middle class. We are heading directly into that scenario with both eyes fully wide open. Many of the new jobs added since the Great Recession ended have come in the form of low wage employment. Low wage jobs are largely made up by lower wages of course but also, a lack of employment security and rising healthcare costs are forcing families to shoulder a larger financial burden as employers shift costs directly onto them. The problem with rising costs is reflected by stagnant income growth for households. Adjusting for inflation, American families are making what they did in the 1980s. Our young workers looking for better opportunities go to college but then leave with an insurmountable level of student loans. This debt burden delays household formation and puts a clamp on consumer spending. Finally, it would seem for the last couple of decades, the only segment of the economy thriving is that of the financial and banking sector. In other words, the American Dream that once rewarded hard work in mass is becoming a mere mirage in the midst of crony capitalism and financial speculation.

Young struggling with student debt

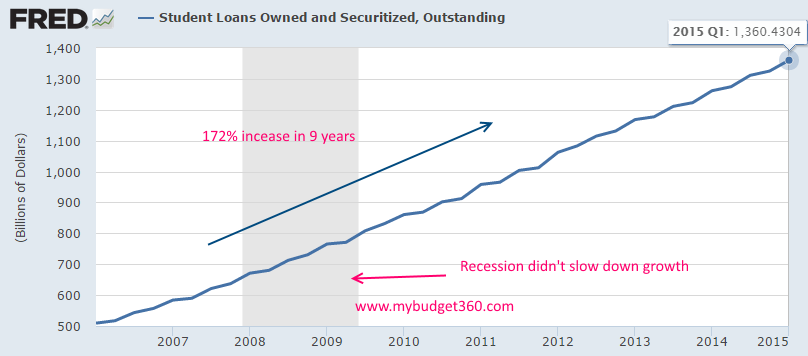

It is no exaggeration but we have a crisis when it comes to student debt. Total outstanding student debt is now up to $1.36 trillion. This figure should seem high to you because it is. Student debt now makes up the largest non-mortgage consumer debt. Young Americans between 18 and 22 are saddled with backbreaking debt before they even start their working life. And many are finding work in lower wage jobs.

Just take a look at the growth in student debt:

In the last 9 years alone student debt has risen by 172%. We went from $500 billion outstanding to $1.36 trillion. This is not a healthy trajectory. And we now know that 7 million students in debt are simply not making payments. And then we wonder why younger Americans are not buying homes, a symbol of what used to be the American Dream.

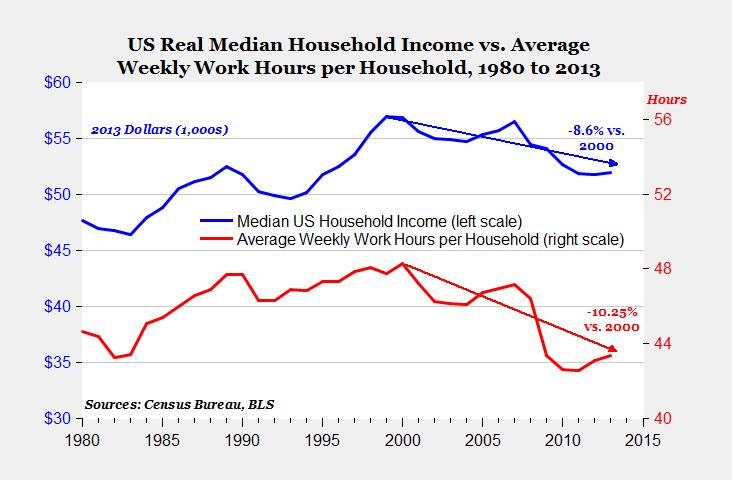

Stagnant household income

Household income is the best indicator of a rising standard of living. However household income adjusting for inflation is back to levels last seen in the 1980s:

There are numerous reasons for why this is happening. Unfortunately the financial system bailouts largely went to protect the financier class in the United States while punishing American families. While millions were losing their homes through the foreclosure process banks were receiving billions of dollars to maintain the status quo until they could polish up their balance sheets. What was afforded to the banks was not afforded to American workers. The end result is a deeper and more entrenchment financial power base while American families struggle. And you can see how the game works: any big ticket purchase now requires a big debt burden which of course is financed by the FIRE system – college, housing, and cars. The days of diligently saving to purchase one of these items is largely going away.

