7 million college debtors have yet to make a single student loan payment in last year. The college debt bubble grows.

- 10 Comment

The student debt problem continues to spiral out of control as millions of young Americans enter the workforce only to be greeted by low paying jobs and the monthly bill for their college experience. For the most part studies show that college graduates do better than non-college graduates. Yet these studies fail to take into account the soaring cost of college today. These studies also mix in top performing schools with paper mill operations. There was a recent analysis showing that there are now 7 million college debtors who haven’t made a college payment in the last year. This is a staggering 17 percent of federally held student debt while many others are inching closer to the 360-day delinquency window. In other words, many people are simply not paying back their college debt. The amount of student debt is staggering coming in at over $1.36 trillion. The student debt bubble is symptomatic of the way our financial system is now operating and that is debt is piled upon debt and strung out over years to be paid back in hopes that inflation will pass the bill to future generations. The bill is getting harder to pass.

Shuffling debt and income plans

The government and banks realize that many millions of students deep in debt are simply not going to pay back their debts. This is a fact. Yet there is also this inability to recognize when people have taken on too much debt. Just look at Greece. There is no better example than the current central banking system being unwilling to write-off debt instead of putting people into debt-servitude that will last forever.

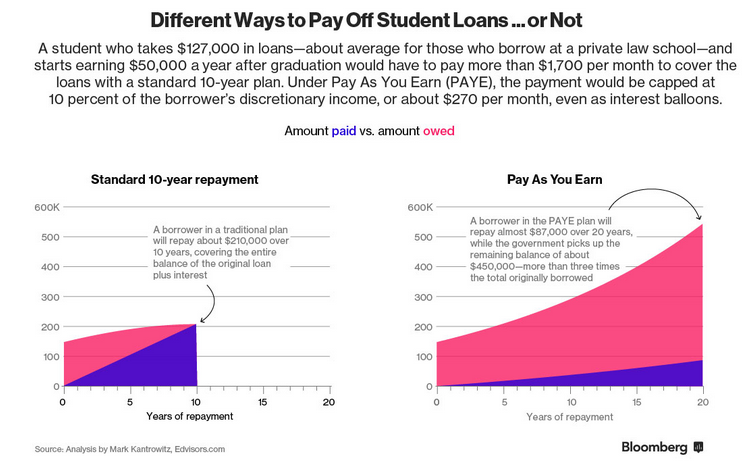

We are seeing shifts of trying to put more students on income based repayment plans. But look at what this does to total payments:

This is nuts. So if you owe $200,000 under more traditional models the borrower will end up paying back a total of $210,000 covering interest and the balance. Under proposed plans, this borrower will pay $87,000 over 20 years while the government picks up the tab on the other $450,000! If you are having a hard time tracking the math you are not alone.

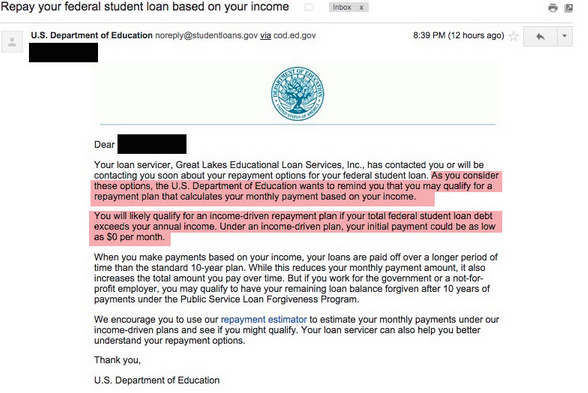

Take a look at a letter for an income based repayment plan:

In some cases people are earning so little that their monthly payment will initially be $0. You don’t need a Ph.D in Mathematics to understand that if you pay $0 a month, it is unlikely that you are going to make a dent on that student debt. The problem is, federal student loans (backed by the current banking system) have inflated the cost of college. In turn, colleges jack prices up and this becomes a vicious cycle. In the end however someone is left with the biil.

