The economy chugs along with consumers going into deep credit card debt: Credit card debt surges in top 25 US metro areas according to Equifax data.

- 3 Comment

Credit card debt is like crack for the American consumer. A cheap alternative to pure spending cocaine but enough to keep you on the hamster wheel of consumption. I recently discussed how credit card debt while remaining subdued since the Great Recession suddenly made a 180 degree turn. Americans are spending money they don’t have on shiny plastic. Total outstanding credit card debt recently surged beyond the $900 billion mark. That is a lot of consuming. And with the average nationwide interest rate of 14% that means spending hamsters are probably dropping tens of billions on interest costs alone. I found it interesting that I got a few e-mails proselytizing how great credit cards were after my last piece. My reaction: So you enjoy locking in future earnings for money you don’t have today? Keep in mind people pray to the hedge fund gods for a 7% annual return. Getting a 14% return is like finding El Dorado had a sister name AmEx. It is amazing to get a 14% return (and with some cards, you are getting close to usury). Equifax released credit card data on 25 US metro areas and the results are startling.

Spending like you don’t have money

Credit cards do have a purpose in our society. Yet most people don’t realize that buying a $1,000 TV at 14% interest and paying the minimum can easily turn that TV into a $2,000 or $3,000 purchase. And many people do this while obviously neglecting retirement savings. How do we know this? Because half of retirees rely on Social Security as their primary source of income and would be out on the streets living under a bridge if it were not for Social Security. Credit card debt is like junk food. Easily accessible, easy to use, but hard to work off. We all know junk food is bad but most of the country is overweight. We know credit card debt is dangerous yet people go into deep debt on a continual basis.

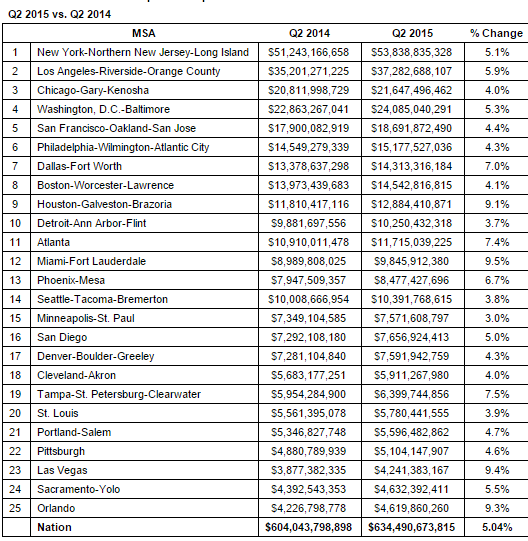

First, take a look at the Equifax data:

Source: Â Equifax

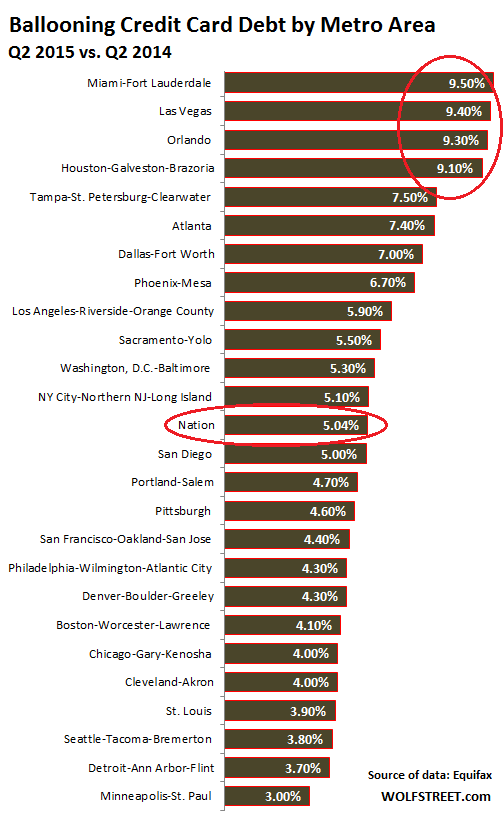

This is recent data and reflects an American society consuming goods with money they don’t have. Just look at the annual growth figures:

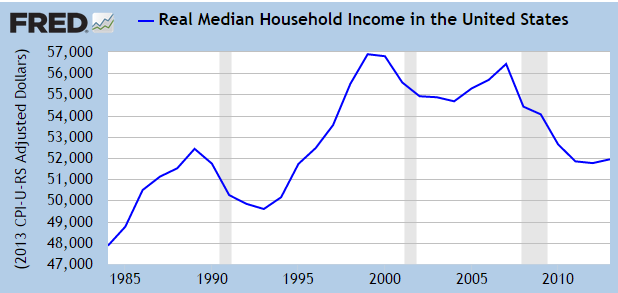

This is good news for the financial institutions that are producing these products. It is also good news for the businesses that rely on consumer spending. But just look at US household income:

Adjusting for inflation US household income is back to where it was nearly 30 years ago. So to keep up the pretense that things are perfectly fine with the middle class, people are spending money they don’t have. This by the way, was at the core of the Great Recession. It was truly a massive credit bubble let by casino banking. Americans buying homes and cars they couldn’t afford and using real estate as a piggy bank. Banks were happy to oblige and when everything went bust, it was corporate welfare and bailouts for the banks and Greek style austerity for the broke public (aka vast oceans of foreclosures and bankruptcies that seem to have been forgotten recently).

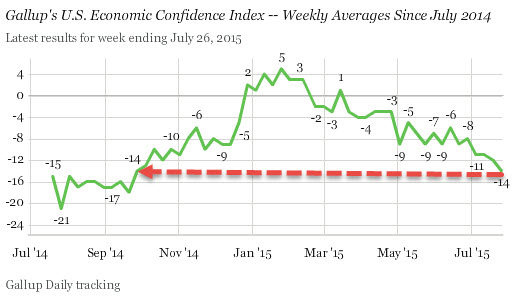

But going back to that Equifax data, credit card debt has surged in the last year but income hasn’t followed. The only thing we can say is that consumer confidence was up last year but this is also waning in recent months:

Apparently many Americans thought those corporate profits were going to trickle down into their paychecks. The joke is on them! We have a sea of low wage jobs and this is why politically, we have candidates with populist rhetoric gaining traction. While people in high paid metro areas shop at Whole Foods and pretend everything is fine, most of the country is feeling the economic pain deep in their wallets. And by the way, we’ve been on a ridiculous stock market bull run and the housing market is reflecting bubble like behavior.

All of this might make your average Americans feel confused but spending money feels good. Spending on a credit card feels even better. Just wait until that credit card statement arrives in the mail.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Beano said:

Do they pay it off is what I’d like to know?

August 2nd, 2015 at 12:38 pm -

Rife said:

A bimbo friend of my wife’s ran her cards up to the max in anticipation of the world ending on Dec. 21, 2012………………

Guess what?August 6th, 2015 at 5:52 am -

Pete said:

Excellent thoughts and a great article. YES I agree that what your data really shows (consumer credit card debt) is that a huge number of American families CANNOT maintain their lifestyles. I do not think that American parents get out of bed each day and say … “Gosh, how can I give another $500 to VISA today?”. I think that people are truly struggling. And the reason is that REAL wages are sinking. We keep trying to belong to a country called Used-T-Be-America. But it does not exist any more!

The deeper problem is that Americans are unable to SIMPLIFY their lives. It is extraordinarily difficult to simplify and cut costs. Basic things are expensive. Our society creates a huge number of roadblocks every day – and they all cost money. There is NO SUCH THING as simple any more. That is the underlying problem. It is killing the budgets of American families these days.

August 6th, 2015 at 12:22 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â