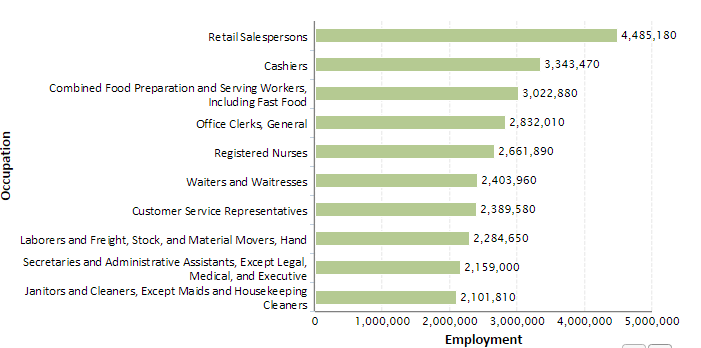

Low wage jobs

Many of the new jobs added since the recession ended have come in the form of low wage jobs:

The top four employment sectors in the US pay less than $10 per hour. With all the talk of making the minimum wage $15 per hour, what do you think will happen in these industries? Costs are simply going to be pushed onto consumers. In other words already bad inflation is going to get worse. If you believe BLS inflation figures, we don’t have much of an issue with inflation. Did you just see the chart on college debt? Does a 172% increase in student debt seem like a moderate amount? Does the household income chart look positive?

More and more Americans are working in low wage jobs with little job security. That is why for many retirement looks like working until you die. There is one segment of the economy that is doing well however.

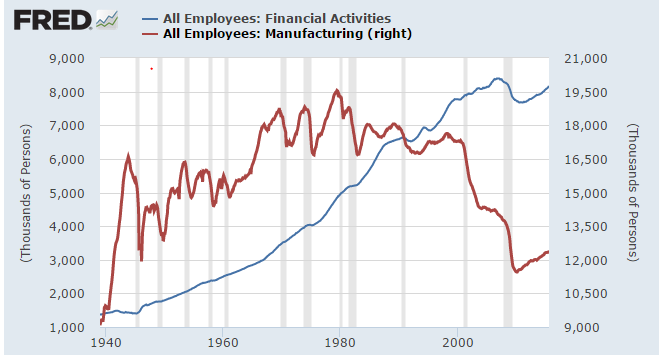

FIRE economy dominance

We have massively increased the number of workers employed by the financial system while completely obliterating those in the manufacturing sector:

We went from having 1 million workers in the FIRE sector of the economy in 1940 up to over 8 million today. Manufacturing went from 9 million to a peak of 19.5 million in 1980 all the way down to 12.3 million today. In essence we have 7 million fewer manufacturing workers today than we did in 1980. Conversely, we have 7 million more working in the FIRE sector of the economy since 1940. Yet many of these jobs simply serve to grease the wheels of a new rentier class. For example, with the bailouts and low rates many banks and hedge funds purchased single family homes in order to turn them into rentals. Single family homes are the number one item for net worth growth for most households. So what you had happening is banks subsidized by bailouts and Fed policy crowded out regular families from the one item where most people build wealth.

It is rather clear that the American Dream is being deferred if not outright eliminated for many families. This is why 2016 is going to be an election dominated by middle class issues. The question to be addressed is how much influence money will have on the overall population.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Larry said:

Student loans emulate young fathers who owe huge amounts of child support…

September 13th, 2015 at 7:39 am -

robert siddell said:

When the PIIGS and Japan fall like Greece, then England, Germany the USA and BRICS will all be forced by the depression to take the next step down; then businesses will have to lay off more workers in retail, restaurants, offices, etc, and the dreams deferred will become like the desperation of the people left in the paths of Sherman’s and Sheridan’s Union Armies. For hundreds of years the modern world progressed until the greedy Elite created fiat money and became like Monopoly player banksters with unlimited money to burn the candle at both ends and the middle buying everything until all the other players were bankrupt slaves.

