You Cannot Afford a $250,000 Home with a $50,000 Household Income!

- 21 Comment

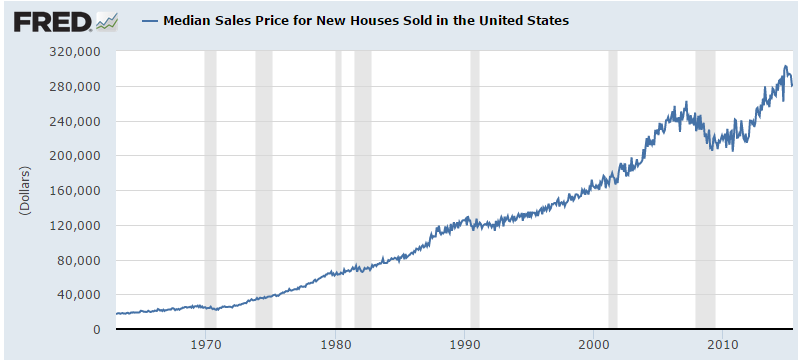

People are still surprised why new home sales remain anemic and new home building is simply not materializing. The latest Census data shows that the typical new home sold for $281,000. At the same time we also realize that your typical U.S. household is making about $50,000 per year. The reason home sales remain weak is because the vast majority of Americans simply cannot afford to purchase homes! The minority category of Millennials that are doing well are coming from rich parents – the data backs this up. You really don’t need a Ph.D. in Physics to figure this out but a household making $50,000 a year simply cannot afford a $281,000 home! Let us be generous and look at the figures for a home costing $250,000. We’ll provide you a full household budget so you can see the numbers at work.

You cannot afford a $250,000 home with a $50,000 household income

The banking sector has followed down a path of low interest rates trying to revive sales in homes, cars, and consumer spending in other areas. Low interest rates are tied to mortgage rates and the lower the rate, the more a household can afford even if incomes are stagnant. Instead of realizing that the standard of living is becoming compressed, banks are trying to get consumers deeper into debt with low interest rate magic. The biggest debt taken on by most households is mortgage debt.

It might be helpful to note that the homeownership rate has plunged in the last decade. Home prices are up primarily for a couple of reasons – low inventory and investor demand. The typical traditional buyer is simply not to be found. Millennials are now in the perfect home buying age range yet many are unable to buy because they are stuck with student debt and low wage jobs.

Let us assume our typical U.S. household is looking to buy a new home in Texas. We’ll even be generous and assume no student debt and no car payments.

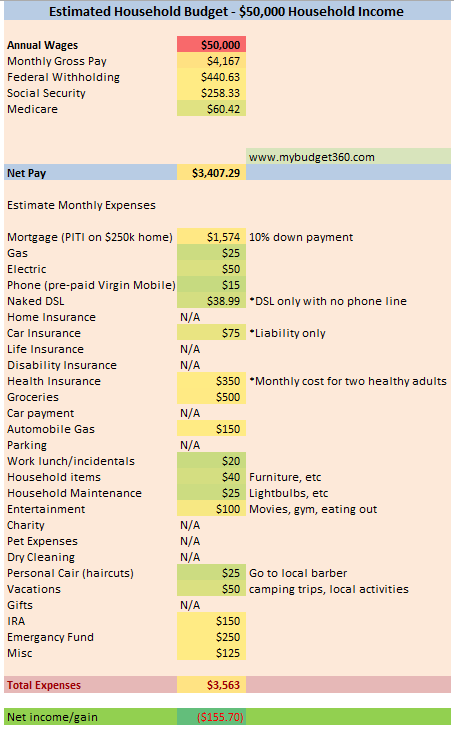

Let us break down the numbers here:

The most important line item is net income. This is how much the household has to spend on expenses per month. We find that the $50,000 a year household has $3,407 per month to spend on expenses. Texas has no state income tax so we are in a very favorable climate.

So we ran the numbers here very carefully. When you usually read articles online about what you can afford they rarely provide you a hypothetical budget. But this is how people live. This is where the rubber meets the road. And this is why half of the country is living paycheck to paycheck.

So let us now move on to the biggest line item, the housing expense. We are assuming this household purchases a $250,000 home with $25,000 down (10 percent). This is reasonable given the price of new homes:

The typical new home in the U.S. now costs $281,000. We’ll go with $250,000 here. The total principal, interest, insurance, and taxes per month will run at $1,574. This is the monthly payment here. Also keep in mind that the $25,000 down payment is hard to come up with for many families.

