The American dream myth: Income mobility; 4 out of 5 Americans struggle with poverty, joblessness, or go on welfare at some point during their lives; and bottom 80 percent of Americans control 7 percent of total wealth.

- 1 Comment

There is an odd sort of Greek-like mythology that the American dream is only getting stronger when various pieces of economic data clearly show that this is not the case. The middle class has noticeably shrunk over the past few decades. Income inequality is at levels last seen during the wildly opulent Gilded Age. We are seeing a record percentage of our population on food stamps. This certainly doesn’t sound like the American dream. This dream once centered on economic prosperity built around good jobs, a strong middle class, and growth opportunities for those that worked hard. As we devalue work in a low wage system that exploits workers and the middle class and the mainstream media glorifies the financialization of the system we have to ask is the Americans dream a reality or a myth?

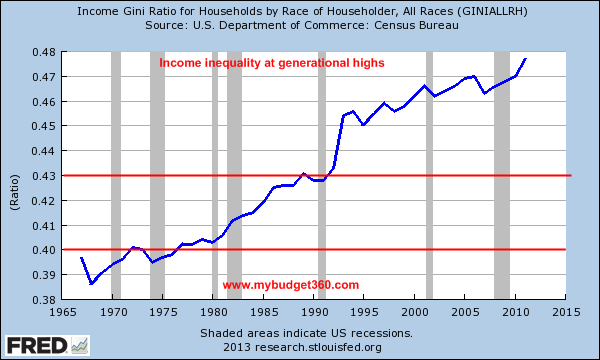

Income inequality at generational highs

If we look at the Gini ratio we see that income inequality is at generational highs:

From the 1940s to about 1980 the range held steady and ushered in the largest middle class the world has come to know. Part of this decline also came with the decline of our manufacturing sector and we now see longer lasting effects like the once mighty Detroit limping into bankruptcy.

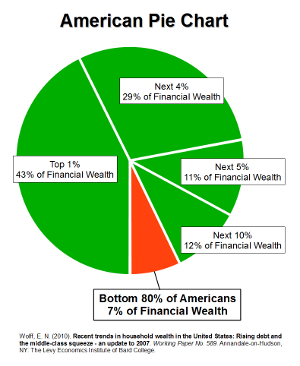

The growth of this disproportionate wealth cycle has come from a system that has largely demoralized the working and middle class at the expense of the financial class. For example, the top 5 percent of Americans control 72 percent of all the wealth in the country. The bottom 80 percent of Americans only control 7 percent of the wealth:

It would be one thing if the winners of this current economy where the job creators but instead, it is the politically connected and those who have mastered financial engineering. For example, during the housing crisis we had large hedge fund managers exploiting the market and actually making billions of dollars on bets that Americans would completely fall apart at the seams when it came to housing. Ironically, as it later came out, some of these hedge funds were encouraging further horrible lending practices or turning a blind eye knowing the payoff of the bet would only be larger when a regular family would be financially strained.

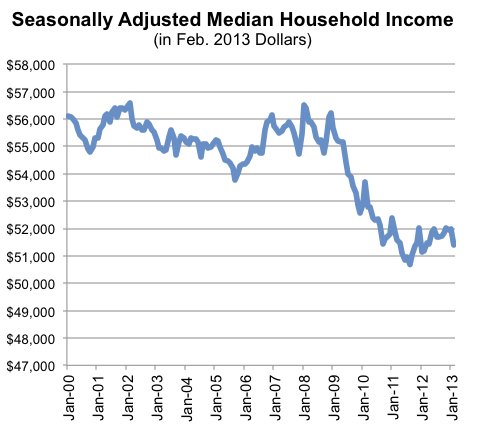

Most of the income growth has also gone to a very small portion of our population. For the rest, income isn’t doing so well:

Since many Americans have a very tiny amount in stocks, this record stock market is merely a spectacle, like watching a lion roar in the circus, and is also a reason as to why we can have this happening at the same time that we have 47.7 million Americans on food stamps.

