Millennials that are thriving in this economy are those with links to rich parents: The vast majority of other Millennials are mired in debt and unable to purchase homes.

- 6 Comment

Most young Americans are still living in an economy that feels like it is in a recession. Yet there are Millennials that are doing well and are thriving in this economy. How are they escaping mountains of student debt? How are they gaining access to down payments to purchase more expensive homes? The short answer is that they have rich parents. This isn’t some Trumpism. This is merely facts that are coming out of research from the Fed, Census, and Zillow. For the vast majority of young Americans the last decade has been one of low wage labor and a market mired with very expensive colleges. Despite the disappearing middle class many of those Millennials that are thriving are doing so thanks to familial wealth transfers. We tend to romanticize the “self-made†person in the United States but it is increasingly becoming more difficult. More wealth is accumulated in fewer hands and it is staying there.

The Millennials who are thriving

Millennials have taken it on the chin during this recovery. They are saddled in debt and are a large part of the $1.3 trillion in outstanding student loans. Many are finding jobs in the lower paying service sector of our economy even with college degrees. Many are delaying buying homes and in many cases, are stuck living at home with parents even after college.

But a portion of Millennials are doing well:

“(The Atlantic) And then there are those who are doing just great—owning a house, buying a car, and consistently putting money away for retirement.

These, however, are not your run-of-the-mill Millennials. Nope. These Millennials have something very special: rich parents.

These Millennials have help paying their tuition, meaning they graduate in much better financial shape than their peers who have to self-finance college through a mix of jobs, scholarships, and loans. And then, for the very luckiest, they’ll also get some help with a down payment, making homeownership possible, while it remains mostly unattainable for the vast majority of young adults.â€

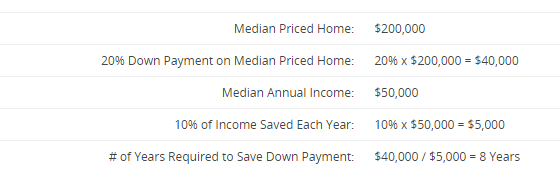

The two biggest benefits here are paying for college and a down payment for a home. Paying for college allows these Millennials to enter the workforce with a minimal debt load. Add in the down payment for a home and you accelerate the wealth building years for this group immediately. Take for example saving 10 percent for a typical US home down payment:

Source:Â Trulia

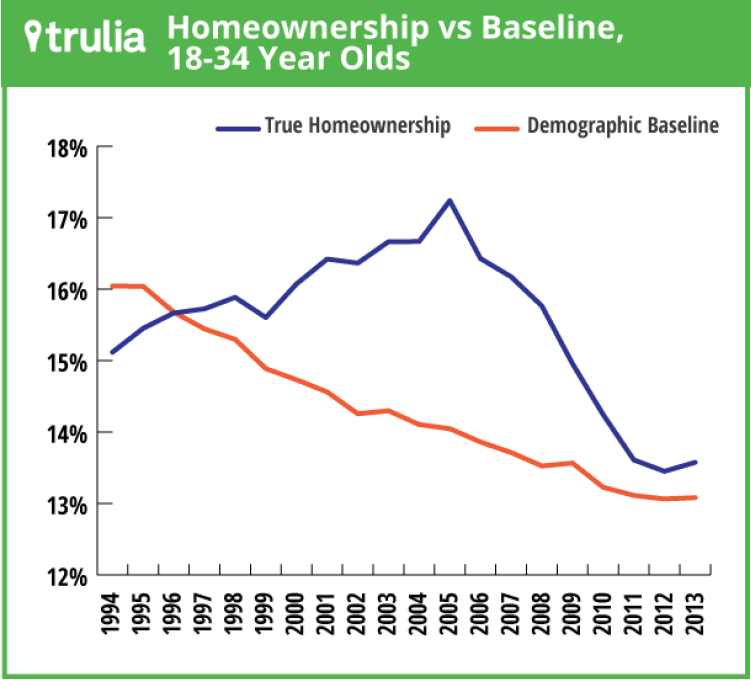

Your typical American household will take 8 years just to save for that down payment. Compare that to getting immediate assistance from your family and you suddenly own a home 8 years quicker. That is a big deal and since most Millennials don’t have this privilege, the home ownership rate has been plummeting in a group that usually leads household formation:

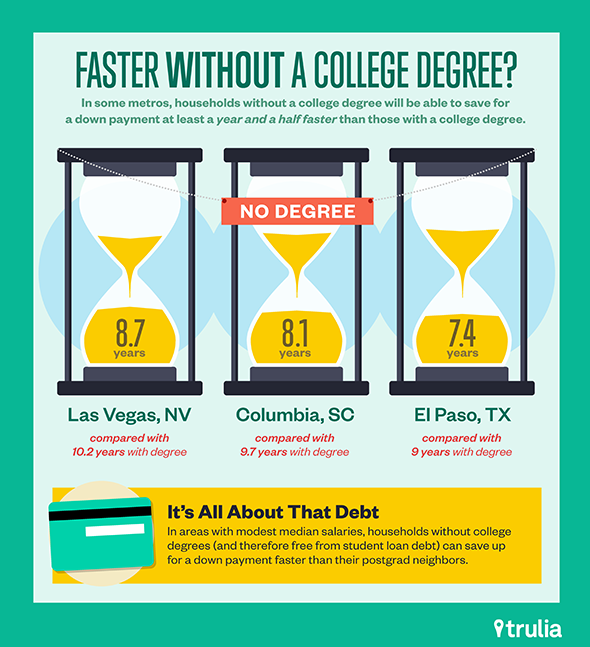

In some parts of the country, going to college may delay your ability to build wealth:

In Las Vegas, households without a college degree can save for a down payment 1.5 years faster than those with a college degree. This isn’t advocating for avoiding college altogether but as Greece is showing us, having way too much debt can be a really bad thing. Education is vital but you have to question the underlying cost of what you are getting. The Millennials that are doing well have access to capital and that is important:

“The study calls this a “funnel of privilegeâ€: Young adults with rich parents soon become rich themselves.

“Haves are turning their riches or their wealth into bigger wealth because they are investing in the housing market by simply living in a house,†says Gudell. This advantage is one that these Millennials will carry forward as they earn more than their degree-less peers, and save more than those who were forced to throw away tens of thousands of dollars on rent due to their inability to buy. In the future, they’ll have wealth to pass down to their own kids, continuing the cycle.â€

Homeownership is the main path for Americans to build wealth. As the market has been pillaged by big Wall Street investors, the homeownership rate has collapsed all the while prices have gone up. Those building their wealth (those who control stocks and real estate) can then pass that wealth down quickly to their children. In the past, buying a home was a big part for the young emerging middle class. Now, it is becoming more of a privilege to own a home especially in a more expensive metro area. The study merely reveals something we probably already know: more wealth is being filtered into fewer hands.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Ame said:

This is true about many rich parents bestowing riches gained upon their children. This is just and only a socialist society would think that money should be re-distributed equally to all the children of the “village”.

I have some questions: If people saving for a down payment only save 10% of their annual income toward that, how do they then pay upwards of 25-35% of their annual income to the loan they obtain? Why aren’t they saving 25-35% for a down now? Is the difference going toward their student loan?

Which brings me to another set of questions. Which is the better “return on investment” of those payments; the paying down of student loans which have X% interest due or building X% of equity in a home minus X% of interest on the loan due?

July 20th, 2015 at 5:17 pm -

Millennial said:

Good article. Largely true. But there are some seriously flawed arguments here, too.

1. Why use a median home price as the example for a millennial’s first home purchase? That’s the median price of all homes across the whole market. Don’t most young people buy a home that is smaller, older and less desirable than the “median home”? A $100,000 house is much more affordable and much more likely to be purchased by a young person. Build some equity and maybe in 10 years cash out to that 2- or 3- hundred k home.

2. Of COURSE college delays one’s ability to build wealth. Its practically self explanatory. If you don’t go straight to gainful employment at 18 and instead go to school and take on tens of thousands in debt, you’re going to delay the escalation of your net worth. But study, after study after study shows that college is expensive because it works – it opens doors that are otherwise closed to you. And it, on the average, increases lifetime earnings substantially. Google “lifetime earnings by education”.

July 23rd, 2015 at 8:39 am -

Mildude said:

This is absolutely interesting, and points to relevant trends in home ownership. But the anecdotal data is misleading regarding the three cities listed where non-college home ownership happens sooner than degree-holding home ownership. Those three cities — Las Vegas, NV; Columbia, SC; and El Paso, TX — are all military communities. The Military provides non-college professionals a chance to earn a stable income in a much shorter time frame than many peers, and home loans underwritten by the Veterans Administration can close with no money down, making home ownership far more possible for career military personnel. I’m not convinced that the data points in this article have the rigor needed to draw any specific conclusions.

July 23rd, 2015 at 9:12 am -

Bob said:

This illustration also misses the fact that many first time homebuyers would qualify for HUD or other similar loans which generally come with some type of down-payment assistance as well as a lower down payment % like 5-10 with a PMI required until 20% is hit. This significantly lowers the barrier to entry. Take myself: $65k/year, Original loan was $210k at 3.75% Original Down payment was only $18k. (yes this is after all the changes went into effect) After 5 years I shed my PMI and am down ~30% on principal. The study needs to adjust for area that degree was received (liberal arts/ comp sci) THEN factor in family income.

July 23rd, 2015 at 1:37 pm -

DaR said:

Ame: Spoken like someone who never had to save for a down payment. The difference goes to rent, silly. Well student loans too, but mainly rent. Many people get mortgage payments that are less than their rent payment.

July 23rd, 2015 at 1:55 pm -

M said:

@Ame..If the loan repayment you mention is their mortgage payment, perhaps the reason they aren’t saving that amount is because they are paying RENT. You are assuming they could set aside the whole amount of mortgage payment while paying to live somewhere in the mean time?

July 24th, 2015 at 3:49 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â