We are being extremely low with our monthly gas bill at $25, electric bill of $50, and using low speed DSL at $38.99. We are also assuming this household is using basic pre-paid cell phones. Again, the point here is to show this family is not living the high life.

We are assuming this is a married couple and will pay $350 per month in health insurance (for two healthy adults). Groceries are at $500 per month. I think this is a middle of the road approach here. Cost conscious but not extravagant. We’re also assuming this couple has no car payment (many Americans carry two car payments per month). We are budgeting $150 for gas per month and this assumes this couple is close to their work.

We’ll allocate $20 for work lunch (they are brown bagging it), $40 for household items, $25 for household maintenance (this is low), and $100 for entertainment. Personal care of $25 per month for haircuts, and $50 for one annual vacation (save up to $600 per year). We assume they want to save a bit for retirement so they are putting away $150 per month into an IRA. They stash away $250 per month for an unforeseen emergency. And $125 for random items (say the engine goes out in the car).

The end result? This couple is running a deficit of $155 per month and they are being more frugal than most Americans here. No wonder why credit card debt is growing once again. Throw in a kid here and the numbers get thrown fully out of whack (i.e., child care could eat up $600 to $1200 per month depending on where you live). So in short, there is no way a household making $50,000 a year will be able to afford a $250,000 home.

What are your thoughts on these numbers?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!21 Comments on this post

Trackbacks

-

Laura said:

We live off my husband’s $54,000 teacher salary and bank mine. We send $1500 for PItI each month with no problem. We don’t have any other debt. We have one child. It’s not that hard. We have $300 spending money on top of $135 Iphone cell service each month and $70 high speed internet. I get fancy haircuts. We pay for Lightroom, netflix, audible, and TiVo each month. We pay $75 /month for RV storage. We allot $180 per month for RV trips each month. $58 for gifts. About $90 combined for the cat and dog. Etc. it’s not hard to do. $4000 per year ( we make $54k and the article referred to $50k) more isn’t much more a month. We get new iPads every other year. We have lots of toys. We pay $450 per month for med ins and $433 for food. you just need to define your priorities. We don’t feel deprived at all.

July 28th, 2015 at 12:43 pm -

Jim said:

Great article! Of course different cost of living vary in different areas.I’m in upstate NY and that $155 deficit would be much higher! Also, the $250,00.00 would buy less house than in many other area’s.NY state is a horrendous state for taxes, cost of living and value (and corrupt politicians)

July 29th, 2015 at 2:57 am -

bill said:

Back in the day,the tried and true rule of thumb was that the maximim purchase price was three times gross income. On a $50,000 income thats a $150,000 home, or less if you want to give yourself a cushion. These homes are out there,usually older but well worth hunting for.

July 29th, 2015 at 5:03 am -

Miguel said:

Painfully accurate. This trend of stagnant wages is unsustainable in the United States.

Kudos on the article!

July 29th, 2015 at 5:43 am -

BudinPA said:

Easy…they should buy a $150,000 home

July 29th, 2015 at 5:43 am -

Roger said:

Spot on analysis, the average family cannot afford the average home. In my market, Idaho the wages are even lower. Fortunately, the home prices while seemingly high, are lower than the national average. If you want a $150,000 house in the Boise market, you are getting a basic 3 bed, 2 bath 1200-1400 sq. foot probably built by a “production builder” and it wont be in the city core. Commuting to Boise from the outer lying areas will add time and expense to the budget.

I always counsel would be buyers to buy something that is in their comfort range rather than the maximum you can afford.

July 29th, 2015 at 6:52 am -

Owl said:

Being a Texan with a median income as described in the article, I think you were being over generous with expenses. I have been running a zero based budget since 2007, and can easily concur that it is impossible to afford a $250K home on a $50k income.

In Texas, electricity expense is high due to the heat. A $250K home will be quite large (2500+ square feet in many cases), with heating and cooling bills in excess of $200 for most months of the year. Naked DSL is closer to $50+ in these parts after taxes and fees are added. As a home owner, the maintenance will far exceed $25 per month over an average year. And I don’t know of a single Millennial who would be caught dead with a pre-paid $15 per month cell phone plan – that is a status symbol for them. Realistically, the net will be negative $400 per month without car payments. Add in just one single car payment, and that amount goes up not just for the total payment, but also for the increased insurance costs.