Income mobility and poverty

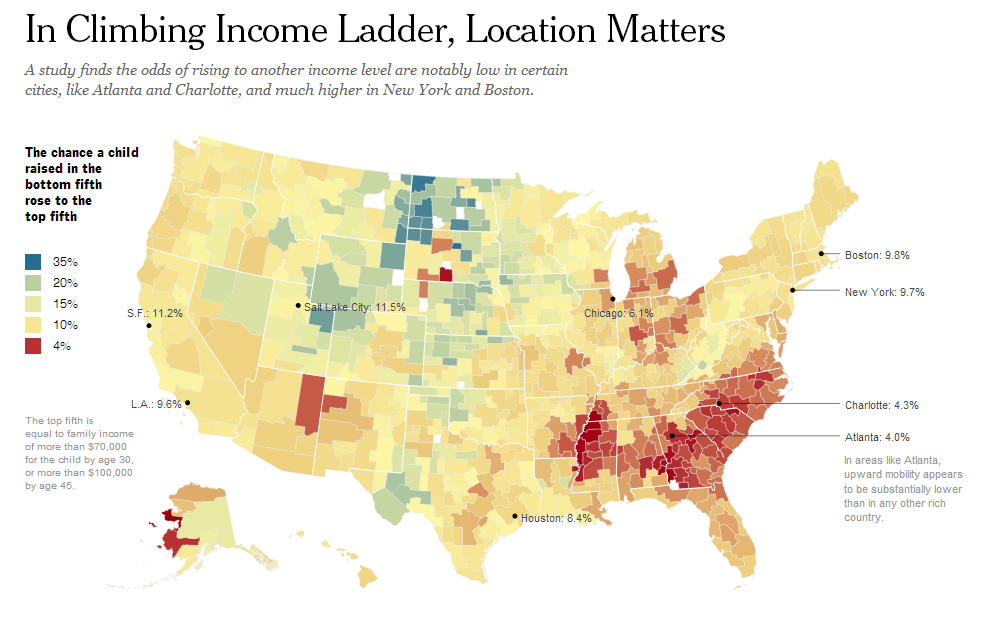

A fascinating article highlights income mobility in the US. The chart is sobering:

Source:Â NY Times

The notion that most Americans can pull themselves up by their bootstraps into wealth (or a decent paying job) is largely a myth. If you look at the chart above, most that are born poor will have a very tough time making it into the top 20 percent of our country (where all the wealth is concentrated). Even in places like New York, only 9.7 percent of people born in lowest economic part of our ladder will rise to the top 20 percent. And this isn’t someone becoming Bill Gates. This is merely someone being able to make at least $70,000 a year (a good salary) by age 30.

What was more startling regarding the chart is how hard it is to rise up in the Southeast of the country and the boom in places like the Dakotas and Utah. My take on the Dakotas and Utah is this is based on the recent boom in this part of the country and the low cost of living. Yet the cost of living is very cheap in the South so it is hard to explain this incredibly tough income stratification.

Either way, the areas with very high mobility have a tiny portion of our population. Even in San Francisco only 11 percent of those born poor will end up making $70,000 a year by the time they are 30 and this is one of the most mobile and large markets. An interesting thought to ponder but just go back up and refer to the Gini ratio we have shown. Income inequality in the US is at record levels and working and middle class Americans continue to face challenges.

The American dream – 4 out of 5 US adults struggle with joblessness, poverty, or welfare for parts of their lives

One very troubling statistic is the number of Americans who have faced deep economic challenges:

“WASHINGTON (AP) — Four out of 5 U.S. adults struggle with joblessness, near poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream.

Survey data exclusive to The Associated Press points to an increasingly globalized U.S. economy, the widening gap between rich and poor and loss of good-paying manufacturing jobs as reasons for the trend.â€

What do you expect when fierce austerity is expected of the working and middle class while Wall Street is bailed out for essentially speculating, building, and profiting from the economic collapse. Thanks to the Fed, many large financial institutions are once again back to speculating in the real estate market. When many bets went sour, they were bailed out while the public lost their homes, jobs, and have seen income growth decline to levels last seen in the 1990s. The American dream seems to be a very exclusive club now. Good luck trying to get in if you are not already in.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Roddy6667 said:

I read an article over ten years ago on how Americans were more likely to remain in their socio-economic class for generations more than the British. Blue collar begets blue collar. forever, it seems. Must be a kind of imprinting, like you see with baby ducks.

July 31st, 2013 at 12:30 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!