September 13th, 2015 at 1:22 pm -

Opiner said:

I have really enjoyed your writings over the years. Thank you for keeping these important points in our thoughts. Here are a few of my observations and opinions.

The computer has changed everything. They opened up the world to competition amongst each other and other nations. The American Worker will never be the same as our father’s generation knew it. The days of getting out of high school and going to work for the local factory and making a middle income lifestyle is gone and won’t be coming back. Don’t even pine for it. The corporations will go where they can get the best return for their investment and profit.

Computerization, mechanization, automation, and robotization has impacted all jobs. Even eliminated many of them. Those jobs are not coming back. Every time you use the self-checkout at the supermarket or big box store, you are helping eliminating a job. A lot of times these days you have little choice unless you want to wait for the few just-in-time workers to check you out. When you order on-line, you are contributing to fostering automation and eliminating a brick and mortar job in your home town. People are going to continue ordering on-line. There’s no use fighting it.

The government has made it much more difficult to start and open a business because of regulations. It’s near impossible to get rid of those regulations once enacted as many have been imposed because of safety reasons. Those will remain. The corporations have also made it harder to compete against them. They have bought the legislators and have made things so that they are in a better position to compete. Without taking money out of politics, that’s not going to change. And good luck with that. By the way, the President of the US has very little power. They appoint the cabinet members who are usually the most knowledgeable in their fields so they will about always go along with them. It’s the Senators and Representatives who really have the political power and they are the ones that need to change to make a difference in the US. The citizens of the US are not knowledgeable enough to understand this and that’s not going to change.

The environmental laws have made it so it is harder or near impossible for corporations to produce here than abroad. It’s near impossible to turn those laws back.

There is the legal impact in the US that corporations don’t have to deal with as much overseas. We have too many lawyers here in the US. Most of the laws are there because of “goodâ€. There’s no way to easily turn that back.

There are tax advantages to producing overseas especially if you keep the money there and don’t bring it back into the US. There might be a small chance that could be changed in the future, but, I wouldn’t hold my breath on it.

The biggest issue is that because of the computer and global competition, our US workers have no chance of competing against someone that is willing to work for $3.50 an hour. That’s also not going to change especially because of currency manipulation, but, I’m getting too far into the weeds. Also, the American culture has become “Crapâ€. This is partly due to the movie, music, and advertising industries. Our young Americans can’t compete with workers abroad, especially those from Asia. Our school system has not kept up with international competitiveness. We teach students to pass standardized tests that effectively dumb down the classes to the level of the lowest student. I think America needs to have a much easier standard which all students must meet, but, individualize lesson plans so all students are encouraged to excel where they are good. No one is good in everything. Look up the 7 multiple intelligences to see where I’m coming from. Why test all students on quadratic equations on standardized tests when they most likely won’t use it in real life. Why not make sure they have enough math to balance their checkbook and foster their mechanical aptitude for instance? I think you see my point. Also, we need to go to school more time out of the year and longer hours each day. Why have a 3 month summer vacation these days? If we don’t change our culture will render our students non-competitive in the world as test scores have borne out.

Yesterday’s high school degree advantage now requires a college degree and yes that doesn’t guarantee a good job, but, without it, you don’t have much of a chance.

There are so many other factors why we won’t win this international game, but, this is getting long in the tooth so I’ll stop preaching.We live in a different world now. The cat’s out of the bag, the train has left the station, and there’s no way back. The only thing that you can do is “do better than those around youâ€. Always strive to get ahead, be competitive and win.

September 13th, 2015 at 6:56 pm -

Bud Wood said:

When our third son decided, after completing 10th grade, that he had learned everything worth knowing, my decision was to kick-him out of the house so he would have to get a job. Thus, being a janitor without a high school graduation looked bleak. However, not spending 2 years to complete high school and not wasting 4 more years sitting in college, that gave him 6 years head start as compared with peers.

Those six years head start provided him with some savings as compared with “educational” debt. Thus, he was employed with some good experience, Compared with college kids who may have had “stars in their eyes”, but no job, he was working with savings rather than debt.

September 15th, 2015 at 1:15 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â