The financial gouging of the American college student: Tuition is up 300 percent from 1990 and total outstanding student debt has grown by over 1 trillion dollars since 2000.

- 0 Comments

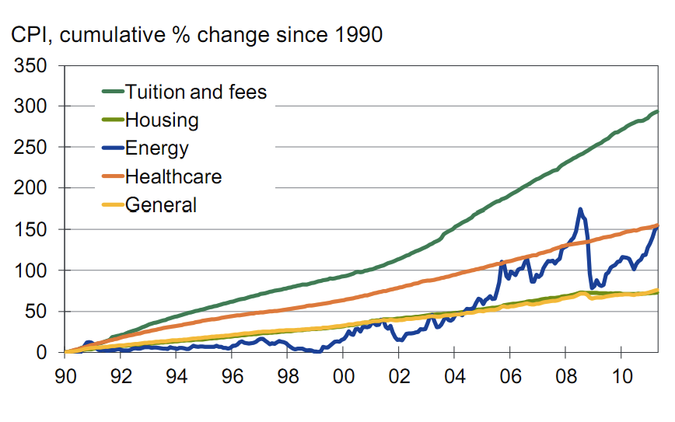

Inflation is such an insidious standard of living destroyer. Little by little those dollars in your wallet get worth less and you suddenly find yourself needing to go into large levels of debt to purchase cornerstones of the American Dream. Going to college has been the dream for many Americans after the G.I. Bill was signed into law in 1944. Even in the early part of our country, going to college was a privilege largely reserved for the elite and wealthy. It wasn’t viewed as a public good until World War II. The heyday of the US middle class was after World War II and slowly this has been chipped away starting in the 1970s. As of today, going to college is fraught with so many financial landmines. Working class areas are targeted by predatory for-profit colleges. Many others go to quality schools but come out with too much debt relative to what they can earn in an environment littered by lower wage jobs. This is the future of higher education. But think of this jaw dropping stat: since 1990 tuition has gone up 300 percent. You can rest assured wages have not kept up.

The wild ride of college tuition

It is interesting that even in the depths of our Great Recession, the cost of going to college continued to go up. Housing prices crashed. The stock market tanked. Deals were to be had on practically everything (if you had money). Everything but college costs.

The cost of going to college has gone up non-stop since the 1990s and the amount of debt associated with going to college is now the second largest category of debt carried by Americans (behind mortgage debt).

Take a look at this recent chart:

Even in the face of rising energy costs and the biggest housing bubble in our lifetime, college tuition and fees is in a world all unto itself.

Energy which has gone up dramatically since 1990 is up 150 percent. Health care which is breaking the bank for many older Americans has gone up 150 percent. These are such big challenges that politicians have made them front and center of their campaigns. But what about college tuition? Unfortunately politicians realize that younger Americans are not as engaged in the political process. So this isn’t a pressing issue. However, it has become a pressing issue give the 300 percent rise in college tuition and fees since 1990.

This is deeply problematic and the reason colleges can keep increasing fees is because of easy access to debt. Even if you have no money as many for-profits realize, they can push you into federal loans and suddenly you can “afford†to go to school. The schools take all the cash and the student is left with a giant loan once they graduate. This would make sense if incomes were keeping up with these changes but they are not. The system is being played left and right.

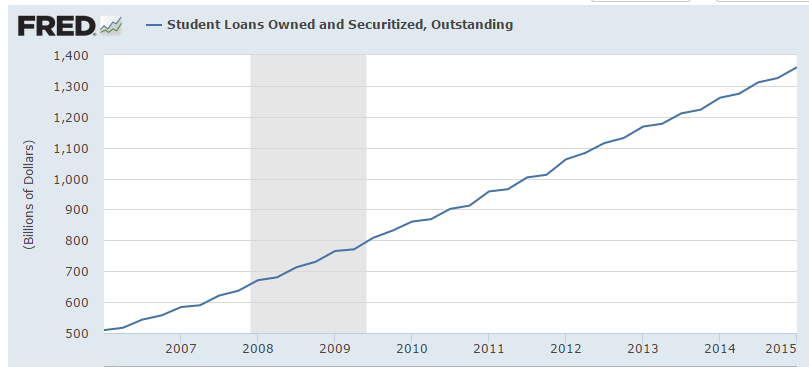

Take a look at total student debt outstanding:

A total of $1.36 trillion in student loans is outstanding. That is simply crazy. In 2006 $500 billion in student loans were outstanding. So the total amount of debt outstanding has gone up 172 percent in a matter of 9 years. That is insanity. Even crazier is to think that just in 2000 we had a total of $200 billion in student debt outstanding. So we’ve added over a trillion in student debt just since 2000.

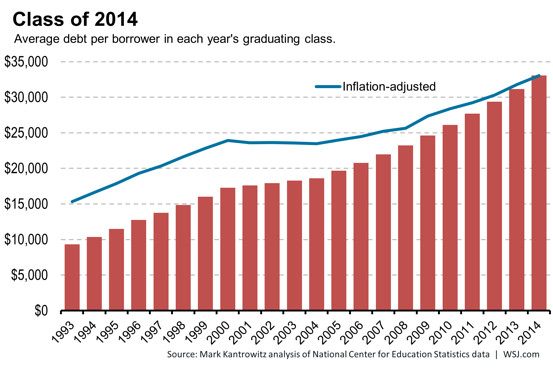

The typical borrower now carries over $30,000 in student debt upon graduation:

This is double the inflation adjusted amount from 1993. This is a real burden for college students. The problems are real because we now see it in the back crushing debt. College graduates being unable to pay their student debt is reflective of deeper issues:

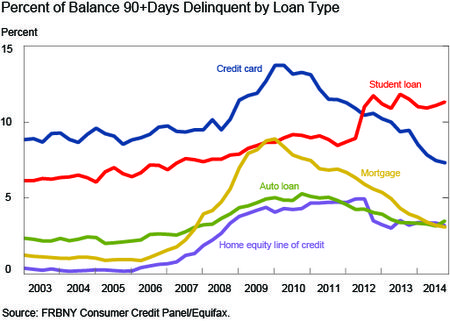

The worst performing debt class in the US is with student loans. This is going to be an important topic for young Americans in the 2016 campaign. Hopefully politicians will listen up and take a deeper look at this unsustainable system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â