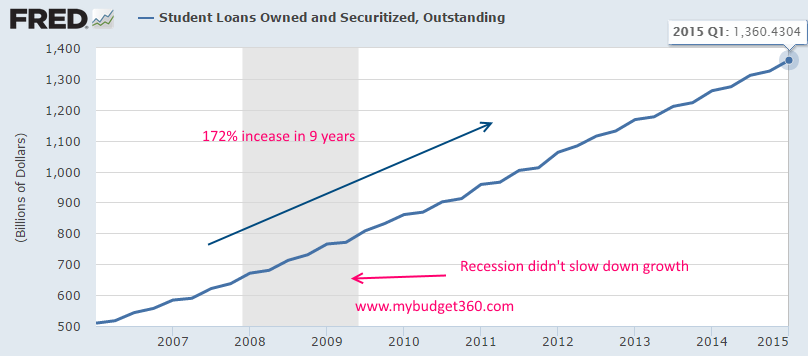

All of this ties into the core of what caused our last financial crisis. The financial crisis was a solvency crisis, not a liquidity crisis. There is a big distinction. Yet all the tools now in place are attacking this problem as if it were a liquidity crisis. People are starting to wake up and realizing that much of the debt floating in the system will simply not be repaid. Yet this acknowledgement essentially renders banks powerless and the market will forcibly contract. This is why Greece was not allowed to default. This is why there were no write-does on mortgage debt. And this is why student debt is going to be allowed to flutter into the future even if some borrowers pay $0 a month. Student debt outstanding now stands at $1.36 trillion:

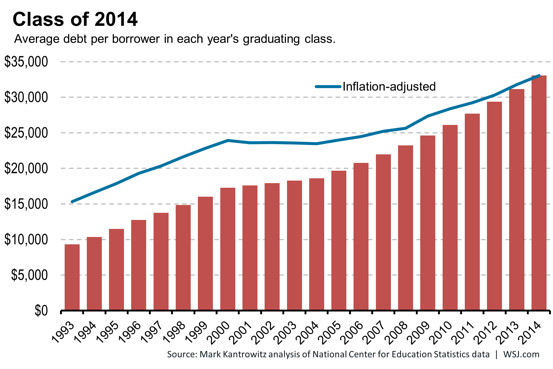

Student debt has gone up 172 percent in the last 9 years and the recession did very little to halt any growth in this market. It also appears that each successive graduating class is also deeper in debt than previous years:

The WSJ which discussed the 7 million borrowers not paying on student loans added the following:

“(WSJ) The development carries big implications for borrowers, taxpayers and the economy. Economists have warned of student-debt defaults damaging borrowers’ credit standing, which would hurt their ability to borrow for things like cars and homes. That in turn would hamper the economy, which relies heavily on consumer purchases for economic activity. Delinquencies also drain government revenues, which are used to make future loans.â€

And that is the crux of the problem. Robust economic growth is going to come from having a vibrant and young working class. It is not going to come from an indebted young population that is merely trying to work to pay off their student debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

B from CA said:

Knock off all interest. Take the principal only. Have the student/debter get a copy of their latest paycheck sent in whereby (5,10,15 whatever) per cent is determined across the board for all equally. Like a FLAT TAX. I know, like FAT CHANCE. Too Easy.

August 26th, 2015 at 3:14 am -

joel said:

Some of us paid our way through college the hard way, and some of us paid off our loans….. If the government lets these useless kids off the hook, I’m going to file a suit against the government to get my money back. What a bunch of rotten apples this generation is churning out.

August 26th, 2015 at 5:06 am -

Toby said:

I find it kind of sad that Americans put the full blame on the borrowers instead of the government handing out these predatory easy loans to teenagers. I suppose the government can never do wrong.

August 26th, 2015 at 3:44 pm -

Cindy said:

Start garnishng their wages

August 26th, 2015 at 4:06 pm -

Dave said:

College education, what a joke. I recently worked for a young man who was a graduate of Georgia Tech. This “ejukayted” yellow jacket could not write. I mean he could not sign a check, he printed everything. 1 out of about 7 words printed were misspelled.

If ANYONE in this country can get through public school and beyond and can not write and or spell correctly, they are at the point in their education that someone my age was at entering 3rd grade. Holy crap, what leaders we will have in the future. Trillions spent and NOTHING to show for it.

God help us…August 27th, 2015 at 3:30 am -

Mark said:

What about the sentence in that letter that forgives your entire debt after ten years if you work for the government or a non profit? That’s insane, as the people then pay that debt one way or the other. And it’s very likely the non profit is a liberal organization working to dismantle our nation…… pathetic the battle fronts we are looking at today. Criminal really. Who passes such crap.

August 27th, 2015 at 12:43 pm -

Rachel said:

I work for a non-profit that helps homeless and hungry people and a significant, increasing number are college students. Those who ignore the fact that in a significant number of areas around the country there are few jobs and that poor people already struggling to pay the bills cannot afford to move in search of jobs are uninformed and mean spirited. I truly understand both sides of this situation, that a debt is to be repaid and that there are many who are unable to (whether short or long term).

Due to both of these harsh realities, a one size fits all approach will NEVER work. Solutions do not include boasting about those who paid for college the “hard way.” On the flip side of that rude comment, it could easily be argued that if that commenter’s parents had planned well and never created/had them until they were financially set that there would have NEVER been a need to pay for college “hard way.”

