Is college worth the 172 percent price increase over the last 9 years? The cognitive dissonance between rising tuition and falling wages.

- 1 Comment

$1.36 trillion. That should sound like a lot of money because it is. How much is $1.36 trillion? Texas has an annual Gross Domestic Product of $1.4 trillion. $1.36 trillion is the amount of student debt that is attached to millions of Americans like a financial albatross. There is an ugly thing about this unrelenting trend given that many students are now unable to payback their loans. It is no coincidence that young Americans are putting off marriage, buying homes, and starting families because of the incredible weight of debt they already carry from their college years. It would be difficult to argue that education is a “bad†thing. To the contrary, getting an education is vital and important. Yet with many colleges charging $25,000 to even $50,000 per year merely to study general education courses, you have to question the value of what people are paying for. The most expensive college seems to be Sarah Lawrence coming in at $65,480 per year for tuition, room and board, and fees. Just as a measuring guide, the median household income in the US is $50,000. There is a growing problem and student debt is growing into a financial avalanche.

The growing mountain of student debt

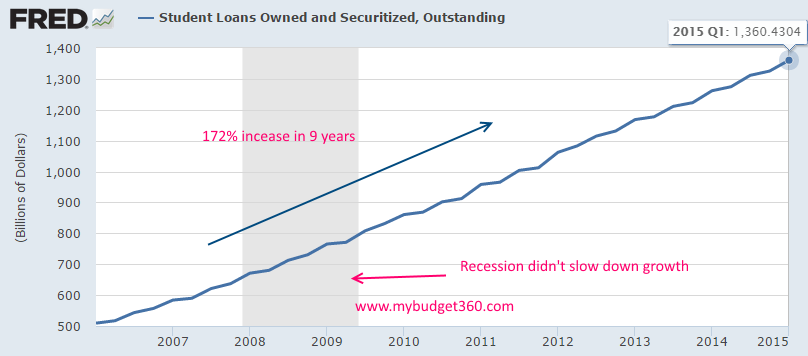

What is interesting about college debt is that it grew equally fast through the recession whereas the following debt sectors contracted: mortgages, auto debt, credit card debt, and personal loans. Student debt was the only sector that expanded. It could be argued that people lost jobs and had to go back to retool. But many of the jobs added since the recession ended in 2009 have come in the form of low wage labor. This is why the student debt enigma is being discussed at a louder level in the media and with politicians.

In the last 9 years, student debt outstanding has risen a stunning 172% from $500 billion to $1.36 trillion:

There is no reason for this growth in terms of wage gains. This is really happening because of government backed loans and how student debt works. There is no income barrier here. And that is possibly good. But you have for-profits marketing heavily to low income neighborhoods knowing full well that these people will qualify for big government grants and loans and providing them an education that is good is merely an afterthought.

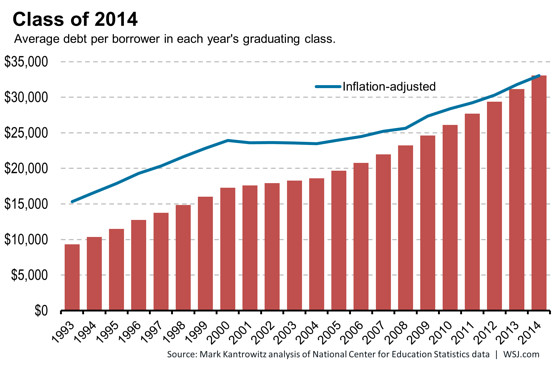

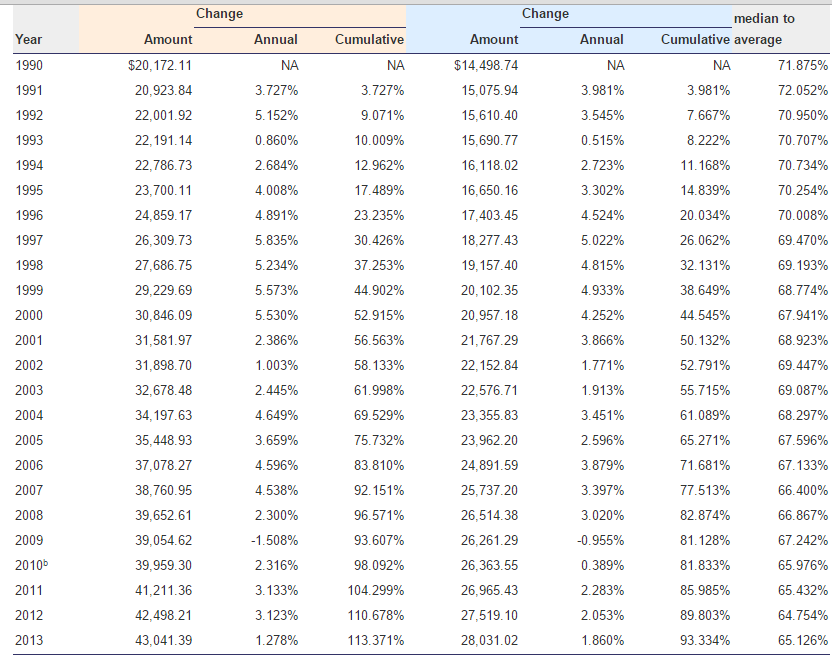

The risk is being carried by the taxpayers. Student debt is now the most delinquent loan class in the United States. Take a look at this chart adjusting for inflation:

The typical graduate is now carrying roughly $30,000 in student debt. The median net compensation of US workers is $28,000 for reference:

Source:Â Social Security

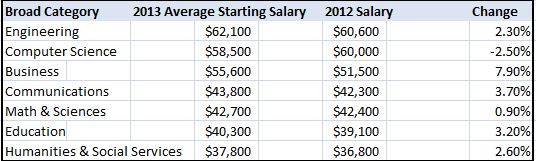

And this is where the crux of the problem stands. The cost of going to college in many cases is becoming too expensive. Sure, college graduates earn more but does this make up for someone going into $100,000 of student debt? If the degree is for computer engineering, the answer might be yes. For other career paths the answer might be a clear no. Here is some data on starting pay for various disciplines:

What these charts fail to mention is the ease of getting jobs. First, many engineers have an easier time landing that higher paying job. For many of the humanities majors, they are battling it out to land those lower paying jobs. So these charts don’t highlight the supply of jobs per worker. Also, they don’t show long-term career payoffs. For example, an accountant has a clear trajectory of earnings as they move along. For other majors, the potential for career and wage growth may not be so clear given the glut of supply in the market.

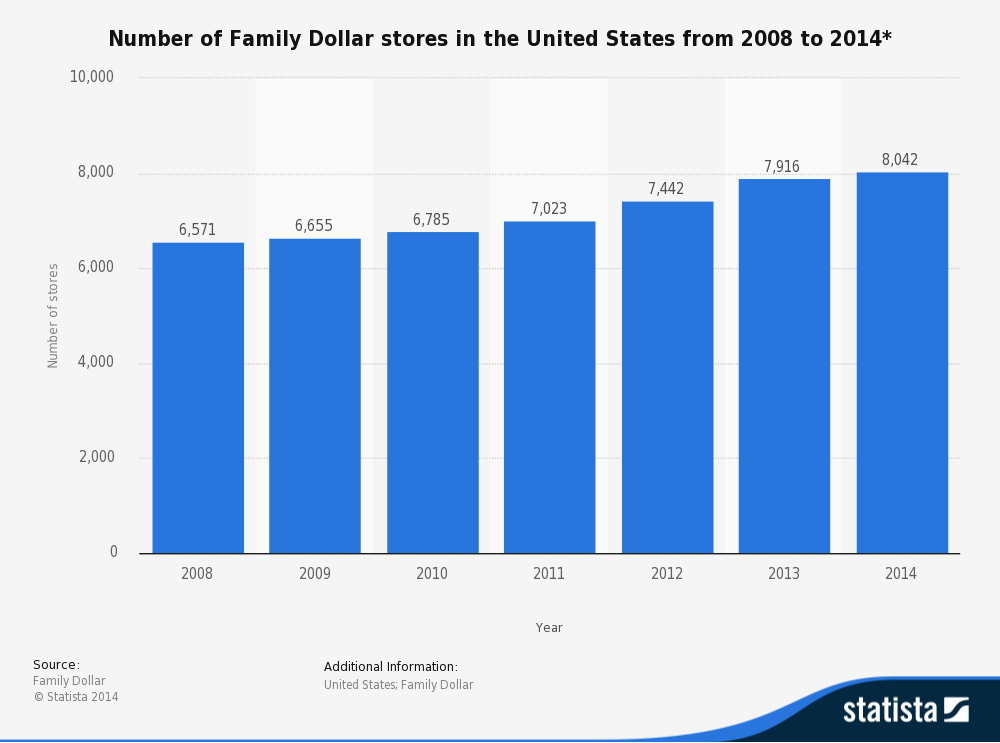

This narrative might not jive with the “follow your passion†ideology that we seem to see through the media. Then again, many in the media are detached from the daily challenges of the American worker. There was a segment where someone mentioned that half of Americans live paycheck to paycheck and the anchor seemed to think this was some kind of large lie. All it would take is a brief look at multiple surveys and they would realize this is no lie outside of their bubble. Who is shopping at the 8,000+ Family Dollar Stores?

Is college worth it? The answer isn’t a clear yes or no especially when you remove the cost side of the equation. In many cases it is but like any investment, it does matter what you pay for it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Ame said:

Follow this idea: College becomes so expensive that kids don’t go. America has less and less native-born educated from which to choose when filling positions in companies. So, those companies must either relocate overseas or else recruit educated employees from other countries to come to America and work (often for much less than an American would).

Hum, it sounds as if that IS the plan. Make higher education of the average American kid so out of reach that they don’t become educated. The dumbing down of America is accomplished and America becomes a land filled with foreign worker-slaves and low-wage servants. Of course those people cannot afford to buy a home, so must pay rent to their overlords.

Back to surfdom we go.

June 14th, 2015 at 5:17 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â