What many people seem to never consider, especially in Texas, is living rural, but working in the city. We live in a large 2400 square foot newer house, with acreage, 100 yards from a desirable lake in a rural area. This house cost 1/4 of a similar sized home with comparable land in the city. Some of the savings go into increased fuel costs ($240 month) for commuting to work in the city (65 miles away), and increased auto maintenance ($70 month), but nets us a savings of nearly $900 per month which was plowed into paying off our debts.

Sure, we give up some conveniences of living in the suburbs/city, but we are also debt free and in a far better financial position than the majority of our counterparts. Convenience is simply not worth the debt.

July 29th, 2015 at 7:02 am -

BillyR said:

Very well stated. I do think you are being generous (most will not be this frugal) but it goes to show you that there are lots of things we don’t think about on monthly expenses. Like you said, add car payments (which will increase insurance because of collision), credit card minimums, dental, vision, school loans…don’t even get started on the expenses if you have kids…it is nuts!

July 29th, 2015 at 7:12 am -

Bleh said:

Thought #1: I think you can make the numbers show whatever you want. $25 haircuts (“Personal Cair [sic]”) every month? A decent job but no health insurance from it?

Even with all this, this couple is only $155 down per month, or $1860 a year. If they can save $25K for the downpayment, they probably have some savings already, and dipping into it less than $2K a year isn’t much.

Thought #2: Not everybody needs to own a house. You can get a fantastic apartment for a lot less than $1574 a month, in most places. Save your money and buy when you’re able.

It boggles the mind that anyone would think any $250,000 object is mandatory to own. I don’t own an airplane, because I can’t afford one, so when I need one, I pay a tiny fraction of its cost to have somebody else own and operate it for me. You don’t hear me complaining that I can’t afford to own my own airplane.

Thought #3: 50,000 may be the median, but it seems pretty low for a couple with no children. It sounds like one of them isn’t working, or else they have jobs that aren’t that much above minimum wage. Those are definitely both valid life choices to make, but they’re not necessarily compatible with the goal of owning a quarter-million-dollar asset.

In this life, you can have anything you want, but you can’t have *everything* you want.

July 29th, 2015 at 7:46 am -

Ted said:

As a physician, our family is now focused squarely on getting out of the system rather than buying all we can or getting what we qualify for. The only thing that matters to us nowdays, is time with each other and family and friends, not money, or how much money we can make only to have the gov steal it from us and use it for policies we do not agree with or to support the increasing majority known as couch potatoes who seek and get monthly handouts. We have NO interest in working harder to support these people or the trending polices coming out of Washington DC.

July 29th, 2015 at 11:14 pm -

Dave said:

Laura, while you say you do well on $54,000 income and give examples of your expenses, I see nothing for emergency funds/savings. That is critical for long term survival. I would challenge your “success” by saying that it doesn’t appear you’re handling your money responsibly. Why do you need new iPad’s every 2 years? Why do you need the other luxuries you list? You’d be far better off putting away a few hundred dollars a month for the future because I guarantee that one day you will need it. Life does not always go along predictably or without surprises.

July 30th, 2015 at 8:03 am -

Dave said:

One other thing Laura, I worked for years at lower incomes and yet saved and saved until, when my income had peaked at $45,000 per year, we were able to buy a home for cash. Over time we were able to move up with additional savings and the sale of that home. The last 3 homes I’ve owned were purchased with cash. That freed up so much money it was ridiculous. Now, I have learned I have a terminal illness and I don’t have to worry about what will happen to my wife. She will have a home to live in without having to worry about paying a mortgage.

July 30th, 2015 at 8:06 am -

Jason C said:

Let’s look at a real cost of living. One income, stay at home wife + 5 children.

Auto Ins $150

Cable + Internet $150

Water/Sewage/Sanitation $100

Electric $150

3 Phones $220

Fuel $600 (25 miles from work)

Food $1500 (yes, they’re hungry all the time)

Auto/home maint $400

Student Loans $500

Mortgage $1450

Medical Copays $300

Medical Ins $600

Total $6,120This does not include other costs such as travel, pets, etc. I have no other debt and I own my vehicles. That is why household formation is continuing to fall in the U.S. A regular income cannot support more than 1 or 2 children.

July 30th, 2015 at 9:34 am -

James Umatsu said:

Another great article. Surprised by some of the comments. Especially “Dr.””Ted” who seems to blame the government which is, of course, only half right. “Dr.””Ted” lost me completely when he blamed, I guess, the poor instead of corporate greed and income inequality which the government at every level sanctions.

August 2nd, 2015 at 5:43 am -

Ame said:

If this couple were to purchase the home in the budget scenario, they would be required to get homeowners insurance to cover themselves in case of fire. If they live in earthquake territory or flood plane, there is added expense.