Each debtor must repay whether it be a reduced payment or not. Forbearance and deferment help people but should not be a years long approach. However, starting payments at $0 makes zero sense and is not a solution either.

For those with valid proof of catastrophic illnesses, injuries, or disease, why should their loans NOT be forgiven? For those with zero income, shouldn’t forbearance and deferment help until they can earn an income? And if someone has even a small income, why can they not pay at least interest only or heck, $10, $20, $30, etc. a month whether towards interest and principal or just interest whether they work at McDonalds or not?

Those who think a one size fits all approach will work are uninformed as to all the different things that fit into ability to pay and they refuse to understand that millions of people are struggling for the very basics day in and day out. Those with snide comments about them are thankfully not in or have never been in the dire situations that millions of American adults (and children) are day in and day out.

Lastly, there are increasing numbers of food pantries on college campuses across the country to feed those students who CANNOT feed themselves. The 1st two commenters need to perform some research or volunteer work to grasp this fact and understand the difficulties facing a large number of TODAY’s students and graduates! I am most certain those with the easy answers and boasting about paying for college the hard way never had to choose between a student loan payment or being on the streets. For them, ignorance is bliss with regards to this matter. END OF RANT!

August 27th, 2015 at 2:58 pm -

roddy6667 said:

I paid off my student loan. I also worked every semester I was in college. My loan balance was only $1200. That was in the period of ’66 to ’70. College prices have gone up at a rate that is extremely out of proportion to other living expenses. The “overhead” at colleges is crazy. The cost of things other than teachers, books, and a classroom is what costs more. There is so much more “administration’ that is not part of the education process. Fire them all. And don’t even get me started on sports. It is not a necessary part of a university. It’s a hugely expensive distraction from the education process. That is something you pay for with your own money when you graduate and have a job. States should start a stripped down “education only” school for students who are interested in education.

Texas has a program for science, technology, engineering and mathematics majors. A $10,000 bachelor’s degree, not an online degree.

http://comptroller.texas.gov/comptrol/fnotes/fn1208/low-cost-degree.php

http://www.utpb.edu/audience/future-students/the-texas-science-scholar-program

August 28th, 2015 at 2:26 am -

kabir lamar said:

I have credit card accounts with 15 to 27 percent interest rates. I have paid down $3000, which will save me $600 in interest over the next year. There is no place I could earn $600 in interest on $3,000 over the next year. I pay $1,000 to the credit cards ever month and then charge back what i need, this keeps my average daily balance lower, so I save additional interest. I have a few cards with over $2,400 limits with balances of $800 or less. That is what I use for an emergency, so far I will have not had to use them in the last 2 years. I will pay off $10,000 in credit card debt over the next 18-24 months, and will save over $2,000 in interest charges.

How anyone can advise you to save instead of pay down credit card debt, flunked math class.March 31st, 2016 at 8:47 am -

kabir lamar said:

I work for a non-profit that helps homeless and hungry people and a significant, increasing number are college students. Those who ignore the fact that in a significant number of areas around the country there are few jobs and that poor people already struggling to pay the bills cannot afford to move in search of jobs are uninformed and mean spirited. I truly understand both sides of this situation, that a debt is to be repaid and that there are many who are unable to (whether short or long term).

Due to both of these harsh realities, a one size fits all approach will NEVER work. Solutions do not include boasting about those who paid for college the “hard way.†On the flip side of that rude comment, it could easily be argued that if that commenter’s parents had planned well and never created/had them until they were financially set that there would have NEVER been a need to pay for college “hard way.â€

Each debtor must repay whether it be a reduced payment or not. Forbearance and deferment help people but should not be a years long approach. However, starting payments at $0 makes zero sense and is not a solution either.

For those with valid proof of catastrophic illnesses, injuries, or disease, why should their loans NOT be forgiven? For those with zero income, shouldn’t forbearance and deferment help until they can earn an income? And if someone has even a small income, why can they not pay at least interest only or heck, $10, $20, $30, etc. a month whether towards interest and principal or just interest whether they work at McDonalds or not?

Those who think a one size fits all approach will work are uninformed as to all the different things that fit into ability to pay and they refuse to understand that millions of people are struggling for the very basics day in and day out. Those with snide comments about them are thankfully not in or have never been in the dire situations that millions of American adults (and children) are day in and day out.

Lastly, there are increasing numbers of food pantries on college campuses across the country to feed those students who CANNOT feed themselves. The 1st two commenters need to perform some research or volunteer work to grasp this fact and understand the difficulties facing a large number of TODAY’s students and graduates! I am most certain those with the easy answers and boasting about paying for college the hard way never had to choose between a student loan payment or being on the streets. For them, ignorance is bliss with regards to this matter. END OF RANT!March 31st, 2016 at 8:49 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â