Anyone who doesn’t have life insurance when they buy a house (children not in the picture), will likely NOT be able to maintain the payments on that house if their spouse dies and will have to sell/foreclosure.

If they have a child while living in the home, they will likely want life insurance just to assure the child will have some stability should the surviving parent needs to work longer hours or else cannot set aside as much for college, etc. for said child.

No disability? Really? A person is more likely to need disability insurance than life insurance. This line item is a MUST, imo.

Let’s face it. Our wages in America are not keeping up with cost of living for a middle class lifestyle. America was once known as a place where you could climb the latter if you worked hard.

Now…not so much.

August 7th, 2015 at 6:07 pm -

Ian said:

The typical budgeting process lumps all expenses in as if they all had the same level of importance/priority. This just is not or should not be the case. Protection items come first (health insurance, life insurance, disability insurance, home owners and auto insurance with liability protection). Then, one should “pay themselves first” by saving 15 to 20% of their income or they will NEVER have financial security. This savings includes all forms (qualified, non-qualified, savings and investments). Next, the mortgage should be properly structured. As a rule of thumb the mortgage payment should not exceed 15 to 20% of the Gross Income otherwise you will be “house poor”. There should be no short term “bad debt” like high interest credit cards and such. If there is, divert savings to a debt payoff plan… never skimp on protection. Lastly, you should live on what is left and spend what is left with no guilt… if you want to take vacations, buy 3 iphones, eat out all the time – whatever – you have given yourself permission to spend what is left however you choose. There is a hierarchy to expenses. The typical budget process lumps everything together as if they were all the same priority – and they are not. I help people with this “cash flow hierarchy” all the time and it changes lives. – Ian

August 15th, 2015 at 6:53 am -

Jim Martin said:

It is clear that new home prices are very expensive relative to median household income here in the U.S. Likewise for Canada.

Depending on where you live, you might be able to find a modest older home for around $150,000 (roughly 3 times the U.S. median household income).

As mortgage interest rates rise, this will put renewed downward pressure on residential real estate prices, including new home prices.

Sometimes it makes more sense to rent. This may be one of those times.

August 15th, 2015 at 11:12 am -

Marie said:

Dave,

I am interested to know how you did that. My husband and I live on one income and desire to buy a home for our family, but find it very difficult as he only makes $2600 take home p/m. We have no debt. Just interested if you have any advice. Thanks.

January 6th, 2016 at 7:44 pm -

Tommie said:

People go into debt trying to live the american dream. It’s ok to rent especially in this wacky job market, so many people ruin their lives chasing homes they can’t afford. In many states two people would barely be able to afford rent living off $54,000 a year let alone a mortgage. Then on the other hand there are states where you can get great homes, with a little land for $100,000. Problem is people try to apply those sort of things to every location and you simply can’t do it.

some regions pay great in general but things costs much more, some areas pay poorly but it costs nothing to live. You have to find a balance, and be willing to move outside of your comfort zone (area you live in) if your desperately looking to have a home for your self and your family.

I know folks who pay $1500-$4000 per month in rent……and can own a multifamily home 15 miles away for about $1500 a month total (taxes, pmi, insurance, gas , elect, mortgage) but they choose not too..

July 21st, 2016 at 2:20 pm -

Evelyn Trowsdell said:

Its not hard if your 50,000 is retirement money and no taxes come out am doing it with a 500,000 house.

August 14th, 2016 at 1:54 pm -

Edward said:

I need advice on my situation. My wife is planning to buy a house around 3/01/2018. Here is the situation; the house that she wants is about 250k in Virginia beach, VA. Her income is 50k a year, no debts except a car loan for $520 a month, her credit score is around 740. She has a saving of 20k but we planning on a minimum down payment. She wants to use the first time homebuyer program available in our area. I know 50k for a 250k mortgage sounds too high. The car loan is under her name but I use the car and I pay the loan since day one so that will be an issue for sure. My question is do you think she can get a 250K loan on her self according to the profile that I gave you?

Right now she is just saving as much as possible for next year so she can have at least 20 or 25k by 3/1/2018 and paying all her bill on time.

Now I know you are asking yourself why not to include myself on the loan or just transfer the car loan under my name, and the answer is that I recently file for chapter 13 but my wife is not included because we separated for a few months. I can afford the car loan and I will be paying it. also all expenses for our kids comes out of my paycheck, in other words she will only have the mortgage responsibility.September 19th, 2017 at 2:09 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â